The Significance of Using a Compliance Maturity Model

Discover what a compliance maturity model is, explore its key benefits, and learn how to conduct a compliance maturity assessment to evaluate your organization’s current standing and drive continuous improvement.

Published 17 Feb 2025

Article by

8 min read

What is a Compliance Maturity Model?

A compliance maturity model is a structured framework that helps organizations assess and improve their compliance processes over time. By evaluating key critical components, this tool enables businesses to identify gaps, reduce risks, and strategically progress toward higher levels of compliance maturity. This approach ensures compliance initiatives align with organizational goals, regulatory requirements, and evolving industry standards.

Benefits of Using a Compliance Maturity Model

By leveraging this model, organizations can transform compliance management from a reactive burden into a proactive driver of operational success and long-term resilience. Here are the more concrete benefits of following a compliance maturity model:

Improved risk management – It helps organizations identify gaps in their compliance programs, enabling proactive risk management. By progressing through maturity stages, businesses can anticipate regulatory challenges, reduce vulnerabilities , and strengthen their risk mitigation strategies effectively.

Increased operational efficiency – As organizations advance within the compliance maturity model, they adopt standardized and automated processes that eliminate redundancy and improve resource management . This results in faster decision-making, reduced compliance costs, and greater overall efficiency across compliance management activities.

Proactive compliance culture – A compliance maturity model fosters a shift from reactive to proactive compliance practices. Employees across all levels of the organization adopt a compliance-first mindset , driving consistent behavior and ensuring adherence to policies before issues arise.

Enhanced regulatory readiness – A compliance maturity model ensures organizations are well-prepared to meet evolving regulatory requirements . By continuously measuring and improving compliance processes, businesses minimize the risk of non-compliance, fines, and legal issues, while maintaining a strong reputation in their industry.

Enhanced competitive advantage – A mature compliance program can differentiate an organization from competitors by showcasing reliability, transparency, and strong governance. This advantage can attract new clients, investors, and partners who prioritize working with trustworthy organizations .

Transform Your Compliance Strategy

Automate tracking and harness digital workflows to ensure compliance with evolving regulations effortlessly.

What are the 5 Levels of Maturity Modelling?

The five levels of compliance maturity represent the progressive stages organizations undergo as they enhance their compliance programs. Understanding them can help organizations identify their current stage and take actionable steps to advance, ensuring stronger compliance frameworks, reduced risks, and long-term success in a complex regulatory environment. The levels of maturity are as follows:

Level 1: Ad Hoc

At this stage, compliance efforts are reactive and unstructured, often lacking formal policies or processes. Organizations typically address issues as they arise, leading to inconsistent practices and increased risk exposure. The absence of a defined framework makes it challenging to identify or prevent compliance violations, leaving the organization vulnerable to fines and reputational damage.

Level 2: Repeatable

In the repeatable stage, organizations have established some compliance processes, but they are manual, inconsistent, and not fully documented. Efforts are still reactive, but there’s a growing awareness of the need for structured policies. While improvements are being made, compliance management is resource-intensive and heavily reliant on individual expertise, which can result in inefficiencies and gaps.

Level 3: Defined

At the defined level, organizations have documented and standardized compliance policies, procedures, and controls. These processes are consistently applied across the organization, improving accountability and reducing variability. While implementation is more systematic, there may still be limited use of technology or metrics to measure effectiveness, leaving room for optimization.

Level 4: Managed

Managed compliance programs are based on data-driven decisions, with organizations actively monitoring and evaluating their performance. Advanced tools and technologies are often utilized to automate processes, reduce manual errors, and enhance efficiency. Compliance efforts at this stage are proactive, enabling the organization to anticipate risks and respond quickly to regulatory changes.

Level 5: Optimized

The optimized stage represents the peak of compliance maturity, where processes are fully automated and continuously improved. Organizations at this level demonstrate a proactive compliance culture, leveraging real-time insights and advanced analytics to stay ahead of regulatory requirements. Compliance is embedded in the organization’s operations, reducing risks while fostering stakeholder trust and supporting strategic goals.

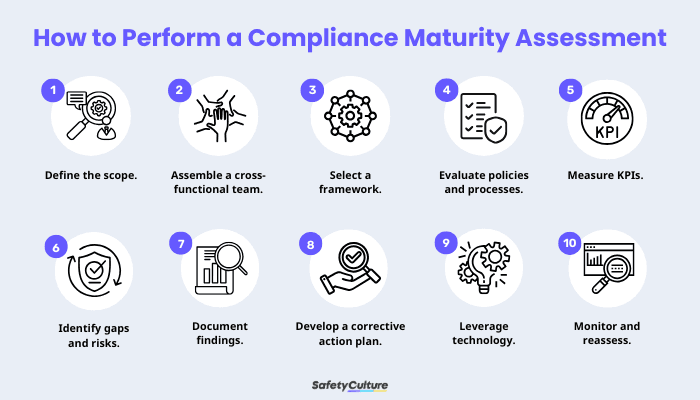

How to Perform a Compliance Maturity Assessment

By adopting a compliance maturity model, businesses can create a scalable and sustainable compliance program that evolves with changing regulatory landscapes and supports long-term growth. Here’s a step-by-step procedure to help organizations effectively assess their compliance maturity:

How to Perform a Compliance Maturity Assessment

1. Define the scope of the assessment.

Start by clearly defining the scope and objectives of your compliance maturity assessment. Identify the specific regulations, standards, or internal policies you want to evaluate. This step ensures the assessment is focused and relevant to your organization’s industry, size, and operational needs.

