Understanding the Importance of Key Risk Indicators to Organizations

Know what key risk indicators are and their role in organizational risk management and overall operations.

Published 25 Sept 2025

Article by

7 min read

What are Key Risk Indicators?

Key Risk Indicators (KRIs) are specific data points or metrics that organizations use to monitor and assess potential risks that may impact their operations, financial health, or overall performance. KRIs also provide early warning signals that help organizations identify, analyze, and address risks before they escalate into significant issues. Hence, they are a crucial component of risk management and strategic decision-making.

Purpose

KRIs help organizations proactively identify, monitor, and manage potential risks. In detail, they serve several important functions to enhance the overall risk management strategy:

Early Warning System

KRIs alert organizations to emerging risks before they become bigger, more complicated concerns. By monitoring metrics and data points, KRIs provide timely signals that something may be going wrong or needs urgent attention.

Risk Identification and Mitigation

KRIs also help in the quantification of risks that could impact an organization’s objectives, operations, or financial health. This is because they offer a systematic and data-driven approach to understanding risk factors.

Once a KRI triggers, organizations can initiate risk mitigation measures promptly, minimizing the potential or expected negative impact. Hence, this allows for a more proactive and effective risk management process.

Efficiency and Resource Allocation

By focusing on high-priority risks identified through KRIs, organizations can allocate resources where they’re most needed. This way, efforts for risk management become more intentional and strategic.

Communication and Reporting

KRIs provide a standardized way to communicate risk-related information to stakeholders, from management to board members. This improves the process of reporting and promoting accountability in managing risks as a shared responsibility.

Compliance Monitoring

In regulated industries such as oil and gas,manufacturing, and transportation, KRIs can help organizations monitor and ensure compliance with regulatory requirements and standards. This is particularly important for avoiding legal and regulatory issues.

Decision Support

When organizations have a clear view of their risk landscape, they can make more informed and strategic decisions, allocate resources effectively, and adjust their strategies as needed. Ultimately, these contribute to sustainable and long-term success.

Continuous Improvement

Over time, organizations can learn from the data provided by KRIs. This knowledge can lead to the refinement and improvement of risk management strategies and processes, along with the overall operations of an organization.

Characteristics of Good KRIs

KRIs possess key characteristics that make them effective for risk monitoring and management. These help ensure that they provide valuable, actionable information that organizations can use to act upon.

To give you an overview, a key risk indicator must play the following roles and exude these attributes:

Relevance – must directly align with the specific risks that the organization is exposed to and the goals it aims to achieve

Quantifiability – should be expressed as numbers or ratios, making it easy to track and analyze changes over time, allowing for data-driven decision-making

Sensitivity – can detect subtle shifts in risk factors, providing early warning signals, and should respond promptly to changes in the risk it’s monitoring

Consistency – should be based on reliable and consistent data sources, ensuring that the information is accurate and comparable over time

Specificity – should be narrowly focused to provide a clear signal

Timeliness – offer real-time or near-real-time data, allowing organizations to respond quickly to emerging risks

Forward-Looking – must have a forward-looking aspect to identify potential future risks and allow organizations to take preventive measures

Communication – should be easily understandable and communicated effectively to relevant stakeholders, including senior management and decision-makers

Integration – should be part of a comprehensive risk management strategy and process

Continuous Review and Adaptation – must be subject to regular review and adaptation to ensure that they remain relevant and effective for organizations

Key Performance Indicators vs Key Risk Indicators

Key Performance Indicators (KPIs) and KRIs are essential tools in benchmarking the performance of organizations’ operational processes and procedures. However, they serve distinct functions.

KPIs, for instance, are performance metrics that organizations use to gauge how effectively they’re achieving their objectives and goals. These indicators primarily cover positive outcomes, such as revenue growth,customer satisfaction, and operational efficiency. Hence, they’re crucial for tracking progress, making strategic decisions, and improving overall performance.

In contrast, KRIs are risk-focused indicators designed to identify and monitor potential risks and vulnerabilities that could affect an organization’s operations and objectives. They can be either positive or negative, indicating both increased risk and the effectiveness of risk mitigation efforts. KRIs also help organizations anticipate and mitigate potential issues.

Organizations, from small businesses to enterprises, must maintain a balanced approach to using both KPIs for performance optimization and KRIs for risk management. This way, they can effectively work their way toward long-term success and resilience.How to Develop Key Risk Indicators

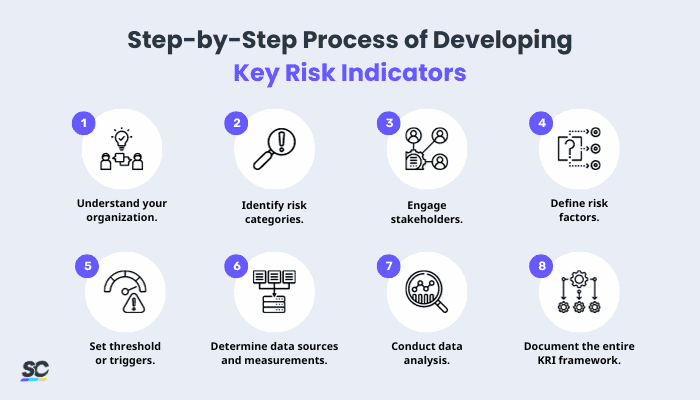

Process of Developing Key Risk Indicators

The process of constructing KRIs requires a meticulous and thoughtful approach to ensure that the selected indicators effectively monitor potential risks within your organization. Keep in mind and follow these steps to guide you while creating key risk indicators:

1. Understand your organization.

Start by gaining a deep understanding of your objectives, operations, industry, and risk landscape. This is to easily identify the specific areas where you need to monitor risks. Make sure to consider internal and external factors that could impact your organization.

