Published 5 Mar 2025

Article by

4 min read

What is Commercial Due Diligence?

A Commercial Due Diligence (CDD) is a comprehensive evaluation of a company’s commercial viability, typically conducted before significant business transactions like mergers, acquisitions, or investments. This process helps investors and buyers make informed decisions and align potential acquisitions with their overall business strategies.

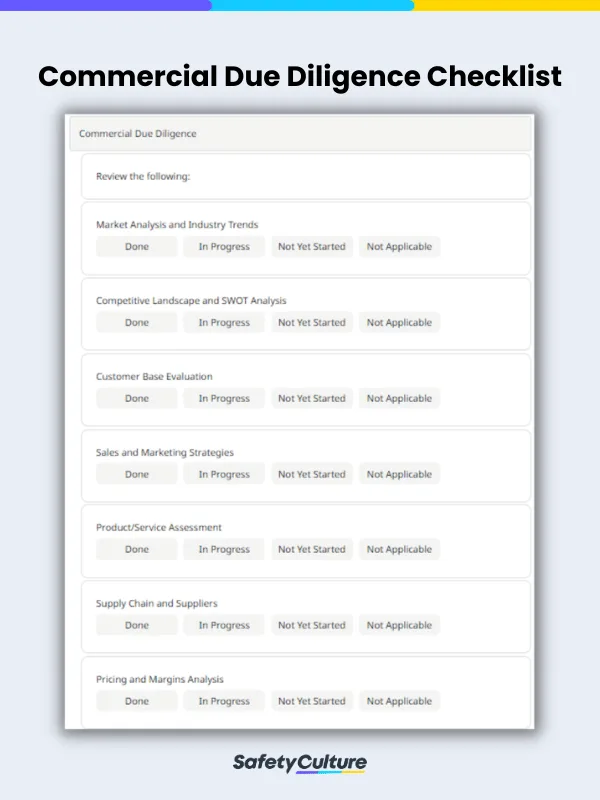

What is a Commercial Due Diligence Checklist?

A commercial due diligence (CDD) checklist is a comprehensive and structured tool used to assess the commercial aspects of a target company. Commercial due diligence reports guide prospective buyers or investors in systematically evaluating the target’s market position, customer base, competition, growth potential, and overall business strategy to ensure an informed decision-making process during Mergers and Acquisitions (M&A) or investment deals.

Benefits of Using a Commercial Due Diligence Checklist

Since there’s a myriad of items, aspects, and factors being considered during due diligence, it’s important to streamline its process to ensure nothing’s overlooked or inaccurate. This is where using a commercial due diligence checklist helps potential investors or acquirers to achieve the following benefits:

Comprehensive Assessment

Optimized Identification of Risks and Opportunities

Better Negotiations

Targeted Risk Mitigation

Enhanced Post-Deal Integration

Informed Decision-Making

Confidence and Transparency

Validation of Assumptions

What Should Be Included in a Commercial Due Diligence Checklist?

A comprehensive commercial due diligence checklist must encompass various essential elements and sections to ensure a thorough evaluation of a company’s commercial aspects. The checklist should include sections, such as:

Competitive Landscape and Strengths, Weaknesses, Opportunities, and Threats (SWOT) Analysis

Customer Base Evaluation

Sales and Marketing Strategies

Product/Service Assessment

Pricing and Margins Analysis

Distribution Channels

Regulatory and Legal Considerations

Intellectual Property Examination

Financial Performance and Projections

Management and Key Personnel

Customer Contracts and Agreements

Compliance and Ethical Practices

Business Strategy and Future Outlook

Integration and Synergy Opportunities

Each of these plays a crucial role in providing a holistic understanding of the target company’s operations, strengths, weaknesses, and potential risks. By evaluating and addressing these areas, the checklist assists investors or acquirers in making well-informed decisions, identifying potential synergies, and mitigating potential challenges that may arise post-acquisition or investment.

Step-by-Step Guide on Creating a Checklist for Commercial Due Diligence

Follow these steps to create an effective commercial due diligence checklist and ensure an organized evaluation of your target company’s commercial aspects

Define the objective and scope of the due diligence being performed.

Gather relevant documents and information about the target company.

Determine the key components you want to include in the commercial due diligence checklist.

Conduct initial research on your target company and its industry to gain insights into its market position and competitive landscape.

Define specific questions tailored to the target company’s unique characteristics and the objectives of the commercial due diligence.

Involve subject matter experts and stakeholders to review the checklist and provide valuable insights before its implementation.

How to Use One

To help you leverage the many benefits of using a commercial due diligence checklist effectively, here are a few tips and reminders you should consider:

Collect all relevant documents and information about the target company.

Perform interviews, data analysis, and research to answer the questions outlined in the checklist.

