Published 25 Jul 2025

Article by

4 min read

FHA Appraisal Requirements Checklist

A Federal Housing Administration (FHA) appraisal checklist is a tool used by HUD-approved property appraisers to have a current estimated market value of the property. This checklist is used by appraisers to assess livability factors of properties and check access to transport, health care, education and more. It helps to assess the property condition such that it meets FHA minimum standards to protect the lender and avoid numerous repair needs for the homebuyers. Conducting an appraisal helps verify important information of the property and gives transparency to the stakeholders. The HUD sorted the minimum property standards into 3 parts, safety, security, and soundness. Remember the 3 S when filling out an FHA appraisal form.

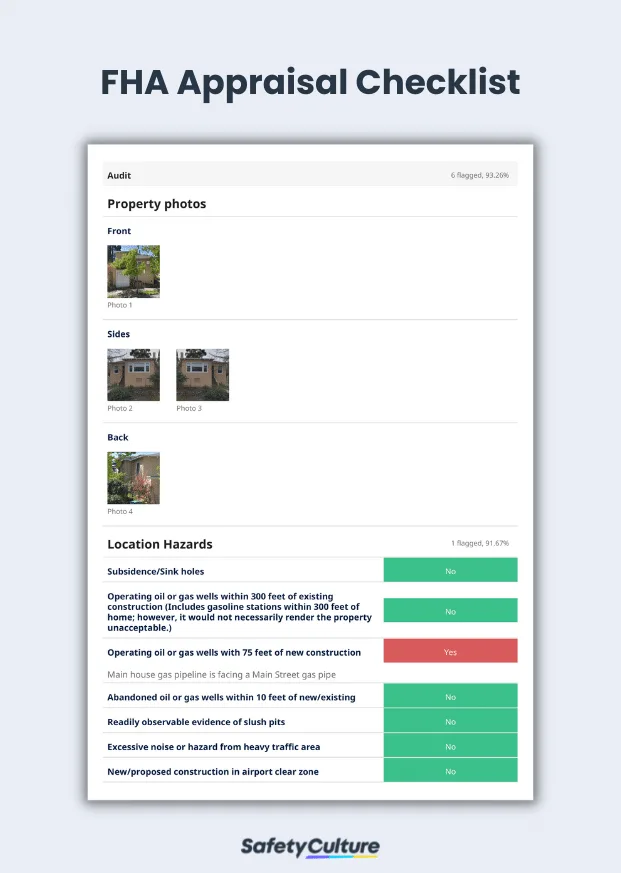

fha appraisal checklist for market value

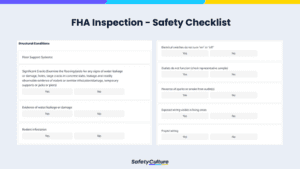

FHA inspection checklist for safety

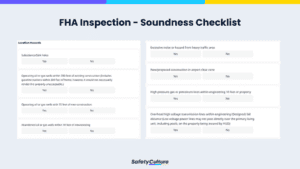

FHA inspection checklist for soundness of property

FHA inspection checklist for property security

What are the FHA Appraisal Requirements?

The FHA Appraisals are required to meet property standards set by the U.S. Department of Housing and Urban Development ( HUD ) to satisfy FHA loan requirements before a buyer can purchase the home. FHA inspections ensure to meet the following minimum standards:

1. Safety

Appraisers should inspect the level of risks to ensure homebuyers/occupants are being protected from non-desirable outcomes. Below health and safety information should be checked:

Environmental hazards and health risks;

Structural integrity of the home;

Electrical installation and utilities; and

Lead-based paint and other chemical hazards

2. Security

Assessing the market value of the property secures the lender to preserve the profit as the property serves as collateral for the loan. The following FHA inspection items are checked to validate the security of the property:

Physical and visual condition of the property;

Grading and drainage problems;

Water Supply shortage;

Road accessibility

3. Soundness

Appraisers should ensure the property doesn’t have any physical deficiencies or conditions that will affect its structural integrity. Below FHA home inspection list is assessed to check for damages and repair needs.

Property Disturbances such as sinkholes or natural depressions;

Large or multiple cracks in the floor and walls of the property;

Poor ventilation systems;

Pest Infestation; and

Roof and gutter leaks

Meeting the minimum standards helps homebuyers control additional costs for extensive damages and repair needs. While for lenders, it ensures deterioration doesn’t cut into the value of the home if the borrower defaults on a mortgage and reduces the risk of paying insurance claims.

What to Include in Your FHA Appraisal Checklist?

Since the main goal of an FHA appraisal checklist is to ensure that a property meets the set standards and is checked for its safety, security, and soundness—it should be an all-encompassing document that helpsassess the property’s condition, utilities, and heating system. Aside from the interior, FHA checklist also considers location-related factors such as accessibility and hazards.

Location Hazards

Location hazards refer to the potential dangers that may be present within the vicinity of the property. To ensure transparency, consider including the following questions in your checklist:

Are there nearby subsidence/sinkholes?