2. Assemble a cross-functional team.

Form a team of stakeholders from compliance, legal, IT, operations, and other relevant departments. A collaborative approach ensures that all aspects of the organization’s compliance efforts are reviewed. This team will provide diverse perspectives and help uncover gaps that might otherwise be overlooked.

3. Select a compliance maturity model framework.

Choose a suitable compliance maturity model, such as a five-level framework mentioned earlier, to serve as the foundation of your assessment. This framework provides a structured approach to evaluating compliance maturity and helps benchmark your organization against industry best practices.

4. Evaluate existing policies and processes.

Use an internal control checklist to assess their effectiveness, consistency, and alignment with regulatory requirements. This step helps identify whether processes are documented, standardized, and consistently applied across the organization.

5. Measure performance using key metrics.

Gather and analyze data to evaluate the effectiveness of compliance processes. Key Performance Indicators (KPIs) such as audit results,incident response times, and the frequency of compliance violations provide valuable insights into your current maturity level.

6. Identify gaps and risks.

Compare your current compliance practices with the selected maturity model to identify compliance gaps and vulnerabilities. Highlight areas where processes are reactive, inconsistent, or underdeveloped to pinpoint risks and prioritize improvements.

7. Document findings and assign a maturity level.

Summarize the results of your compliance maturity assessment in a detailed report. Assign a maturity level based on the findings and provide clear evidence for the evaluation. This transparency helps stakeholders understand the organization’s current compliance posture.

8. Develop an action roadmap for improvement.

Create a corrective action plan to address identified gaps and advance to higher levels of maturity. Prioritize actions based on risk, potential impact, and resource availability. Include milestones, timelines, and responsibilities to ensure accountability and progress.

9. Leverage technology and tools.

Incorporate compliance management software to automate processes, track progress, and enhance efficiency. Technology can support ongoing monitoring and make it easier to transition to higher maturity levels.

10. Monitor and reassess regularly.

Schedule regular compliance maturity assessments to ensure your organization adapts to new regulations, industry changes, and internal growth. Use the results to refine your strategies and maintain a proactive compliance culture.

Best Practices in Maintaining Compliance Maturity

Maintaining compliance maturity requires consistent effort and strategic planning. Here are the best practices for organizations to uphold and improve their compliance maturity levels:

Regularly update policies and procedures – Compliance policies should evolve with changes in regulations, industry standards, and organizational goals. As mentioned earlier, conduct periodic reviews to ensure all policies remain relevant, accurate, and aligned with current requirements, minimizing the risk of non-compliance.

Invest in continuous employee training – Equip employees with the knowledge and skills needed to uphold standards through ongoing compliance training programs . Regular sessions help maintain a compliance-conscious culture, ensuring staff are aware of regulatory changes and understand their roles in maintaining adherence.

Leverage compliance management technology – Utilize compliance software to automate processes, track key metrics, and monitor risks in real time. Advanced tools enable organizations to streamline operations, reduce manual errors, and maintain consistent oversight across all compliance activities.

Conduct regular audits and assessments – Schedule routine compliance audits and maturity assessments to evaluate the effectiveness of your program. These evaluations identify gaps, uncover new risks, and provide actionable insights to strengthen processes and maintain maturity levels.

Monitor third-party risks continuously – Regularly assess the compliance posture of vendors to ensure alignment with your standards. Implement consistent monitoring and reporting processes to mitigate risks from external partners, reducing vulnerabilities within your compliance ecosystem.

Track and adapt to regulatory changes – Stay informed about evolving regulations and industry trends to anticipate and address compliance challenges. Assign dedicated resources to track changes and integrate updates into your policies and processes seamlessly.

Effectively Leverage a Compliance Maturity Model with SafetyCulture

Why Use SafetyCulture?

SafetyCulture is a mobile-first operations platform adopted across industries such as manufacturing, mining, construction, retail, and hospitality. It’s designed to equip leaders and working teams with the knowledge and tools to do their best work—to the safest and highest standard.

Promote a culture of accountability and transparency within your organization where every member takes ownership of their actions. Ensure strict and targeted implementation of internal policies, enhance organizational alignment, and keep an eye on compliance performance through a unified platform.

✓ Save time and reduce costs ✓ Stay on top of risks and incidents ✓ Boost productivity and efficiency ✓ Enhance communication and collaboration ✓ Discover improvement opportunities ✓ Make data-driven business decisions

In this article

Related articles

Digital Tool

Operations

Types of Forms: What You Need to Know

Learn about the types of forms your business can use to standardize processes, collect valuable and actionable data, and ensure compliance.

Logistics

Operations

Warehousing Logistics (Storage Logistics)

Understand warehousing logistics and manage the storage, movement, and handling of inventory to effectively meet supply and demand.

Operations

Human Resources

The Role of HR in Workplace Health and Safety Management

Learn what an HR health and safety program covers, its key responsibilities, and the best practices for creating safer working environments.