What is a Fixed Assets Audit?

A Fixed Assets Audit is the formal process of recording a business’s long-term resources, primarily those used to generate income. Examples include land, buildings, equipment, office furniture/fixtures, and vehicles. Asset audits are performed by asset accountants and/or independent asset auditors who present the findings in an asset report.

The Value in Auditing Fixed Assets

Fixed assets can represent the largest item on the balance sheet of companies, especially in the manufacturing and healthcare industry. Deficient fixed assets records can lead to inaccurate financial reporting. You should perform high-quality audits knowing that fixed assets are not as low risk as you think.

Top 5 Reasons to Perform Regular Fixed Assets Audits

Aside from asset auditing being closely connected with the legal obligation of tax reporting, businesses have much to gain from performing asset audits regularly. Below are some of the reasons why businesses should routinely audit their fixed assets:

• To verify accuracy of financial records

Regardless of company size, businesses are legally obligated to submit tax reports. Regular audits give businesses updated valuations of their long-term resources, essential to writing accurate tax reports, avoiding legal issues, and hefty fines. Additionally, having an accurate snapshot of the business’s financial status can help make budgeting for the future easier.

• To avoid ghost assets

Ghost assets are fixed assets that appear on a company’s ledger, but are either physically missing, or rendered useless and inoperable. Ghost assets, however, still contribute to a company’s tax obligations and insurance payables even if they do nothing to increase profits. Performing fixed assets audits on a schedule can help businesses identify and eliminate ghost assets with greater regularity in order to avoid needless spending and improve overall cash flow.

• To eliminate internal fraud

A business that fails to perform fixed assets audits on a regular basis becomes much more susceptible to internal fraud. Employees, managers, or other personnel could take advantage of the lack of oversight and asset misappropriation can become a problem.

• To provide assurance to shareholders

Not all shareholders hold top management positions which means they don’t always have immediate access to the company’s figures. Regular audits and subsequent reporting can help assure shareholders of the company’s good standing, in turn encouraging their continued support as investors.

• To enhance the company’s credibility for prospective buyers

If the owner is planning on selling the company in the near future, regular audits can help ensure the accuracy and reliability of the figures to be presented to potential buyers.

How to Perform a Fixed Assets Audit Efficiently

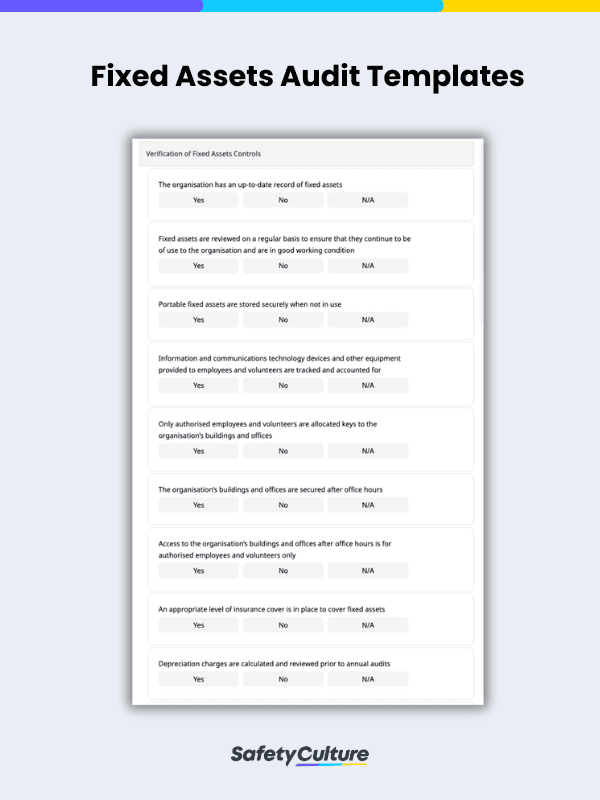

Asset reports can be troublesome to put together, considering that most businesses still do them on paper. It is important that fixed assets are physically verified and documented as evidence of their existence and utility, and accomplishing this manually involves numerous steps. Here’s how SafetyCulture (formerly iAuditor) can make fixed asset auditing easier, faster, and practical:

- Download ready-to-use asset auditing templates for free and get started right away, customize pre-made templates, or create new ones entirely through our easy drag-and-drop template builder

- Take photos and annotate them as evidence for the existence and utility of fixed assets

- Schedule and assign audits to asset auditors and they will be notified via email and/or push notification to ensure they are not missed

- Assign corrective actions on the spot for issues that need resolving. Set the time, date, and priority level for corrective tasks.