Is there excessive noise or hazards from heavy traffic areas?

Is there excessive hazard from smoke, fumes, offensive noises, or odors?

Are there nearby stationary storage tanks with more than 1000 gallons of flammable or explosive material?

Are there high-pressure gas or petroleum lines within engineering 10 feet or property?

Structural Conditions

Your FHA appraisal checklist should specifically review potential damages to a property’s structure. Some of the structure-related questions include:

Is there a sign of rodent infestation?

Is there evidence of water/leakage or damage on the floor?

Are there significant cracks on the floor?

Are there visible holes in framing, walls, or ceiling that could affect the structure?

Are support structures of the attic damaged?

Foundation and Basement

All areas of the property should be checked for their accessibility and soundness. This includes the foundation and basement—questions for your checklist can be along the lines of:

Is the foundation/basement access inadequate?

Is there evidence of water damage?

Is the crawl space inadequate for maintenance?

Are support beams not intact?

Is there excessive dampness or ponding of water?

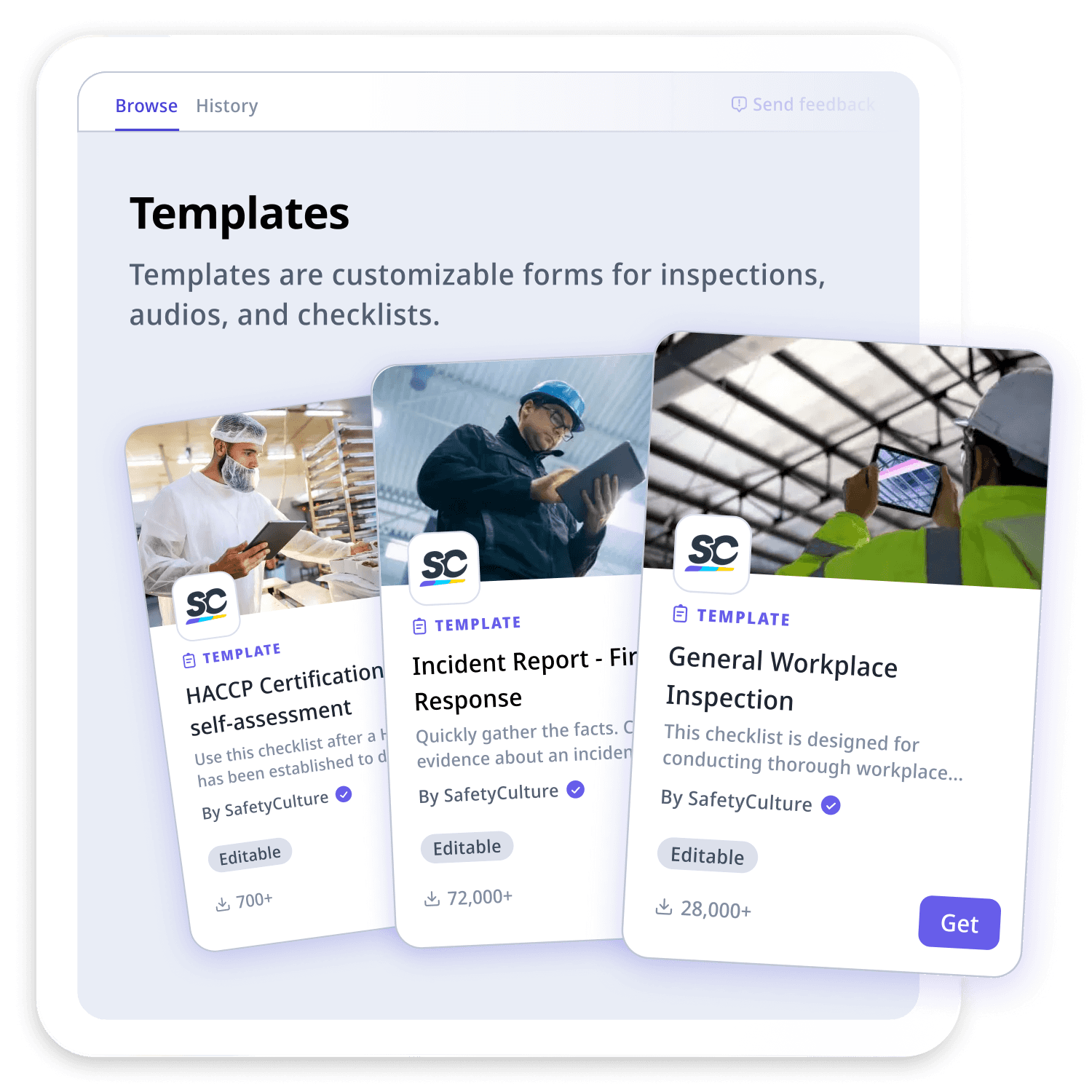

Still looking for a checklist?

Search, filter, and customize 60,000+ templates across industries and use cases.