Why is Risk Management Important for Businesses?

Learn how risk management can protect your organization from potential dangers and ensure that everyone understands the risks involved in their work

Published 14 Nov 2025

Article by

8 min read

What is Risk Management?

Risk management is the process of identifying, assessing, and minimizing the impact of risk. It’s a way for organizations to identify potential dangers and threats and take steps to eliminate or reduce the chances of them happening. If they do end up happening, risk management helps ensure that adverse effects are minimal to none.

All organizations, regardless of size, need to have robust risk management in place. This is because risk management helps to proactively identify and control threats and vulnerabilities that could impact the organization negatively.

Organizations face all sorts of risks, such as financial, safety, and reputational risks, among others. By implementing a risk management strategy for such risks, businesses can protect themselves from these dangers and ensure they’re prepared for any situation.

Importance of Risk Management

So, what is the purpose and importance of risk management in an organization? Simply put, risk management aims to protect an organization from potential losses or threats to its continued operation. This can include financial losses, damage to the organization’s reputation, or harm to employees.

Keep in mind that when it comes to risk management, there’s no one-size-fits-all solution. Every organization is different and will encounter different kinds of risks.

That’s why it’s so important for organizations to have a risk management plan in place. A risk management plan contains all the assessed risks that the organization is facing and the corresponding steps in place to mitigate those risks.

By taking a proactive approach to risk management and continuously training employees, an organization can reduce the chances of something going wrong and minimize the damage if something, such as an incident, does happen. Risk management is an essential part of any organization, and must be given the attention it deserves.

Risk Management Strategies

There are five primary types of risk management:

1. Risk Acceptance

Acceptance is when an organization decides to accept the risks associated with a particular situation. With this kind of risk management, the company has recognized that it is not worth the cost and effort to mitigate the events that may occur due to the risk.

2. Risk Transference

Transferring risk is when an organization shifts the risks to another party, such as through insurance. For example, When a person or an organization gets insurance, the financial risk associated with an unfortunate event is transferred to the insurance company instead.

3. Risk Avoidance

Avoidance of risk is when an organization takes steps to prevent or avoid a particular risk from happening such as an injury, disease, or death. The company mitigates such risks by not involving in risky activities or situations.

4. Risk Reduction and Loss Prevention

Loss prevention and risk reduction are when an organization takes steps or methods to reduce the impact of a particular risk that occurs. It combines risk acceptance as it acknowledges the risk involved while also focusing on how to reduce and contain the loss from spreading.

5. Risk Sharing

Risk sharing is when an organization distributes the risk to the whole team. This method removes the burden of problematic events to one department and shares it with others so that those who can help and provide support for that problem can help and control those risks.

5 Principles of Risk Management

Risk management is identifying, assessing, and controlling risks to an organization. The goal of risk management is to protect the organization’s assets, including its people, property, and profits.

There are five key principles of risk management:risk identification, risk analysis,risk control, risk financing, and claims management. Let’s look at each one in more detail.

Risk identification – This is the process of identifying potential risks to an organization.

Risk analysis – It is assessing the likelihood and impact of those identified risks.

Risk control – It involves taking steps to communicate , mitigate , minimize, or eliminate the impact of potential risks.

Risk financing – This is the process of allocating financial resources to cover the costs associated with potential risks.

Claims management – This is the process of dealing with any claims that may arise as a result of a risk.

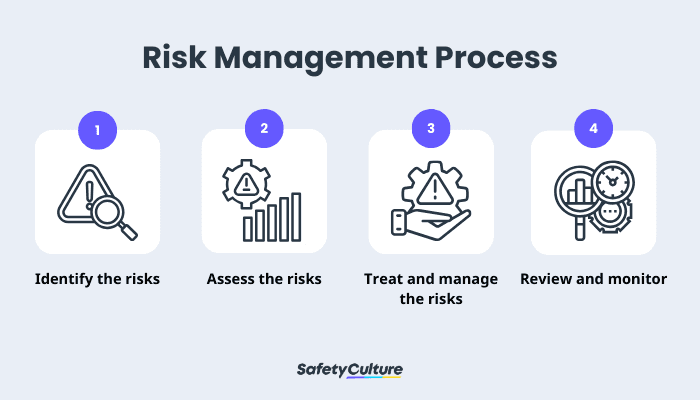

The Risk Management Process: 4 Essential Steps

Risk management is an important part of any organization, and should be taken seriously. Implementing proper risk management can help keep your organization safe and secure. With these four steps, organizations can protect themselves from potential damage and losses.

