What is an Insurance Inspection?

An insurance inspection is conducted by insurance companies to assess the premium insurance cost, and determine the compensation in case there’s a claim. The purpose of the insurance inspection is to identify hazards, recognize conditions which may increase the risk of claims, as well as to confirm if a property is insured with the right value. It also helps guarantee that a property or vehicle’s condition is acceptable prior to the company insuring them.

The inspection is performed by safety engineers, supervisory authorities, hired contractors, or a representative from the insurance company. It is usually done within 30 days to 90 days after a new policy is signed, or immediately after a claim was reported.

Why do Insurance Companies do Inspections?

Insurance companies perform inspections for various reasons and they differ based on the elements of the property insured. It gives the companies a well-founded basis for their decisions for every insurance application and claim of policyholders. Here are the primary reasons why insurance companies conduct insurance inspections:

Ensure the property/vehicle value is correct

After a policy is signed, an inspection sometimes takes place to help insurers verify that your property value is correct. Some factors affecting these are: 1) if you live in an older home; 2) the value initially declared seems inaccurate; 3) if they can’t determine the replacement value for certain items in the property; or 4) any other factors that may cause miscalculation in the policy value.

Assess the value after major renovations

This mostly applies to home insurance. An inspection is performed if a policyholder had a recent or ongoing major renovation that could potentially change the value of the property. Insurers also use this opportunity to propose safety and risk management recommendations.

Verify your claim’s validity

As part of the insurance claim process, inspectors help companies ensure that the claim is factual, determine the property damage and the loss incurred, and monitor the progress of repairs to confirm the reconstruction value of the property.

Mitigate possible losses

Insurance companies also inspect properties as a proactive approach to preventing the chance of increased risks of claims and reducing company losses.

Kinds of Insurance Inspection

The details and conditions of an insurance inspection vary depending on the policy and the agreement between insurers and policyholders. Different indicators are also considered depending on the type of property being insured.

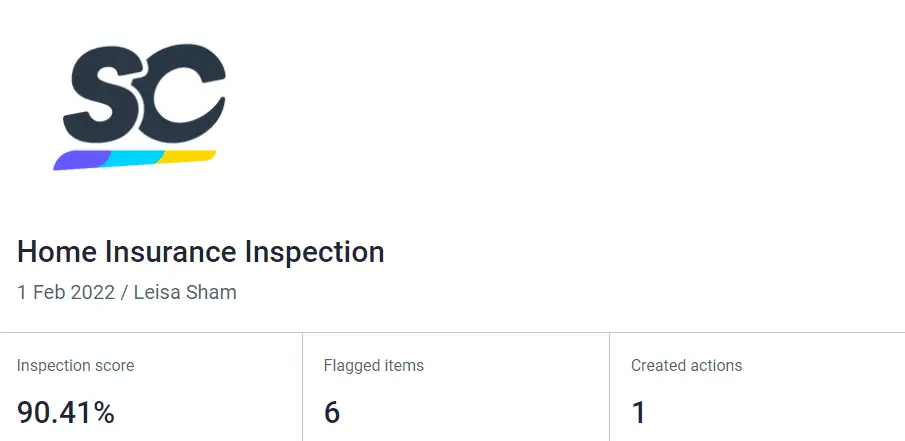

Home Insurance Inspection

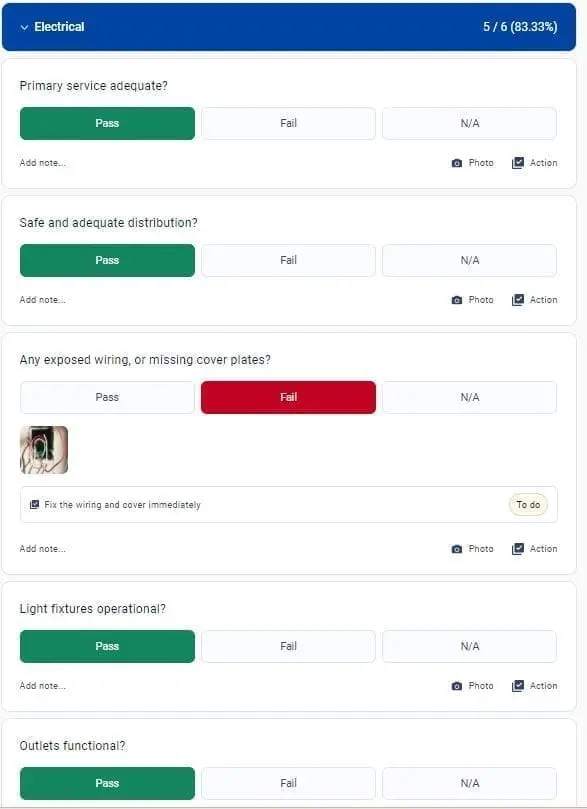

This type of inspection focuses on a residential property and examines the exterior and interior portion of the house. Exterior inspection includes a check of chimney and roof, foundation, surfaces, property grounds, and other common items the insurer deems necessary.

