Navigating Compliance Risk Assessment (CRA): Best Practices and Strategies

Discover everything about compliance risk assessment: its key steps, tools, and best practices to mitigate risks, improve compliance, and ensure operational efficiency.

Published 19 Mar 2025

Article by

6 min read

What is a Compliance Risk Assessment?

Compliance Risk Assessment is a systematic process of identifying, understanding, and prioritizing the risks associated with non-compliance to internal policies, laws, regulations, and industry standards. By keeping up with changes in these rules, businesses can better spot potential problems, measure their impact, and create mitigation strategies to reduce their risk exposure.

Importance of a Compliance Risk Assessment

Many compliance issues aren’t blatant violations. These subtle deviations are difficult to recognize, especially for employees who aren’t fully aware of the requirements. Additionally, regulations are inherently complex and continuously changing, making it difficult for organizations to keep up. Implementing a compliance risk assessment framework is one of the best ways to manage the company’s compliance and gain the following:

Increased operational efficiency – Comprehensive CRA helps organizations identify and assess potential risks , allowing them to allocate resources for early mitigation . This proactive approach streamlines operations, reducing unnecessary costs due to failures and operational disruptions.

Better stakeholder confidence – Companies that demonstrate a commitment to proactive risk management for compliance are trusted by stakeholders, driving a reputation of reliability and credibility in the market.

Improved business continuity and resilience – Continuous evaluations allow companies to stay ahead of emerging risks. Compliance risk assessment tools are useful in creating business continuity plans and driving adaptability to thrive in competitive markets.

Transform Your Compliance Strategy

Automate tracking and harness digital workflows to ensure compliance with evolving regulations effortlessly.

Common Compliance Challenges

There are numerous problems organizations face when conducting risk assessments for compliance. Recognizing and understanding the company’s weaknesses is the first step compliance officers and risk management teams should take. Here are the most common threats to modern compliance endeavors:

Complex regulatory landscape – Organizations, particularly those operating in different jurisdictions , grapple with complex and sometimes contradictory regulations . Worse, requirements frequently change, making it hard for personnel to adapt.

Lack of awareness – Employees at various levels don’t always understand the nitty-gritty of Governance, Risk, and Compliance (GRC) structures. The workers’ lack of participation in proactive risk assessment leads to failures in identifying potential compliance pitfalls.

Data management issues – Effective risk assessment relies on accurate and comprehensive data collection and interpretation. Without the right compliance risk assessment tools, designated teams can’t make data-driven decisions .

Integration difficulties – Risk management efforts are often siloed within specific departments. This fragmentation results in inconsistencies, undermining the effectiveness of the entire compliance management program.

Resource constraints – Lack of funds, time, and personnel limit the organization’s ability to conduct thorough risk assessments, leading to subpar methodologies and results. This challenge also influences the aforementioned challenges because deficient resources mean no training and tools for GRC teams.

To help mitigate and deal with such challenges, an average company allocates 1.34% of its total labor expenses to tasks specifically related to complying with regulations. These tasks may include completing paperwork, maintaining records, conducting audits, training employees on compliance, and ensuring adherence to industry rules and legal requirements.

Hence, establishing a robust framework for identifying, evaluating, and mitigating risks for these issues helps companies navigate the intrinsic complexities of compliance. Also, implementing strategies for ensuring compliance-related tasks are completed on time contributes to an organization’s healthy compliance status.

Process of Compliance Risk Assessment

Assessing compliance risks is a trying undertaking, made more formidable by various challenges in the current regulatory landscape. Whether the organization is spurred by adjusting to new industry regulations, strengthening internal policies, or evolving stakeholder expectations, implementing a robust compliance risk assessment is an effective way to build a culture of accountability and continuous improvement.

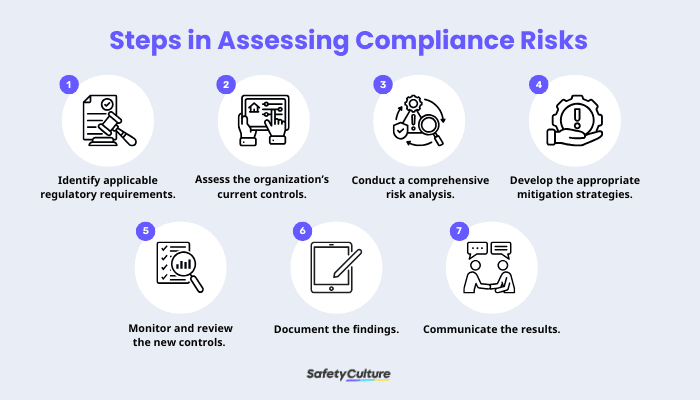

Steps in Assessing Compliance Risks

Step 1: Identify applicable regulatory requirements.

