Published 26 Sept 2025

Article by

4 min read

What is a Property Damage Report?

A property damage report is a formal document that provides a detailed account of the damage sustained by a property. It serves as a comprehensive record of the incident, describing the extent of the damage, the cause or event that led to it, and any other pertinent information related to the incident.

They are essential for assessing the severity of the damage, determining liability, and facilitating the process of repairs, insurance claims, or legal actions.

What is Classified as Property Damage?

Property damage refers to any harm, destruction, or loss incurred by physical assets or property of an organization. It includes damage caused by various factors, such as the following:

Accidental Damage – vehicle crashes or collisions, falls, fires, water leaks

Natural Disasters – earthquakes, floods , hurricanes, tornadoes, wildfires

Vandalism – graffiti, broken windows, property destruction

Theft or Burglary – broken locks, damaged doors, stolen belongings

Fire Damage – structural damage, burnt belongings, smoke damage

Water Damage – structural deterioration, mold growth, damaged possessions

Storm Damage – high winds, hail, fallen trees, damage from flying debris

Environmental Factors – resulting from environmental factors

Equipment Failure – caused by equipment malfunctions or failures

Wear and Tear – leading to structural issues or functional problems

Why Create an Incident Report for Property Damage?

As part of property management, filing an incident report for property damages and even early signs of potential damages is important to help prevent them from occurring or happening again.

Aside from that, creating a report for property damage is essential for the following reasons:

Documentation – serves as an official and comprehensive document that records the details of the damage and an accurate account of the incident

Insurance Claims – provides evidence of the damage, helps determine the value of the claim, and assists in establishing the cause of the damage

Assessing Liability – helps determine liability for the damage

Repairs and Restoration – provides a detailed understanding of the damage sustained

Historical Reference – acts as a historical reference, capturing the property’s condition before and after an incident

Communication and Transparency – facilitates clear and transparent communication between all parties involved

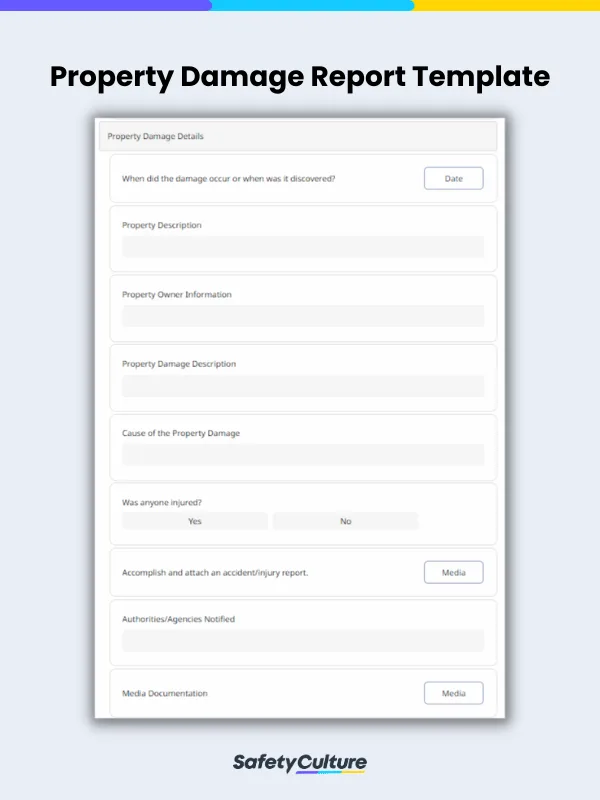

What Should be Included in a Property Damage Incident Report?

To ensure the accuracy and completeness of your report, it’s helpful to use a property damage incident report form with organized sections and fields. This way, you can document every key detail, including the following:

Date and Time of the Damage

Reporter’s Contact Information

Property and Property Owner Information

Description of Damage

Cause of Damage

Injury/Accident Report

Visual Documentation/Evidence

Witness Information

Insurance Details

Repair Costs/Estimates

Other Relevant Documents (e.g., Police or Incident Report )

How Do You Write a Property Damage Report?

To guide you in writing a property damage report, it’s best to use a report form template. Carefully account for every important detail by following these steps:

Include your full name, address, phone number, and email address as the one reporting the property damage. This allows the recipient (e.g., insurance company or law enforcement agency) to quickly contact you for further communication.

Specify the date and time when the damage occurred or was discovered.

Describe the property, including its address, relevant identifiers (such as apartment number or unit), and any additional details that help identify its location.

Provide a clear and detailed description of the damage, including the affected areas, the extent of the damage, and any visible signs of destruction.

Explain what caused the damage, whether it was a specific incident (e.g., fire, flood, vandalism) or a gradual occurrence (e.g., water leakage, structural issues). If the cause is unknown, state that it is under investigation.

Attach photos or any other visual documentation that captures the damage.

If applicable, include the names and contact information of witnesses along with a summary of their statements, and provide details of the insurance policy to be used for your claim processing.

Obtain repair estimates from qualified professionals experienced in addressing the specific type of damage.

Attach relevant supporting files (e.g., police reports, incident reports, invoices for temporary repairs, or correspondence with appropriate parties) to provide further context or evidence to support your claim.

Sign the report to confirm its authenticity and completeness.