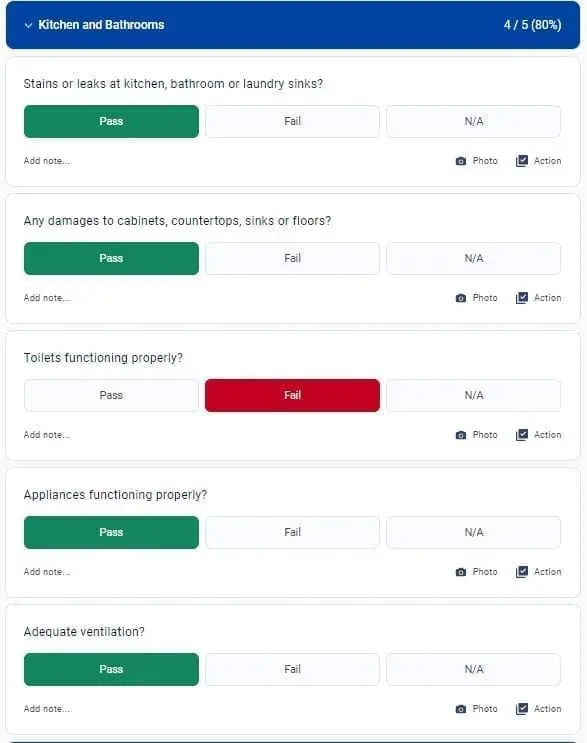

Meanwhile, interior inspection consists of checks of attic and basement, plumbing, electrical, heating/cooling, and drainage systems. As well as checks of bedrooms, bathrooms, and kitchen.

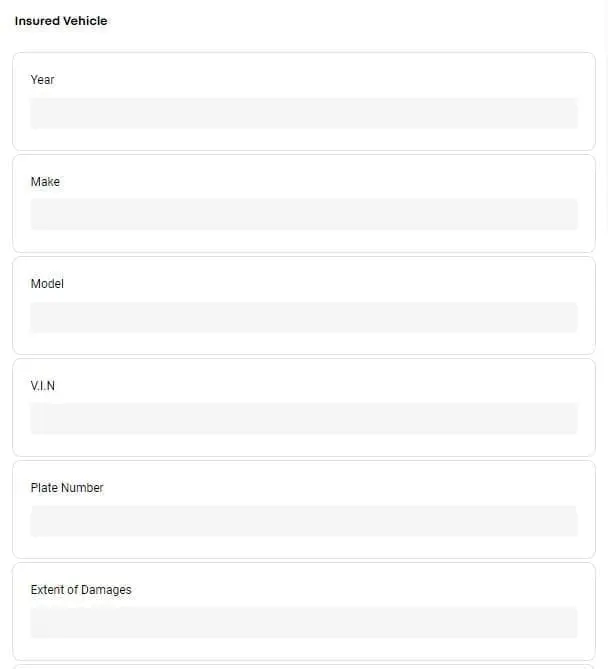

Automobile Insurance Inspection

This inspection is usually performed when an insured vehicle suffers any type of damage. The insurance company will have to examine and document the damage to be able to provide an amount they can cover in the total repair cost.

Companies also do inspections as a requirement before agreeing to insure a used vehicle. This helps them check if there is any existing damage or issue that was not initially declared by the policyholder, which also aims to reduce the risk of insurance fraud.

Commercial Property Insurance Inspection

A comprehensive building inspection helps insurance companies determine the insurability of the commercial property and get an accurate calculation of the premium value of the real estate.

Aside from this, inspectors will also look for any hazards that could potentially increase risk claims such as property defects, electrical system failures, and any other hazards within the property.

What is an Insurance Inspection Form?

