FHA Appraisal Requirements Checklist

A Federal Housing Administration (FHA) appraisal checklist is a tool used by HUD-approved property appraisers to have a current estimated market value of the property. This includes livability factors such as access to transport, health care, education and more. It helps to assess the property condition such that it meets FHA minimum standards to protect the lender and avoid numerous repair needs for the homebuyers. Conducting an appraisal helps verify important information of the property and gives transparency to the stakeholders. The HUD sorted the minimum property standards into 3 parts, safety, security, and soundness. Remember the 3 S when filling out an FHA appraisal form.

What are the FHA Appraisal Requirements?

The FHA Appraisals are required to meet property standards set by the U.S. Department of Housing and Urban Development (HUD) to satisfy FHA loan requirements before a buyer can purchase the home. FHA inspections ensure to meet the following minimum standards:

1. Safety

Appraisers should inspect the level of risks to ensure homebuyers/occupants are being protected from non-desirable outcomes. Below health and safety information should be checked:

- Environmental hazards and health risks;

- Structural integrity of the home;

- Electrical installation and utilities; and

- Lead-based paint and other chemical hazards

2. Security

Assessing the market value of the property secures the lender to preserve the profit as the property serves as collateral for the loan. The following FHA inspection items are checked to validate the security of the property:

- Physical and visual condition of the property;

- Grading and drainage problems;

- Water Supply shortage;

- Septic tank system’s condition; and

- Road accessibility

3. Soundness

Appraisers should ensure the property doesn’t have any physical deficiencies or conditions that will affect its structural integrity. Below FHA home inspection list is assessed to check for damages and repair needs.

- Property Disturbances such as sinkholes or natural depressions;

- Large or multiple cracks in the floor and walls of the property;

- Poor ventilation systems;

- Pest Infestation; and

- Roof and gutter leaks

Meeting the minimum standards helps homebuyers control additional costs for extensive damages and repair needs. While for lenders, it ensures deterioration doesn’t cut into the value of the home if the borrower defaults on a mortgage and reduces the risk of paying insurance claims.

What to Include in Your FHA Appraisal Checklist?

Since the main goal of an FHA appraisal checklist is to ensure that a property meets the set standards and is checked for its safety, security, and soundness—it should be an all-encompassing document that helps assess the various elements of a property. Aside from the interior, FHA checklist also considers location-related factors such as accessibility and hazards.

Here are some sample questions you can include in your checklist:

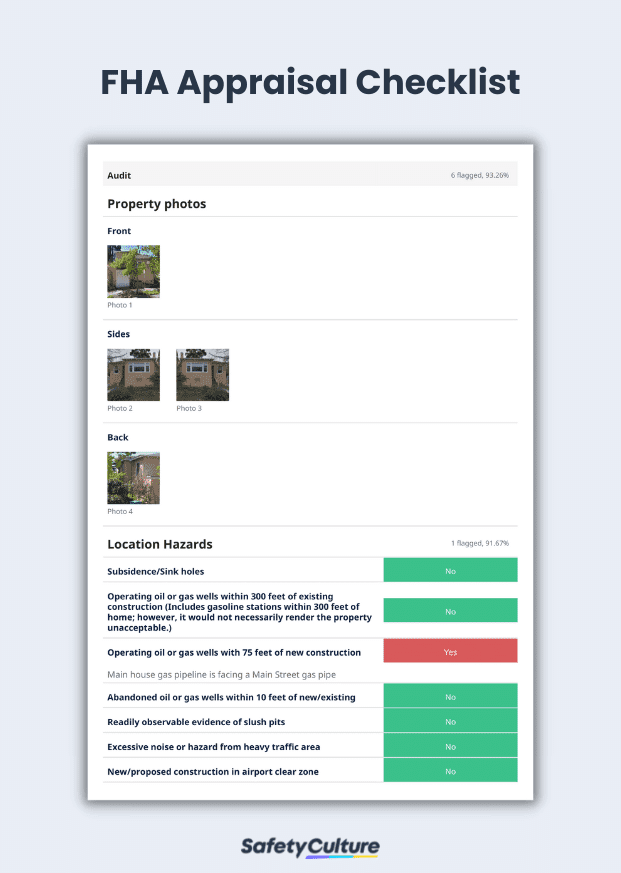

Location Hazards

Location hazards refer to the potential dangers that may be present within the vicinity of the property. To ensure transparency, consider including the following questions in your checklist:

- Are there nearby subsidence/sinkholes?

- Is there excessive noise or hazards from heavy traffic areas?

- Is there excessive hazard from smoke, fumes, offensive noises, or odors?

- Are there nearby stationary storage tanks with more than 1000 gallons of flammable or explosive material?

- Are there high-pressure gas or petroleum lines within engineering 10 feet or property?

Structural Conditions

Your FHA appraisal checklist should specifically review potential damages to a property’s structure. Some of the structure-related questions include:

- Is there a sign of rodent infestation?

- Is there evidence of water/leakage or damage on the floor?

- Are there significant cracks on the floor?

- Are there visible holes in framing, walls, or ceiling that could affect the structure?

- Are support structures of attic damaged?

Foundation and Basement

All areas of the property should be checked for their accessibility and soundness. This includes the foundation and basement—questions for your checklist can be along the lines of:

- Is the foundation/basement access inadequate?

- Is there evidence of water damage?

- Is the crawl space inadequate for maintenance?

- Are support beams not intact?

- Is there excessive dampness or ponding of water?

FAQs about FHA Inspections

As long as the property meets the 3 minimum standards set by the HUD, it shouldn’t be hard to pass a FHA inspection. To increase the property’s chances of passing, prepare for the FHA inspection in advance. Check the property for hazards, broken systems or parts, and quality issues. Consider doing a mock FHA inspection to capture and resolve all of these problems before the actual inspection.

While appraisers may identify a number of problems, most of them will not lead to the property failing the FHA appraisal. However, what will fail an FHA appraisal are health and safety violations such as asbestos, lead paint, and pest infestations. Poor accessibility and signs of structural damage can also prevent a property from passing an FHA appraisal.

Since an FHA appraisal is a comprehensive review of a property’s condition, the inspection itself may take up half a day or several hours. Also, be prepared to wait a few days to get the appraiser’s report. Additionally, if the appraiser decides that specific items need to be fixed or resolved before the property can pass the FHA appraisal, then it can take a week or more for these items to be properly addressed.

If you’re confident about the property’s safety, security, and soundness, then you have nothing to worry about. But it still helps to double-check everything before the FHA appraisal to ensure that the property passes and no further repairs are needed.

If in doubt, consider hiring a third-party inspector to assess the property’s condition based on HUD standards. If the property passes this inspection with flying colors, then you shouldn’t worry about the FHA appraisal. If the property fails the inspection or the third-party inspector flags some items, then you have the opportunity to fix these issues before the official FHA appraisal.