Risk Management Process

1. Identify the Risks

The first step in risk management is to identify the risks that your organization face. This can be done by conducting a risk assessment, which involves reviewing all of the possible risks that could affect your business and recording them on a risk management plan.

Create your own Risk Management Plan Template

Build from scratch or choose from our collection of free, ready-to-download, and customizable templates.

2. Assess the Risks

The second step is to assess the risks that have been identified. This means assessing how likely it is for a risk to occur and how much damage it could cause if it did.

This is an essential part as assessing allows you to figure out the connection between the risk and different factors involved within the organization.

3. Treat and Manage the Risks

The third step is treating the risks that have been assessed. This means taking steps to reduce or eliminate the risks as much as possible. The process is done by allocating the experts in their fields to which risk they can treat and manage.

4. Review and Monitor

The fourth and final step is to review and monitor the risks that have been identified and treated. This involves tracking the progress of the risk management process and ensuring that all steps are being followed correctly. This step also helps ensure that the risk mitigation in place is still effective. In the same way, organizations can use Key Risk Indicators (KRIs) to define metrics or data points as thresholds for maintaining manageable risk levels.

Records management is an important part of the overall risk management process. Properly managing your records makes sure that risks are identified, documented, monitored, and treated effectively.

Improve your GRC management

Simplify risk management and compliance with our centralized platform, designed to integrate and automate processes for optimal governance.

Risk Management Examples

There are a number of different risk management practices that an organization can use, depending on its size and specific needs, to enhance their risk-based decision-making. Some standard examples include:

Compliance Risks – Companies need to keep an eye on their compliance regularly, including alignment with frameworks such as the Sendai Framework for Disaster Risk Reduction . This means checking all their current processes, procedures, and technologies , and making sure they stay up to date. A risk management system can help with this.

Safety Risks – Risk management can also be best applied for safety risks inside the company. This way, any injuries or dangers can be prevented beforehand.

Information Security Risk – Ever heard of a data breach? As technology begins to advance more and more people find ways to hack into a company system to steal their cyber data. By using risk management, companies can carefully plan out how to enhance their information and cyber security networks .

5 Risk Management Tools

Here are the five main risk management tools:

SWOT – Strengths, Weaknesses, Opportunities, and Threats or SWOT helps identify risks by assessing each area of the company.

Root Cause Analysis – It is a method of identifying the main source of a problem or risk and finding a solution to resolve it.

Risk Register – A risk register is useful for identifying potential risks in a project (e.g., construction projects) or organization – which can come in handy for avoiding any potential issues that could throw a wrench in your intended outcomes.

Probability and Impact Matrix – A probability and impact matrix is a way to prioritize risks. It’s important to prioritize risk because you don’t want to waste time chasing a small risk and exhaust your resources.

Brainstorming – This tool allows you to assess any insights that can help resolve any issues that occur inside the company.

Risk Control Matrix – This identifies, assesses, and manages risks by mapping them to corresponding controls, ensuring potential vulnerabilities are effectively addressed.

Effectively Manage Risks with SafetyCulture

Why use SafetyCulture?

SafetyCulture is a mobile-first operations platform adopted across industries such as manufacturing, mining, construction, retail, and hospitality. It’s designed to equip leaders and working teams with the knowledge and tools to do their best work—to the safest and highest standard.

Promote a culture of accountability and transparency within your organization where every member takes ownership of their actions. Align governance practices, enhance risk management protocols, and ensure compliance with legal requirements and internal policies by streamlining and standardizing workflows through a unified platform.

✓ Save time and reduce costs ✓ Stay on top of risks and incidents ✓ Boost productivity and efficiency ✓ Enhance communication and collaboration ✓ Discover improvement opportunities ✓ Make data-driven business decisions

Article by

SafetyCulture Content Team

SafetyCulture Content Contributor, SafetyCulture

View author profileRelated articles

Environmental Safety

Safety

Oil Drum Storage: Safety Guide and Best Practices

Learn the practices for safe oil drum storage, its importance, and the regulations for compliance.

Environmental Safety

Safety

Flood Risk Management

Read this guide to flood risk management, its importance, and the key components and strategies for this process.

Environmental Safety

Safety

A Comprehensive Guide to Stormwater Pollution Prevention Best Management Practices (SWPPP BMP)

Learn about the types of best management practices for SWPP and the steps to effectively implement them in prevention plans.