What is a Due Diligence Checklist?

A due diligence checklist is a tool used by investors, business owners, and consultants in analyzing a company that they’re acquiring through either a sale, merger, or other methods. Also referred to as a due diligence checklist for acquisition, due diligence checklists help ensure that the final decision is based on a thorough investigation of all aspects of the business, uncovering red flags and determining if the current value of a company makes it a wise investment.

Due Diligence Red Flags

Investors and consultants need to review key aspects of a business to determine if it will be worth the investment and find red flags that may negatively impact profitability. Here are some of the key aspects to look into and some key due diligence questions to ask (also applies for enhanced due diligence):

- OrganizationIs the business in compliance with legal requirements? Is the company open to sharing requested company information or were there reservations?

- Products and services offeredWhat is the business selling? Do the products and services meet required certification and legal criteria? How about the product development and manufacturing processes?

- FinancesReview all financial records, including all debts acquired and taxes paid. Check for compelling reasons to investigate further and be wary of how the company manages its finances. Does the company exhibit transparency in providing access to financial records?

- PeopleHow are employees treated? How competitive is the employee benefit package? Is there a history of legal action initiated by or against employees? What is the professional history and reputation of the key executives?

- ReputationPublic perception can impact profitability. Find out what the media, competitors, and the target market has to say about the business. How is the business’ corporate social responsibility? Any legal issues or environmental concerns raised against the company? What is the company’s overall reputation in the industry?

3 Major Types of Due Diligence Checklists

There are three main types of due diligence, these are: 1) Legal, 2) Financial, and 3) Commercial. All three types help contribute in providing the right information thoroughly assessing the company of interest’s business, assets, capabilities, and financial performance.

Legal Due Diligence Checklist

Legal due diligence is the examination and review of legal documents and contracts. A legal due diligence checklist includes exploring areas such as:

- Legal structure

- Contracts

- Loans

- Properties and Real Estate

- Employment

- Pending litigations

Financial Due Diligence Checklist

Financial due diligence review focuses on verifying and the evaluation of financial records of the target company. A financial due diligence checklist covers areas such as:

- Earnings

- Assets

- Liabilities

- Cash flow

- Debt

- Management

Commercial due diligence checklist

Commercial due diligence is the thorough understanding and examination of the market that the target company operates in. A commercial due diligence checklist involves activities such as conversing with customers, assessment of competitors and an analysis of the business plan.

How to Use the Due Diligence Checklist

A comprehensive due diligence checklist enables businesses to deep-dive into a company’s trustworthiness, profitability, and growth potential. Having a standardized and readily available template or checklist speeds up the process and at the same time ensures that no critical aspects of the endeavor are overlooked or missed.

Steps to Using the Due Diligence Checklist

Follow these steps for an efficient and effective due diligence checklist:

- Ask the right questions – Use due diligence checklists that would allow you to fully investigate a company’s worthiness as an investment. Ensure that they would provide an in-depth examination of the possible major red flags of the organization itself, its products and services, its finances, people, and reputation.

- Customize your checklist – Since there’s no one-size-fits-all for most business documents, use a checklist that you could tailor fit according to your business needs.

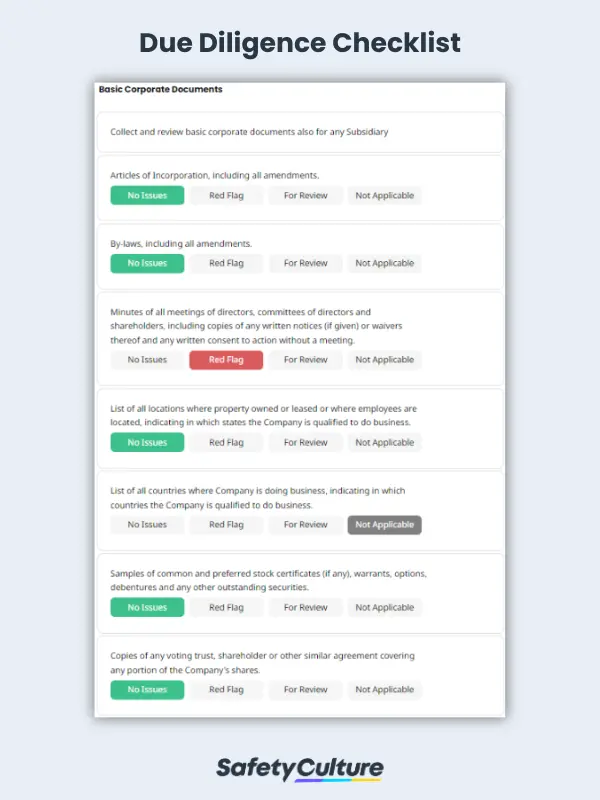

- Indicate the status of the items – Specify if checked items have no issues, are a red flag, need review, or are not applicable at the time of your due diligence audit. This would emphasize business aspects that need to be addressed and highlight issues you could factor in on the assessment of the company/product.