2. Identify risk categories.

Categorize the types of risks your organization faces. Common ones include financial, operational, and compliance risks. Understanding these categories helps define the scope of your KRI development.

3. Engage stakeholders.

Involve the senior management, department heads, and risk management teams in the process. Collaborative discussions can help identify key areas of concern and the information needed to monitor those areas effectively.

4. Define risk factors.

Within each risk category, identify specific risk factors that are specific, measurable, and tied to your objectives. For example, if you’re monitoring financial risk, factors could include liquidity ratios,debt levels, or revenue concentration.

5. Set threshold or triggers.

These thresholds represent the acceptable range for each risk factor. When a risk factor crosses these, it triggers an alert or further investigation. Hence, thresholds must be based on historical data, industry benchmarks, and the organization’s risk appetite.

6. Determine the sources and measurement of data for each KRI.

This could include financial reports, operational data, regulatory filings, and industry benchmarks. Also, develop a method for collecting and measuring the data associated with each KRI.

7. Analyze, report, and visualize the collected data.

Calculating the values of the KRIs can be done through mathematical formulas or statistical analysis, depending on the nature of the risk factor. You must also create a system for reporting and visualizing the KRIs via dashboards and reports, for example.

Also, be prepared to adapt your KRIs as your organization evolves and risk factors change to ensure they remain relevant and valuable.

8. Document the entire KRI framework.

Include the rationale behind the selection of specific KRIs and their associated thresholds. Then, document the policies and procedures for KRI monitoring to ensure they’re readily accessible.

Improve your GRC management

Simplify risk management and compliance with our centralized platform, designed to integrate and automate processes for optimal governance.

Examples

KRIs become unique and specific depending on an organization’s industry, objectives, and risk profile. Here are some key risk indicators examples across various categories and applications:

Financial

Liquidity Ratio – measures an organization’s ability to meet short-term financial obligations

Debt-to-Equity Ratio – monitors the level of debt relative to equity

Revenue Concentration – tracks the percentage of revenue derived from a single customer or a small group of customers

Operational

Equipment Downtime – measures the amount of time equipment or machinery is out of operation due to breakdowns

Inventory Levels – monitors the levels of inventory on hand

Employee Turnover Rate – tracks the rate at which employees leave the organization

Compliance

Regulatory Violations – monitors instances of non-compliance with specific regulations or industry standards

Audit Findings – measures the results of internal or external audits

Data Breach Incidents – tracks the number of data breaches or security incidents

Proactively Identify and Monitor KRIs Using SafetyCulture

Why use SafetyCulture?

The effective utilization of key risk indicators is crucial for organizations aiming to manage and mitigate potential risks proactively. As you navigate an ever-evolving business landscape, the ability to identify and respond to emerging threats becomes more imperative than ever. Also, KRIs empower decision-makers to safeguard against potential business disruptions.

Hence, using technological solutions such as SafetyCulture (formerly iAuditor) not only streamlines the KRI monitoring process but also enhances the accuracy and efficiency of risk management and compliance efforts. By leveraging this workplace operations platform, risk managers, operations managers, compliance managers, and senior management can do the following and more:

Benchmark your organization’s performance in maintaining minimum risk rates on operations by analyzing data from conducted risk assessments .

Monitor and track how processes are pacing toward objectives and goals by regularly conducting audits and inspections .

Standardize and streamline how process checks are performed using checklists and templates .

Mitigate identified risks before they escalate into bigger concerns by reporting them to relevant stakeholders and assigning corrective actions.

Communicate how KRIs are regularly monitored and mitigated by generating reports in various formats, including PDF, Excel, Word, or Weblink. You can also store them on SafetyCulture’s secure cloud .

Ensure everyone is aligned with best practices on managing risks and how to address them by deploying regular training programs and sharing Heads Ups for improved organizational communications.

Related articles

Food Safety

Safety

Cold Holding: The Ultimate Guide

Learn about cold holding methods for food safety and how it reduces contamination risks across operations.

Food Safety

Safety

A Comprehensive Guide to Natasha’s Law Training

Learn about the process of Natasha’s Law training and how it helps food businesses efficiently meet allergen labeling requirements.

Construction Safety

Safety

A Complete Guide to Scaffolding Safety Training

Learn everything about scaffolding safety training, from topics to best practices, to uphold construction and maintenance safety.