Establish the foundation for the CRA by determining the internal policies, relevant regulations, and industry standards that the organization should comply with. Utilizing various horizon scanning tools to identify emerging regulations across multiple regions is a specific example of compliance risk assessment under this phase.

Step 2: Assess the organization’s current controls.

Evaluate the effectiveness of existing controls if they will work against identified risks. Overlooking this step results in implementing unnecessary measures that fail to address critical compliance gaps. Control assessment frameworks like the COSO ERM (Enterprise Risk Management) or ISO 31000 are the most appropriate tools for this task.

Step 3: Conduct a comprehensive risk analysis.

Not all risks are equal. This step facilitates proper risk identification and prioritization based on the likelihood of occurrence and impact of non-compliance. Here are some best practices to consider:

Utilize digital checklists to gather relevant and reliable information, ensuring data-driven decision-making.

Apply qualitative and quantitative methods to gauge stakeholder perceptions and the measurable cost of the risk.

Classify threats based on the compliance risk assessment matrix for merit-based resource allocation.

Create your own Compliance Risk Assessment checklist

Build from scratch or choose from our collection of free, ready-to-download, and customizable templates.

Step 4: Develop the appropriate mitigation strategies.

Effective risk mitigation strategies prevent non-compliance, reducing compliance breaches’ financial, legal, and reputational impact. These are compliance risk assessment examples of what to do under this step:

Development and implementation of new controls, policies, and procedures

Employee training on updated compliance procedures

Tech integration for streamlining compliance processes

Step 5: Monitor and review the new controls.

Compliance risks evolve as business operations, market conditions, and regulations change. Ongoing monitoring ensures that new risk controls remain effective for sustained compliance. Establishing Key Performance Indicators (KPIs), such as the number of compliance breaches, resolution time, closure rates, and percentage of compliance training completion, is a practical way to measure the effectiveness of the controls.

Step 6: Carefully document the findings.

Comprehensive compliance risk assessment reports prove the company’s compliance efforts and provide a historical reference for regulatory bodies and future assessments. Compliance software solutions allow users to keep track of their compliance activities by offering a centralized information hub for exhaustive report generation,recordkeeping, and quick access.

Step 7: Communicate the results to stakeholders.

The final CRA phase is to share the risk assessment outcomes and key findings with stakeholders, including senior management, investors, partners, key department heads, and external regulators. Aside from building trust, this phase aligns compliance priorities with the organization’s overarching GRC goals.

Efficiently Assess Compliance Risks with SafetyCulture

Why Use SafetyCulture?

SafetyCulture is a mobile-first operations platform adopted across industries, such as manufacturing, mining, construction, retail, and hospitality. It’s designed to equip leaders and working teams with the knowledge and tools to do their best work—to the safest and highest standard.

Stay updated on regulatory changes and gain insights for improving controls and mitigation strategies. Streamline compliance processes with pre-made and customizable risk assessment templates, communication tools, and automated reporting mechanisms. Foster accountability and transparency, ensuring regulatory adherence to legal and internal standards within a unified platform.

✓ Save time and reduce costs ✓ Stay on top of risks and incidents ✓ Boost productivity and efficiency ✓ Enhance communication and collaboration ✓ Discover improvement opportunities ✓ Make data-driven business decisions

Related articles

Food Safety

Safety

A Comprehensive Guide to Natasha’s Law Training

Learn about the process of Natasha’s Law training and how it helps food businesses efficiently meet allergen labeling requirements.

Construction Safety

Safety

A Complete Guide to Scaffolding Safety Training

Learn everything about scaffolding safety training, from topics to best practices, to uphold construction and maintenance safety.

Construction Safety

Safety

A Simple Guide to Oil and Gas Production

Learn about the oil and gas production process and the equipment and modern technologies used to improve field productivity.