- Create notes and actions – If issues or red flags are found, create notes or actions that can be used by the team as a guide on how best to manage them. For “to be reviewed” items, indicate if they are tolerable after some tweaks in the business process.

- Complete the analysis – Add a general comment regarding the due diligence audit before signing it with the inspector’s name and signature. Generate a report of the analysis and share it with relevant stakeholders immediately.

What to Include in a Due Diligence Checklist?

A due diligence checklist covers various types of due diligence documents and requirements. Although they can vary according to the involved business themselves, or differ based on the type of due diligence document, a general checklist includes:

- Basic corporate documents

- Legal documents

- Financial documents

- Sales and marketing

- Human resources (executives and employees)

- Tangible assets

- Material contracts

- Patent and Trademark

- Intellectual property

- Good Standing certificate/documents

What are Due Diligence Documents?

Due diligence documents, or due diligence forms, are records, reports, or other documents that helps verify and corroborate the due diligence process. Below are selected documents from each type of due diligence according to a non-exhaustive list made by an industry leader on research, benchmarking, and performance:

- Corporate by-laws and any amendments

- Records surrounding issuances or grants of stock, options and warranties

- List of all business locations where the company owns/leases property, maintains employees and/or conducts business

- Three years of annual and quarterly audited financial statements, with the auditor’s reports and unaudited financial statements for comparison (click here to view the complete financial due diligence checklist)

- Copies of any audit and revenue agency reports for Shareholder

- Employee handbook covering policies, benefits, diligence procedures and training

- Information around sales and marketing procedures, including research, messaging, CRM systems and processes, and lead generation practices (click here to view the complete operational due diligence checklist)

- List of all owned or leased properties and applicable details

- Documents detailing the company’s approach to IP protection and enforcement

- Agreements with distributors, value-added resellers and dealers

- All active litigation files (click here to view the complete legal due diligence checklist)

- Copies of any violations, complaints or requests for information regarding environmental, workplace safety and health

- Any material reports to government entities and agencies, including EPA and OSHA

- Documentation around IT processes including applications development, IT operations, disaster recovery, IT security, and cost management (click here to view the complete technical due diligence checklist)

- Documents covering company values, mission, vision and shared beliefs

- Assessment of strategic fit within the larger buyer organization

Click here to view the complete Due Diligence Documents Checklist

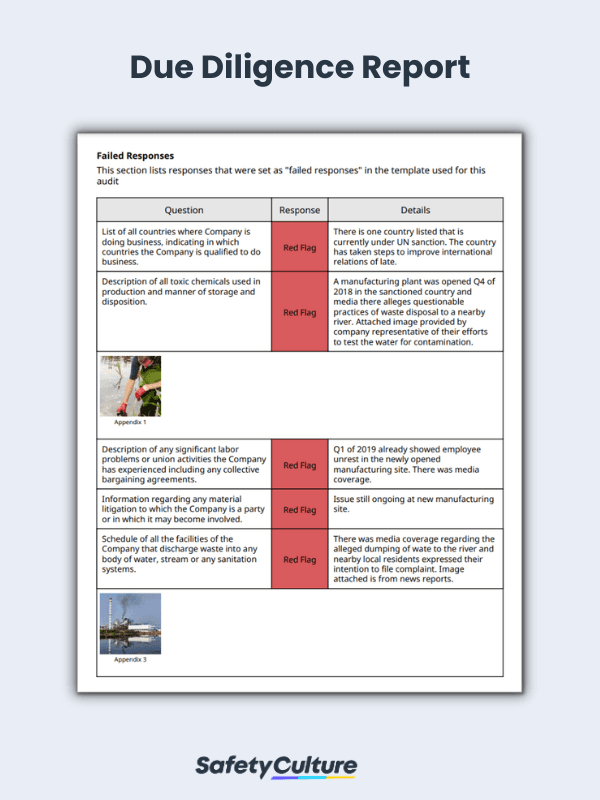

Example of a Due Diligence Report

A due diligence report is a summary of the findings from the entire due diligence process completed by the company’s internal team or a paid third-party group. Reporting about due diligence can seem a daunting task, but it can help to do a breakdown of the reports according to the type of due diligence or highlight red flags like the due diligence report example below: