What is a Financial Due Diligence Checklist?

A financial due diligence checklist is a comprehensive tool used during business transactions to assess the financial aspects of a target company or investment opportunity. It serves as a structured framework to ensure that all relevant financial information, including financial statements, records, tax compliance, operational risks, liabilities, and other key financial factors, is thoroughly evaluated.

Importance of Using a Checklist for Financial Due Diligence

Assessing financial health, performance, and risks associated with a business or company is crucial before a transaction, especially for a merger or acquisition. Since this process involves rigorous checks, it’s important to ensure that everything is well accounted for during a financial due diligence check. On this aspect, using a checklist can be helpful in various ways:

- Structured Approach – helps maintain organization and consistency throughout the assessment process

- Thoroughness and Completeness – reduces the risk of missing important details that could impact the transaction

- Time Management and Efficiency – helps prioritize key areas of focus, enabling the team to allocate time and resources effectively

- Enhanced Decision-making – enables easy comparison and evaluation of different targets or investment opportunities, providing a basis for objective decision-making

- Risk Mitigation – allows the team to analyze financial projections, evaluate the accuracy of assumptions, and identify any red flags or areas of concern

- Communication and Collaboration – promotes collaboration and coordination by providing a shared reference point for discussions, findings, and recommendations

What is Financial Due Diligence Checklist Used For?

The checklist acts as a reference guide, ensuring that no critical financial aspects are overlooked during the due diligence process. By systematically reviewing financial documents, analyzing data, and asking relevant questions, the checklist helps uncover potential issues, discrepancies, or areas that require further investigation. This way, analysts or evaluators can achieve transparency, recommend action plans on mitigating risks, and assist informed decision-making.

Apart from those, using a financial due diligence checklist can also help you:

- identify financial strengths and weaknesses;

- evaluate tax and legal compliance; and

- review assets and liabilities.

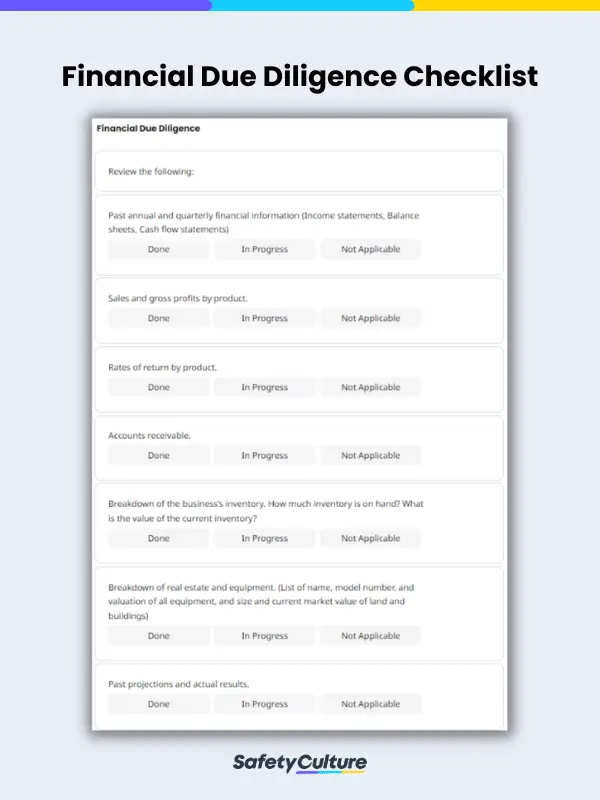

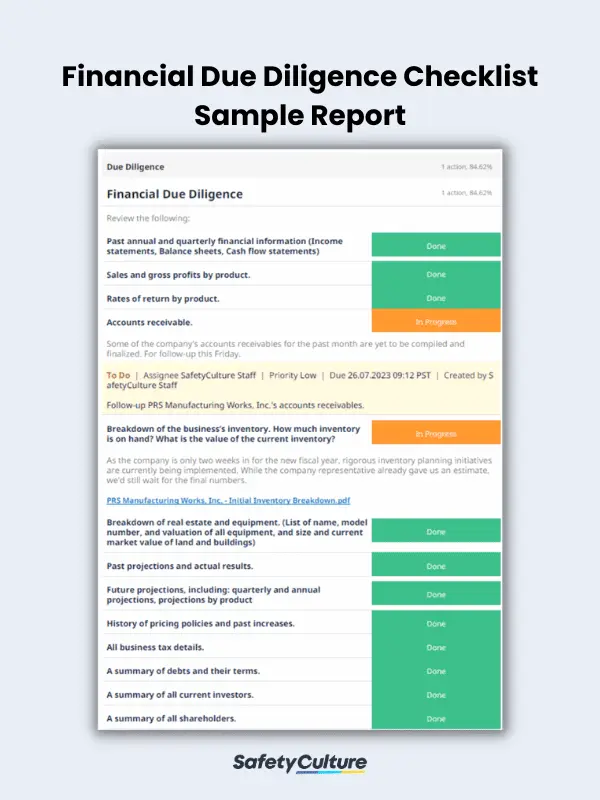

What is Included in a Financial Due Diligence Checklist?

A financial due diligence checklist typically includes a series of items and questions that guide the due diligence process, covering areas such as the following:

- Financial Statements and Records

- Sales and Gross Profits

- Rates of Product Returns

- Business Inventory

- Fixed Assets (Real Estate, Equipment, and Others)

- Financial Projections and Assumptions

- Pricing Policies History

- Tax Compliance

- Debts and Terms

- Current Investors and Shareholders

How to Create One

Developing a financial due diligence checklist involves careful consideration of the specific transaction and industry. It often requires collaboration between finance, legal, and industry experts, considering the unique requirements and risks of the transaction.

Hence, organizations and those in charge of conducting financial due diligence checks must follow a systematic approach to ensuring comprehensive coverage of financial aspects in the checklist. Here are the steps to take on creating it:

- Identify the transaction type.

- Define checklist objectives.

- Gather reference materials.

- Outline checklist sections.

- Formulate checklist questions and choose the appropriate response type (e.g., multiple-choice, open-ended, etc.)

- Customize the checklist by including elements or sections relevant to the industry, need, or purpose of the transaction.

- Seek expert input and regularly update the checklist.

FAQs About Financial Due Diligence Checklists

Yes, a financial due diligence checklist can be adapted and used across different industries. While the specific focus areas and risks may vary, the fundamental principles of financial due diligence, such as reviewing financial statements, assessing tax compliance, and evaluating operational risks, apply to various sectors.

While it’s designed to identify financial risks and discrepancies, a financial due diligence checklist may not always uncover deliberate fraud or financial misconduct. However, it can help identify potential red flags or inconsistencies that may warrant further investigation or forensic audit.

No. It also assists evaluators and analysts in assessing tax and legal compliance, operational efficiency, intellectual property rights, market analysis, competitive positioning, and other factors that impact the financial health and future prospects of the target company.