- Automatic syncing between mobile devices and desktop platform provide real-time analytics dashboards. Get visibility into your compliance, data accuracy, and more.

- Include the auditor’s digital signature to ensure validity and accountability

- After the audit is complete, an instant shareable report is automatically generated.

Often-missed Details During Fixed Assets Audits

Fixed asset accountants periodically conduct audits as often as every month, depending on the fixed assets lifecycle. The routinary nature of the process makes it possible for key information to be overlooked, making it more challenging to solve inaccuracies in future fixed assets audits. Perform high-quality audits by keeping an eye out for the crucial details below:

Insufficient description of fixed assets

Not only is a poorly described asset difficult to physically verify, but it can also confuse recipients of the audit report. While asset numbers are for the books, asset descriptions usually found in property identification tags are for your eyes.

Instead of describing a piece of equipment “Ginger Machine”, go for “Stainless Steel Ginger Polishing, Washing, and Peeling Machine” with its manufacturer, model, and serial number information. Easily identifying the asset to be checked makes the process more efficient, enabling you to have more time for other important matters.

Understated original cost upon acquisition per unit

Internal controls for inconsistent application of the capitalization threshold and assignment of unreasonable lives for depreciation the fixed asset should be addressed. Since the total cost of a fixed asset includes the cost of the installation labor like wages and related fringe benefits, oversight can cause work duplication and business disruption.

Understated acquisition costs can also result in delays to capitalize on the fixed asset. Easy-to-use fixed assets audit software such as SafetyCulture can help facilitate proper documentation across departments and update records in real-time.

Misfiled or pulled out fixed asset invoice

Even as the person responsible for the fixed asset provides you all the necessary information for the audit, the invoice might be unavailable because it was filed somewhere else or pulled out for specific uses like reorders.

This slow turnaround time of the documents you need can significantly push you closer to the deadline, potentially missing more details in the audit report. To help you track exactly what data to follow up on and adjust in the report, assign an action with a priority level, due date, and in-app notification using SafetyCulture’s collaborative actions.

Software for Fixed Assets Auditing

A fixed assets audit software is a computer program used by company asset accountants or independent asset auditors to verify the fixed assets lifecycle and its records. With the SafetyCulture Fixed Assets Audit Software, you can take advantage of free fixed assets audit checklists in the SafetyCulture App so everything is accounted for—with photo evidence. Use SafetyCulture to easily demonstrate the existence of an asset while ensuring top functionality throughout its usable life.

-

Capture photo evidence of fixed assets

Mass scan fixed assets’ barcodes and QR codes to verify the accuracy of records and take photos to reveal their condition—if the person responsible properly implements the fixed assets lifecycle. The SafetyCulture Fixed Asset Software is designed to protect equipment and machinery from overheads associated with poor stewardship like ghost assets and fraud.

-

Comprehensive, customizable audit reports

Accurate reporting is mission-critical when it comes to auditing fixed assets. With the SafetyCulture Asset Audit Software, you can generate comprehensive reports in pre-set formats, both as a web report and as a PDF. Transform completed audits into customizable reports that fit your business needs—add your company logo, a table of contents, and more.

-

Secure data access anytime, anywhere

Automatically save and secure every fixed assets audit report with the SafetyCultureAsset Software’s safe cloud storage. Authorized personnel can easily access the digital audit record history of registered fixed assets from wherever they are. Streamline your audit process and audit procedures through hassle-free reference checking and improve how departments work together throughout the company.