Published 26 Sept 2025

Article by

3 min read

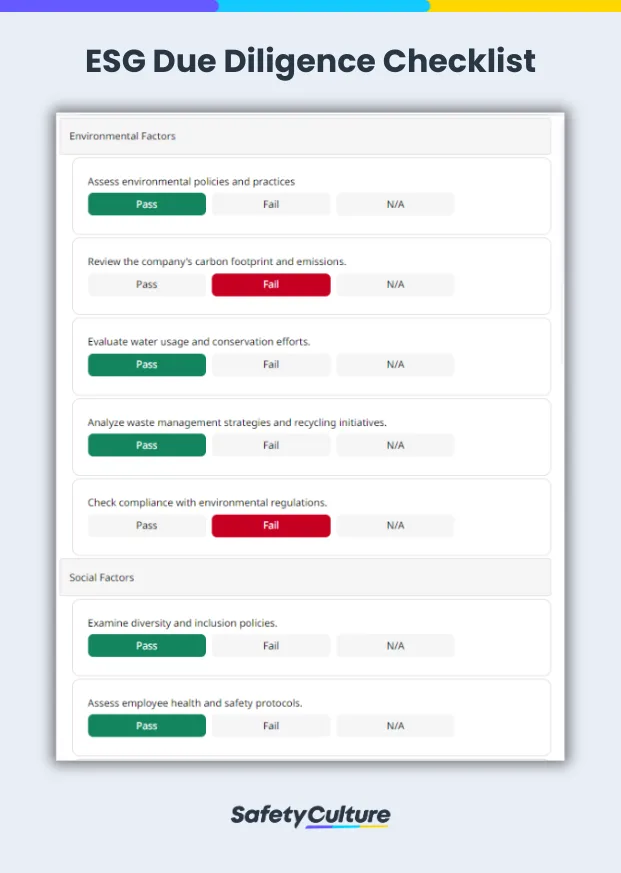

What is an ESG Due Diligence Checklist?

An Environmental, Social, Governance (ESG) due diligence checklist is a tool used to evaluate a company’s ESG policies and risk factors. It helps uncover potential ESG issues, manage risks, and identify value-creation opportunities. By using this checklist, investors and organizations can make more informed and ethical investment decisions and assess the sustainability and ethical practices of the companies they work with.

Importance and Benefits

The benefits of a thorough ESG due diligence process include uncovering crucial data and insights into the success and value of a company’s ESG, identifying and managing risks, and meeting stakeholder expectations. By using this checklist, investors and organizations can make more informed and ethical investment decisions, as well as assess the sustainability and ethical practices of the companies they work with.

Risk Mitigation – By identifying and assessing ESG risks , organizations can mitigate potential negative impacts on the environment, society, and governance, thus safeguarding their reputation and financial performance.

Enhanced Corporate Reputation – By proactively addressing ESG concerns, companies can demonstrate their commitment to responsible business practices. This, in turn, can help them improve their public image and brand value.

Investor Confidence – By prioritizing the right ESG factors and demonstrating fulfillment of ESG commitments, companies can instill confidence in investors regarding their long-term sustainability and value-creation potential.

What Should be Included in Your ESG Due Diligence Checklist?

An ideal ESG due diligence checklist would cover the main three categories: environmental, social, and governmental. Apart from this, it should also incorporate other important categories in line with your business needs and goals.

When conducting due diligence assessments, it’s important to be as detailed as you can by engaging in conversations with the right point of contact. Here are the following key elements to include in your checklist:

Environmental Factors

Assess the company’s environmental impact, including the following:

Carbon emissions

Resource usage

Pollution control measures

This covers the consumption, usage, and efforts being done to control the environmental impact.

Social Factors

Evaluate the company’s impact on society, covering aspects such as:

Labor practices

Employee welfare

Human rights

Community engagement

Product safety

This should also cover whether the organization is adhering to safety regulations, labor policies, and other quality management standards.

Governmental Factors

Examine the company’s governance structure, board composition, executive compensation, and business ethics. This should also assess the board of directors whether the members are qualified experts, diverse, and involved in ESG matters.

Geographical and Sector Information

Understand the company’s geographical location and the specific environmental, social, and governance challenges it faces.

Risk Assessment

Perform a risk assessment based on the information gathered to understand how the company is run and the risks it may pose. This may also cover stakeholder interviews involving company representatives and subject matter experts to gain insights into the company’s attitude towards ESG and its commitment to addressing ESG issues.

Still looking for a checklist?

Search, filter, and customize 60,000+ templates across industries and use cases.