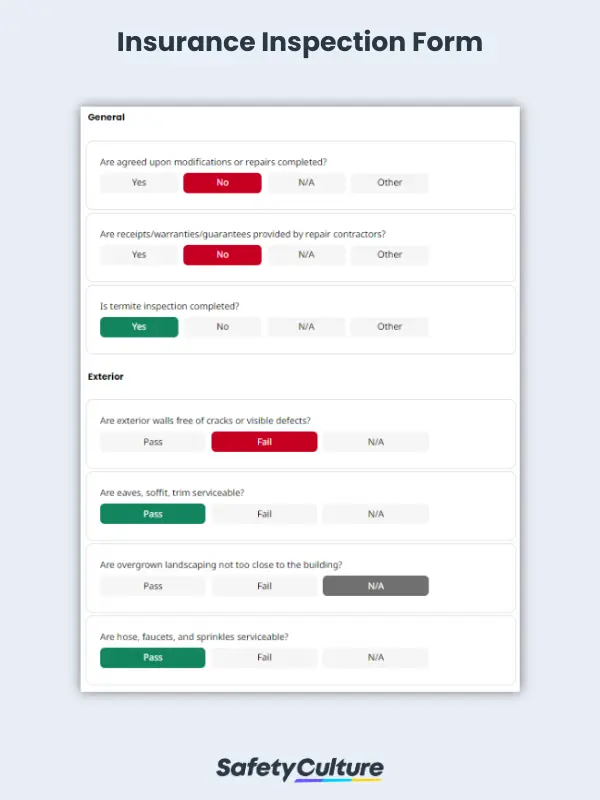

An insurance inspection form or checklist is a tool that insurance companies use to perform an assessment of a property to check its insurability and review the validity of claims.

A comprehensive insurance inspection form is crucial in successfully determining what to check and look for while conducting the inspection. It also helps in generating an accurate report based on the information gathered through the inspection.

Through the use of insurance inspection forms, companies can come up with a plausible evaluation that they can use as a guide in decision-making.

How to Use it?

Below are the essential points in using an insurance inspection form.

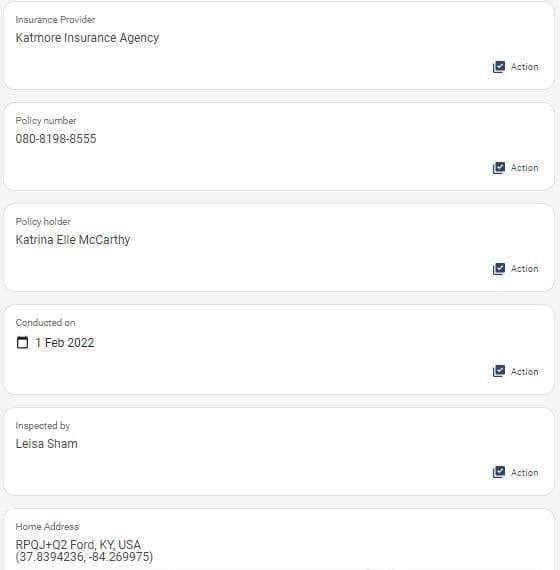

Provide Important Information

Include important details such as insurance provider, policy number and holder, inspector, and date of inspection, as well as exact location/address, if applicable.

Determine the Best Set of Response

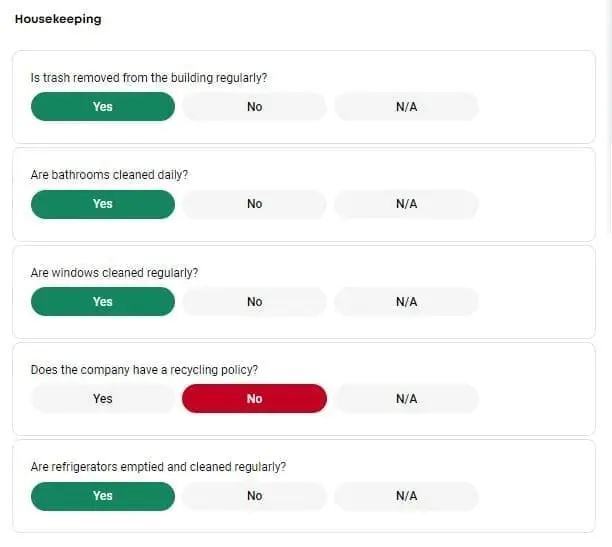

Identify which set of responses would successfully work in achieving an accurate insurance assessment based on the specifications and type of the insured property. This can be a pass or fail type or response, a simple yes or no, or just simply filling out the needed information.

Pass or Fail type of response

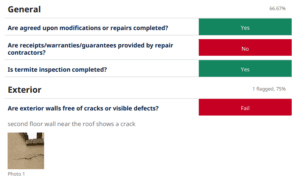

Yes or No type of response

Fill the Details type of response

Check All Essential Items

Go through the inspection form by individually inspecting all the specific items listed and make additional notes or recommendations if necessary.

Include Images

Supporting your inspections with photo evidence helps accomplish one of the primary goals of insurance inspections which is to provide a more detailed view and show the current physical condition of the insured property. This helps ensure that the inspection is done real-time and has high-level accuracy.

Use a Scoring System

If applicable, apply an associated score to each response on the form, checklist, or template. This can help in precisely measuring if an inspection is a pass or fail, this would also depend on the type of inspection as well as the response set used.

Mitigate Business Risks Through Mitti

Further empower your business by utilizing a global technology product that helps businesses manage risks and gain safety insights through industry-leading tools. Mitti is a business insurance company that pairs insurance and inspections to mitigate possible setbacks, incidents, or mishaps in operations. It can help maximize your business’ potential through risk and safety ratings and insights, remote insurance surveys, and digital inspections that raise the quality standards of your business.