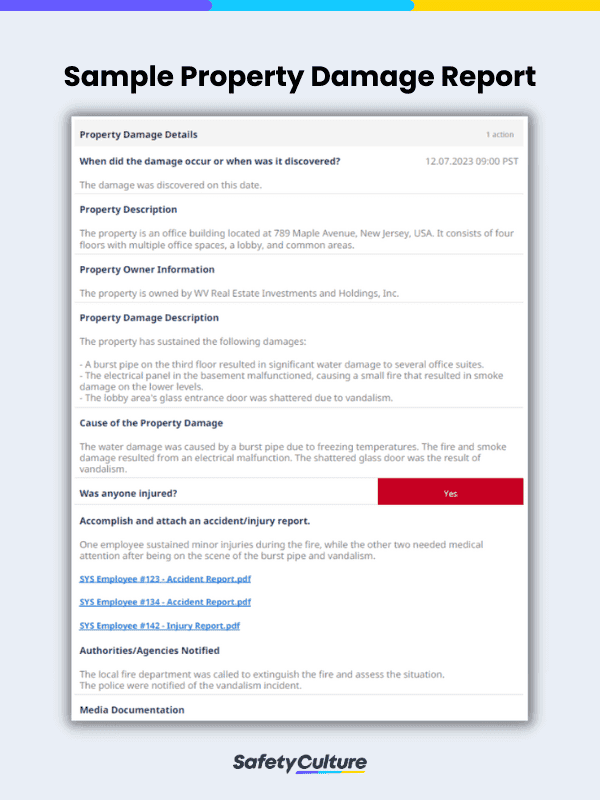

Property Damage Report PDF

Here’s a look at an accomplished sample report using a damage report form.

Property Damage Report Example | SafetyCulture

Remember to keep a copy of the property damage report for your records and provide the original to the appropriate recipient, such as your insurance company, property manager, or legal advisor, depending on the circumstances.

Using SafetyCulture, the team saves 5,000 hours annually on audits, with average audit time cut by 50% and 5S audits by 70%. Hazard reporting now takes just one minute instead of ten.

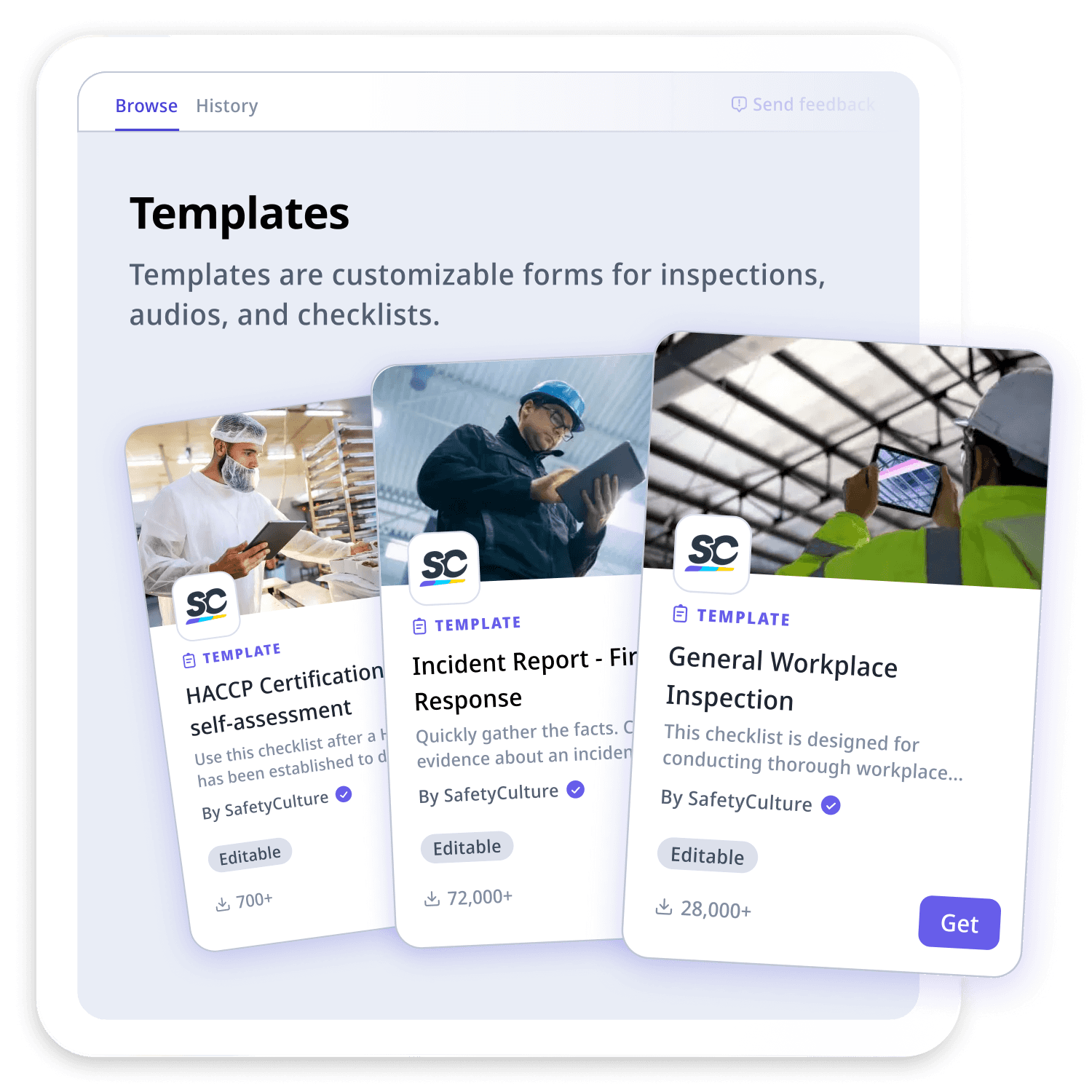

Still looking for a checklist?

Search, filter, and customize 60,000+ templates across industries and use cases.