Audit Program

Validate your organization’s compliance with an audit program.

Published 13 Jun 2024

Article by

6 min read

What is an Audit Program?

An audit program is a system of audit objectives, scope, timeline, and activities that will be carried out by auditors. An audit program, also known as an audit plan, functions as a guide for conducting various types of audits in a company.

Why do Audit Programs Matter?

Audits evaluate the effectiveness of an organization’s internal controls. Having an audit program in place helps businesses maintain an effective system of internal controls, obtain objective insights on operations, identify risks of fraud and misappropriation of assets, and lastly, ensure compliance with relevant laws or regulations.

Types of Audit Programs

Conducting audits is essential in running a business. Having records on every business transaction and operation will ensure accountability in all departments. Depending on the need, organizations can conduct various types of audits. These types of audits can overlap with one another.

Internal Audit – an internal audit is a type of audit that is done within the organization. This type of audit provides visibility on current finances for the shareholders and board of directors. Internal audits are performed to check whether the financial goals are being met and the business is compliant with regulations.

External Audit – an external audit is conducted by governing bodies such as the Internal Revenue Service (IRS) or other agencies. The auditor shouldn’t have any connection to the company. These external auditors follow the generally accepted auditing standards (GAAS) and generate audit reports which include the audit processes and information obtained.

Operational Audit – this audit is commonly performed internally but organizations have the option to do an external operational audit. This type of audit evaluates business operations such as the alignment of company goals, planning processes, procedures, and operational performances. The results of an operational audit are used to improve the business.

Compliance Audit – this audit checks whether the business is complying with the standards set by the business itself and by external organizations such as the IRS for taxes or OSHA for safety. A reason to conduct a compliance audit is to determine if a business is paying its employees fairly or is giving proper shareholder distributions.

Information System Audit – this is usually conducted by software, IT, and other technology companies but other businesses that have their own IT department may also participate in an Information System Audit. This audit helps determine software issues that can lead to cyber-attacks and data leaks. Information system audits also ensure that data processing and computer systems are efficient enough for the business.

Financial Audit – this is regularly used by businesses to analyze the accuracy of their financial statements. Financial audits are required to be conducted by external auditors. Financial audits can be done internally but only for checking purposes. External auditors will share the results to lenders, creditors, and investors.

Tax Audit – the IRS tax audits are randomly conducted in-person or via mail. This audit will determine if there are any discrepancies on the tax return filed by the business. This means that the taxes filed should be accurate because overpaying or information errors can get you in trouble with the IRS.

Payroll Audit – this is typically done internally to fix payroll issues that could lead to external payroll audits. It is recommended to conduct annual payroll audits to ensure correct payroll processes are followed and compliant. This audit checks payroll factors such as pay rates, wages, withholding tax, and employee information.

Pay Audit – Not to be confused with payroll audits, pay audits are used to ensure that employees are paid fairly for their position, rank, skills, and seniority. Factors that may cause disparities are race, religion, age, and gender which have nothing to do with the quality of work. Pay audits also determine fair pay by the business according to location and industry.

How to Prepare an Audit Program

Before creating an audit plan, the organization should consider the following factors.

Support and access from the board of directors – Internal auditors need the support of the directors to carry out their assessments. This gives the auditor authority over different business functions and can uncover any mismanagement.

Independent auditors – this is crucial for an unbiased and objective business assessment

Level of risk per area – the business should focus on allocating time and resources to conduct regular audits on riskier business functions such as finance and operations.

Expertise and training – the auditor, whether an internal or external one, has to be knowledgeable and up-to-date on what they are auditing such as financial statements, regulatory compliance, and operations. They must also have an in-depth understanding of international auditing standards such as ISO 19011 .

Technology – Because manual auditing takes too much time, most auditors currently use digital auditing tools and software. This will help the process become more efficient and free from human error. Another advantage of utilizing digital technology is that auditors and other authorized personnel will be able to access every audit report in one place.

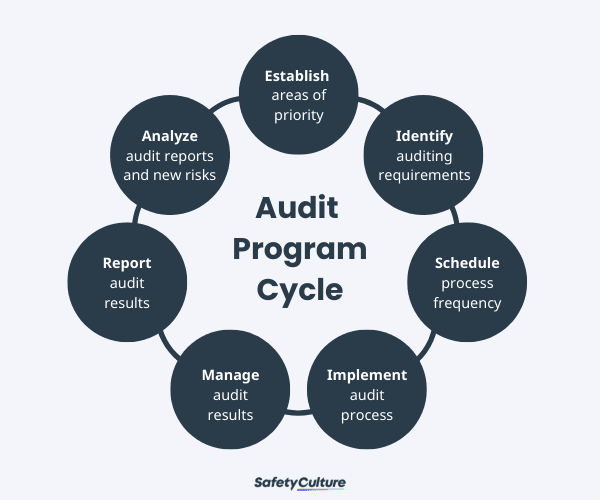

An Effective Audit Program Process

An audit cycle is typically used for auditing financial statements but other types of audits can also utilize its steps. Among the many audit cycle examples, below is a straightforward framework any business can incorporate into its auditing process.