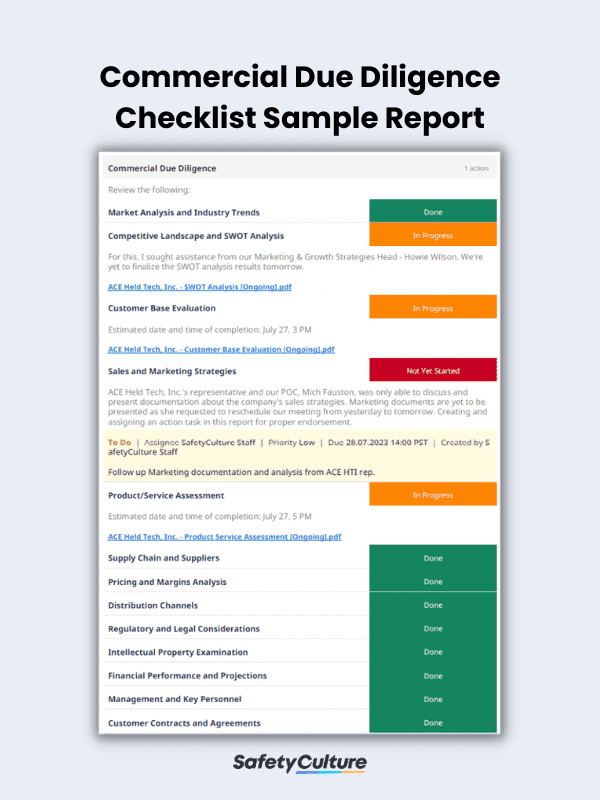

Record any significant risks, opportunities, key insights, and other observations obtained during the due diligence process.

Analyze the data and insights obtained to identify patterns, trends, and potential areas for improvement or risk mitigation.

Utilize the commercial due diligence findings to make informed investment or acquisition decisions.

Compile the commercial due diligence findings into a comprehensive report for presentation to stakeholders or decision-makers.

Use the insights gained to plan post-deal integration strategies.

Gather feedback from stakeholders and subject matter experts to improve the effectiveness of the commercial due diligence checklist. Remember to update it regularly to reflect changes in the target company’s operations or industry trends.

Commercial Due Diligence Checklist Sample Report | SafetyCulture

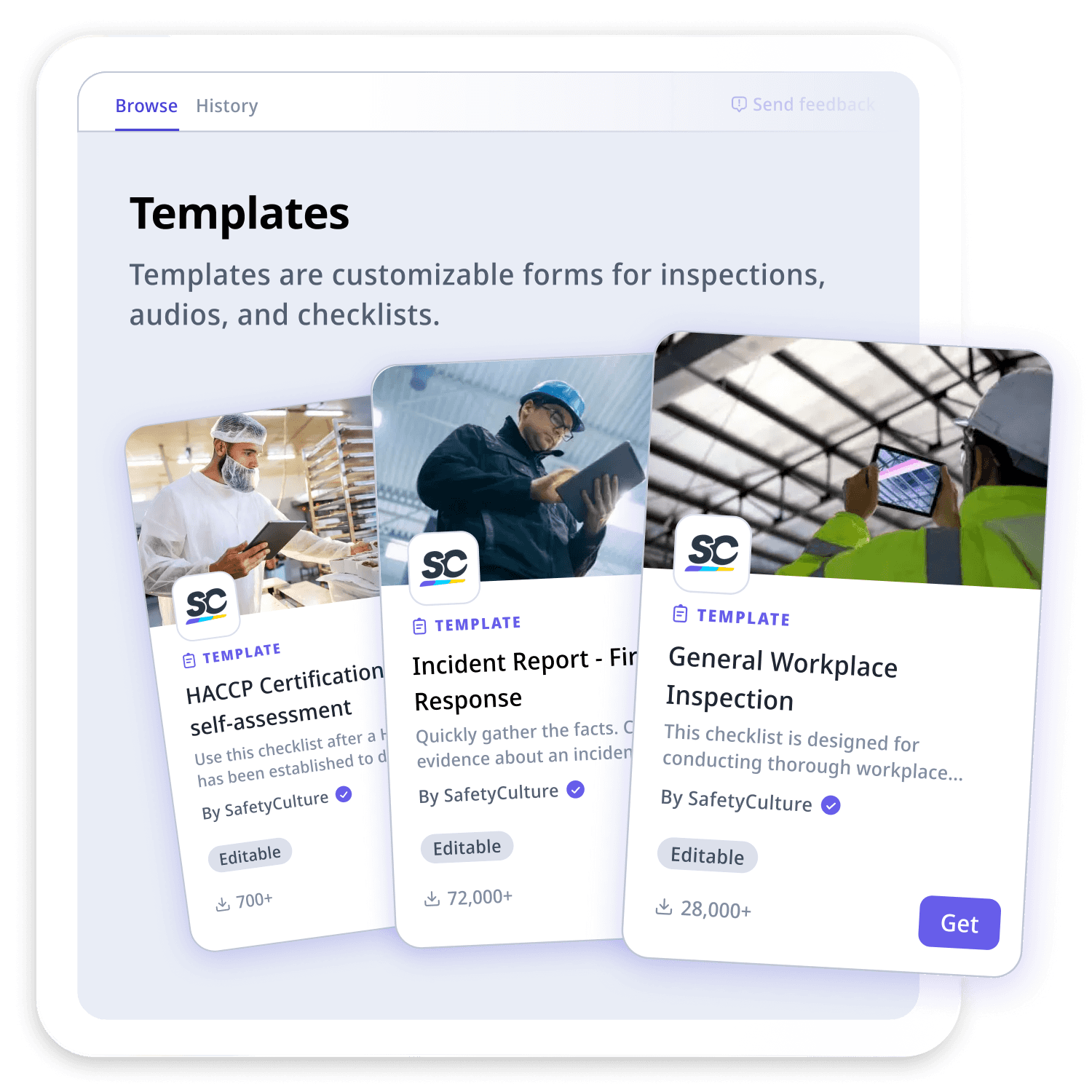

Still looking for a checklist?

Search, filter, and customize 60,000+ templates across industries and use cases.