What is Technical Due Diligence?

Technical due diligence is an investigative survey performed by prospective investors during the pre-investment stage of a product or property. Also referred to as ‘venture capital due diligence’, this assessment aims to provide insight into the costs and risks involved in the acquisition or sales transaction.

Why Use a Technical Due Diligence Checklist?

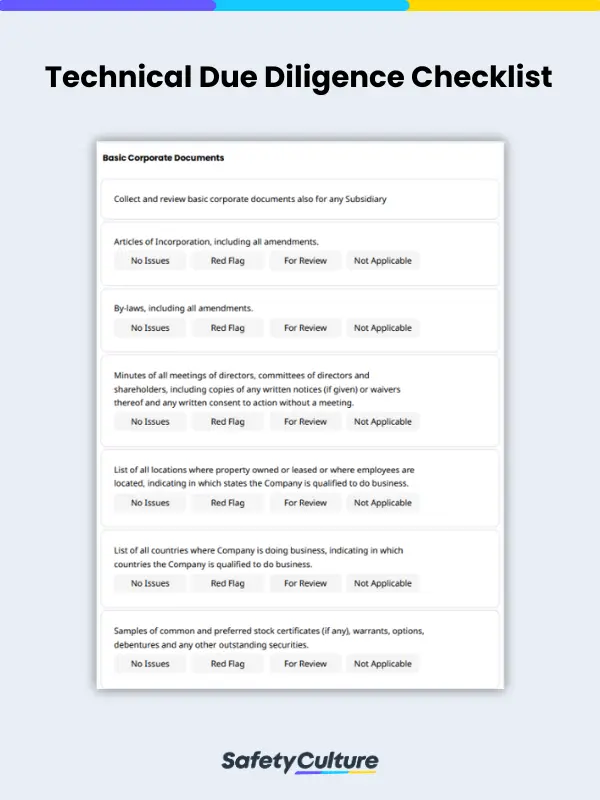

A technical due diligence checklist can help investors outline and organize critical factors in analyzing whether the investment target is a good or bad one. As a risk assessment tool, it provides investors a clear guide on which company assets, liabilities, obligations, contracts, and other possible risks to assume.

Click here to download Technical Due Diligence Checklists

Best Practices for Technical Due Diligence

To maximize the benefits of technical due diligence, investors can adopt the best practices to allow an objective, in-depth assessment of the target. An incomprehensive technical due diligence survey can lead to the investor missing out critical factors, which they may regret later on once the investment decision has been made. With that, here are three of the best practices for conducting tech due diligence to ensure a comprehensive survey:

- Prepare a customized technical due diligence checklist.

Technical due diligence is performed by investors across many industries. For example, angel software investors initiate technical due diligence to assess factors, such as scalability, code quality, and security of the product; real estate investors use tech due diligence to assess the technical and physical feasibility of a commercial property.

Customizing technical due diligence checklists for specific circumstances can help investors develop a tailored list of questions and requirements that will satisfy the elements they consider for a good investment. - Get yourself and the investment target ready.

It is more productive to allow the representative of the investment target to prepare documents and other requirements ahead of time. This can help prevent extensive delays in the tech due diligence survey and enable the investor to study the business better. - Go through checklist items thoroughly and constantly.

While the technical due diligence checklist may only be a list of requirements, investors should not take it for granted and be meticulous in reviewing every checklist item. Take time to interview all major stakeholders of the investment target. Take notes of the details they provide during interviews. Attach photos of noteworthy evidence found in documents provided. Schedule follow-up meetings, when necessary. Make sure that every checklist item is well-founded to guarantee a comprehensive technical due diligence process.