Audit Plan | SafetyCulture

Audit Program Template Example

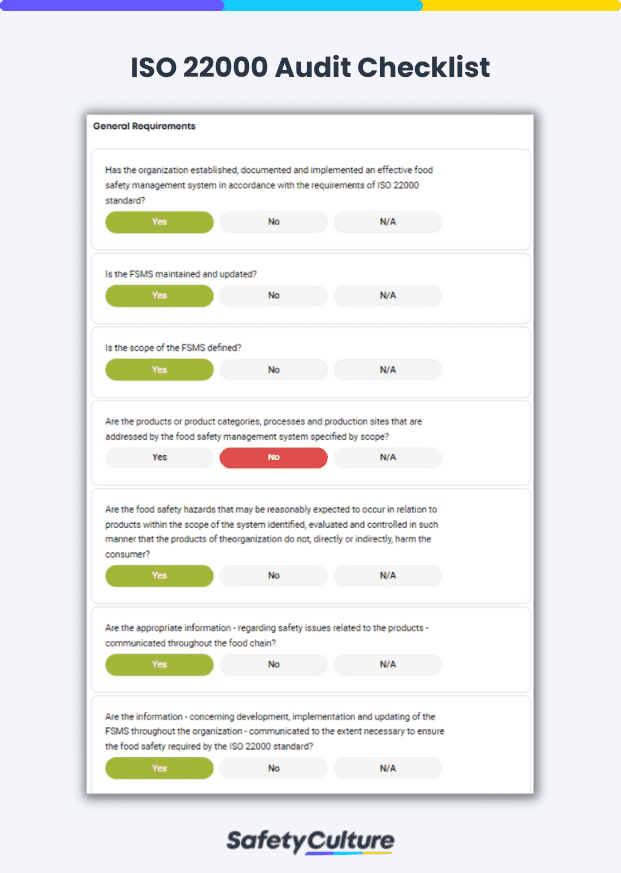

While audits can take any form, it’s important to have every necessary detail to pass an external audit or to receive a compliance certification. Here’s an example of an internal ISO 22000 audit that a business can utilize to prepare for external auditors. This audit template can also be used to conduct a compliance assessment of business processes and procedures.

ISO 22000 Audit Checklist Audit Program

ISO 22000 Audit Checklist | SafetyCulture

Audit Program Toolkit

Internal audit software helps carry out an efficient audit plan. Here are some examples of audit templates your organization can use with a digital auditing tool.

Templates

Internal audit – this template is an extensive ISO 22000 audit checklist that focuses on the business’ Food Safety Management System (FSMS).

Internal and external audit – these audit templates can be conducted by both internal and external auditors to evaluate compliance. The integrated management system checklist helps audit 3 international management system standards which are ISO 9001:2015, ISO 14001:2015, and ISO 45001:2018.

Operational audit – this operational audit checklist is utilized on mainline aircraft. The ISO 22000 audit checklist earlier is also a form of an operational audit.

Compliance audit – this GMP checklist helps audit manufacturing processes and adherence to protocols and standards. It includes factors for quality control such as packaging, labeling, sanitation, documentation, and quality goals.

Information System audit – A risk-based information system audit checklist to help assess potential dangers on cyber security. This also includes audits for security policies and plans.

Create Your Own Digital Audit Template

Mobile App

As an internal audit software,SafetyCulture (formerly iAuditor) is a digital tool utilized by internal auditors and officers to conduct audits of business operations and assess safety compliance. SafetyCulture is used by internal auditors to:

Streamline the internal auditing process

Identify weak areas, inaccuracy, and non-compliance

Create corrective action

Keep records of audits

Perform Audits Efficiently with SafetyCulture

Free Audit Program Templates from SafetyCulture

Get started with your audit plan by using pre-made templates you can customize and use on SafetyCulture. This free collection of audit program templates includes safety audit checklists to help you determine any issues regarding safety in the workplace, keep it updated, and take action on areas for improvement.

Article by

SafetyCulture Content Team

SafetyCulture Content Contributor, SafetyCulture

View author profileRelated articles

Logistics

Operations

Warehousing Logistics (Storage Logistics)

Understand warehousing logistics and manage the storage, movement, and handling of inventory to effectively meet supply and demand.

Operations

Human Resources

The Role of HR in Workplace Health and Safety Management

Learn what an HR health and safety program covers, its key responsibilities, and the best practices for creating safer working environments.

Operations

Performance Evaluation

The RICE Framework: A Strategic Approach to Prioritization

Learn how the RICE framework and prioritization method helps put focus on high-ROI tasks to streamline workflows.