What is an Operational Due Diligence Checklist?

An operational due diligence (ODD) checklist is a comprehensive tool used to systematically assess and evaluate various operational aspects of a business or investment opportunity. This checklist serves as a structured guide to ensure that all critical factors are thoroughly examined before making informed decisions.

Importance and Benefits

Utilizing this checklist ensures that all operational aspects of a business are inspected in terms of regulatory compliance, financial data validation, operational efficiency assessment, uncovering of hidden liabilities, and mitigation of post-transaction surprises. Undertaking this process with a checklist will help you accomplish a seamless business acquisition.

Types of Operational Due Diligence Checklists

Here are some types of operational diligence checklists that are commonly used:

Financial Due Diligence Checklist

- Review financial statements, including balance sheets, income statements, and cash flow statements.

- Analyze historical financial performance and trends.

- Assess the accuracy of financial records and accounting practices.

- Evaluate working capital and liquidity positions.

- Identify any outstanding debts, liabilities, or contingent liabilities

Legal and Regulatory Due Diligence Checklist

- Review legal structure, ownership, and corporate governance.

- Identify any ongoing or potential legal disputes.

- Ensure compliance with relevant laws, regulations, and industry standards.

- Examine intellectual property rights and protection.

- Assess any licenses, permits, or approvals required for operations.

Human Resources Due Diligence Checklist

- Evaluate the organizational structure and reporting lines.

- Assess employee roles, responsibilities, and compensation.

- Review employment contracts, benefits, and policies.

- Identify any labor-related risks or pending issues.

- Evaluate the company’s talent management and retention strategies.

Technology and IT Due Diligence Checklist

- Assess the company’s technological infrastructure and IT systems.

- Review cybersecurity measures and data protection practices.

- Evaluate software applications and technology platforms in use.

- Identify any ongoing IT projects or initiatives.

- Assess the company’s readiness for digital transformation.

Environmental and Sustainability Due Diligence Checklist

- Evaluate the company’s environmental impact and sustainability efforts.

- Identify potential environmental risks, liabilities, and compliance issues.

- Review waste management, energy consumption, and emissions data.

- Assess the company’s commitment to sustainable practices and social responsibility.

Customer and Market Due Diligence Checklist

- Analyze the company’s customer base and market segmentation.

- Evaluate customer retention and satisfaction rates.

- Assess the competitive landscape and market trends.

- Identify growth opportunities and potential challenges.

- Review the company’s marketing and sales strategies.

Integration and Synergy Due Diligence Checklist

- Identify potential synergies between the acquiring and target companies.

- Assess integration challenges and compatibility of systems.

- Review cultural differences and potential personnel challenges.

- Evaluate the timeline and plan for post-merger integration.

What Should Be Included in this Checklist?

A well-structured operational due diligence checklist helps ensure that no crucial aspects are overlooked during this assessment. While there are numerous types of due diligence checklists available for each sector, a general checklist may help you where to start. Ideally, you want to have a checklist that would cover and accomplish the following:

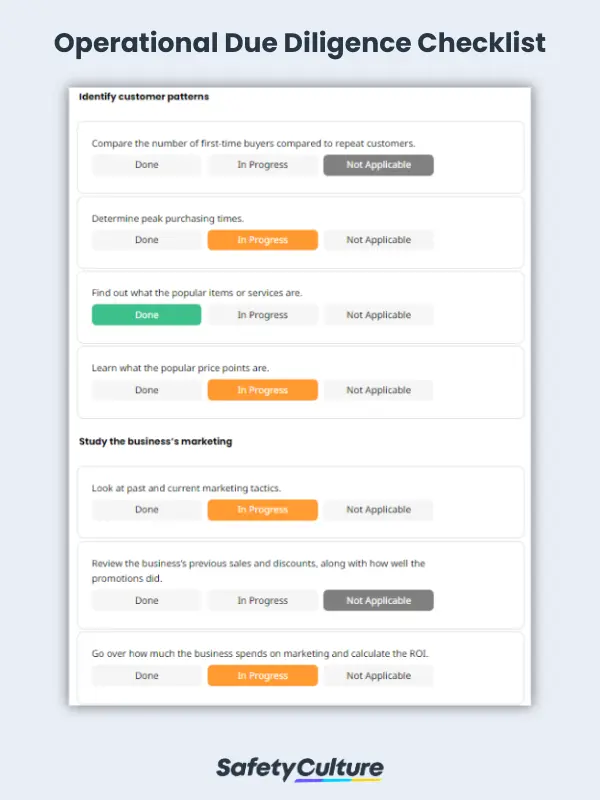

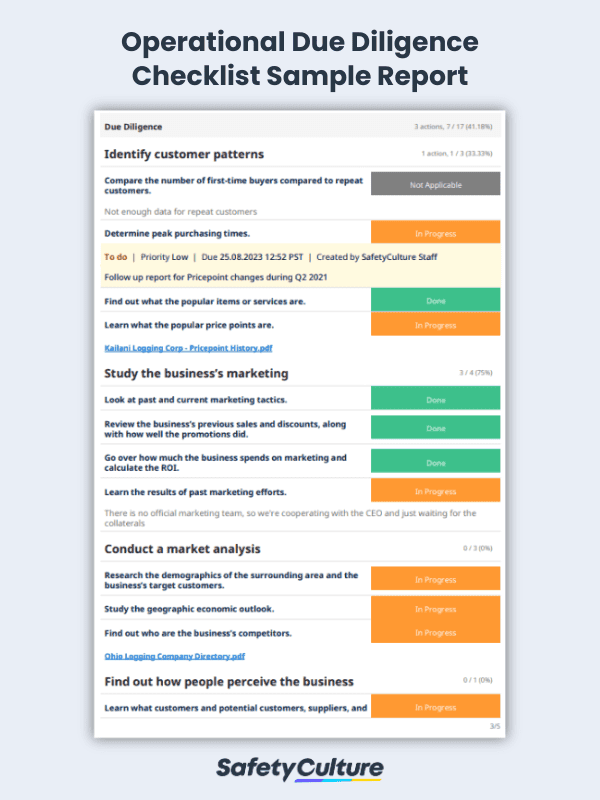

- Identify customer patterns

- Study the business’s marketing strategy

- Conduct a market analysis

- Find out how people perceive the business

- Research industry trends

- Learn more about the business’s competitors

How to Use a Checklist in a Due Diligence Procedure

With an existing checklist in hand, you can conduct operational due diligence by dividing the tasks into different sections. Here’s a step-by-step guide on how to use a template for operational due diligence checks:

- Compile essential documents and important information regarding the company.

- Undertake thorough research, conduct data analysis, and assess competitors to address items on the checklist.

- Record identified risks, opportunities, significant insights, and observations acquired during the due diligence procedure.

- Analyze data and insights to uncover patterns, trends, and potential methods for enhancing and mitigating risks.

- Utilize discoveries to inform justified investment or acquisition decisions.

- Formulate a comprehensive report for presentation to stakeholders and decision-makers.

- Devise integration of post-transaction strategies based on the insights acquired.

- Seek input from experts to refine the checklist, revising it as necessary.

FAQs about Operational Due Diligence Checklists

Operational due diligence is typically performed by professionals with expertise in different areas relevant to the evaluation of a company’s operations. These professionals could include financial analysts, industry experts, risk management specialists, legal advisors, human resources professionals, investment bankers, and more.

A commercial due diligence checklist focuses on understanding the market, industry, and strategic aspects of a business. It assesses market trends, customer behavior, revenue sources, competition, marketing efforts, and product differentiation.

Meanwhile, an operational due diligence checklist evaluates a company’s internal operations. It reviews financial stability, risk factors, supply chain and logistics, technology infrastructure, human resources, operational efficiency, legal compliance, and risk management strategies.

Yes, our ODD templates can be fully customized to best suit your needs. Explore our user-generated checklists and have the freedom to edit, use, or create your own in our public library.