Understanding Vendor Risk Assessment

Discover the essentials of vendor risk assessment—its definition, key benefits, common challenges, effective implementation, and expert best practices—all in this ultimate guide.

Published 12 Feb 2025

Article by

7 min read

What is Vendor Risk Assessment?

Vendor risk assessment is a systematic process used by organizations to evaluate the potential risks associated with engaging third-party vendors. This evaluation identifies potential threats related to data security, compliance, operational stability, and financial integrity that vendors may introduce to a business.

Effective vendor risk assessment is crucial for maintaining business continuity and safeguarding sensitive information in today’s interconnected business landscape. By regularly reviewing and updating vendor risk assessments, companies can adapt to evolving threats and maintain strong vendor relationships while protecting their operational and reputational integrity.

Key Benefits

Organizations often integrate vendor risk assessment into their vendor management programs to create a proactive approach to managing external risks, with its implementation offering several advantages for businesses. Here are the vendor risk management benefits:

Improved operational continuity – Assessing vendor risks ensures that your critical end-product and service providers are equipped to deliver without interruptions. Understanding potential risks related to financial instability, performance issues, or supply chain disruptions allows businesses to develop contingency plans , ensuring smoother operations no matter the circumstances.

Cost savings through risk mitigation – Proactively identifying and addressing risks associated with vendors can save significant costs associated with incidents like data breaches , operational failures, or legal liabilities. Vendor risk assessment templates help organizations manage resources wisely, focusing on preventative measures rather than reactive responses to unforeseen crises.

Regulatory compliance – Conducting vendor risk assessments ensures that your organization complies with standards as many industries are subject to strict regulatory requirements regarding third-party risk management. Meeting these compliance requirements not only minimizes the risk of penalties but also enhances an organization’s reputation as a secure and trustworthy business partner.

Strengthened business relationships – A thorough vendor risk assessment process fosters trust and transparency between an organization and its vendors that demonstrate their commitment to professionalism and reliability. This mutual trust strengthens long-term partnerships and contributes to collaborative success.

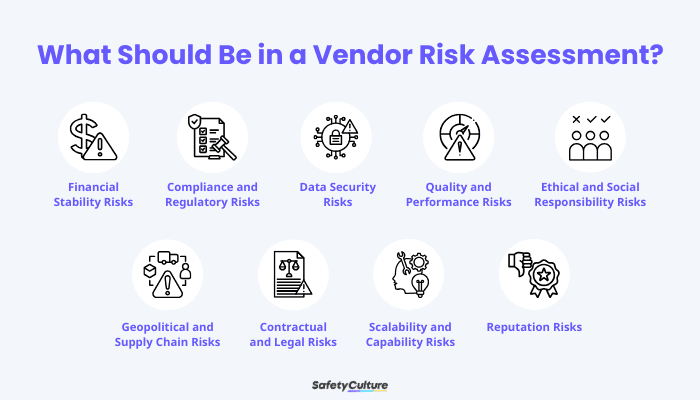

What Should Be in a Vendor Risk Assessment?

Vendor management is a critical part of ensuring business continuity and safeguarding your organization’s reputation and operations. Below are the major risks to look for when evaluating vendors:

Financial stability risks

Compliance and regulatory risks

Data security risks

Quality and performance risks

Ethical and social responsibility risks

Geopolitical and supply chain risks

Contractual and legal risks

Scalability and capability risks

Reputation risks

What Should Be in a Vendor Risk Assessment?

The Complete Vendor Risk Assessment Procedure

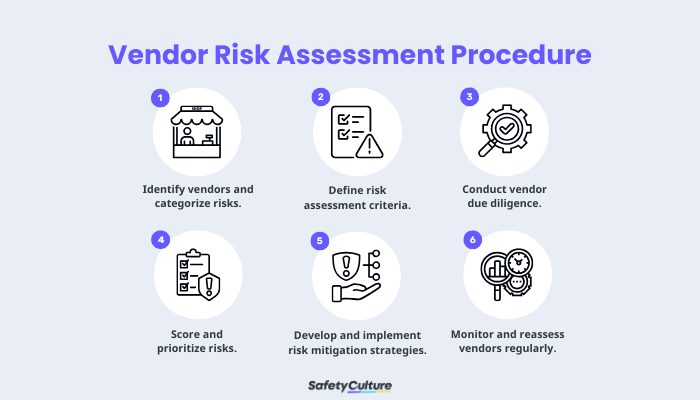

Implementing a vendor risk assessment enables organizations to effectively manage third-party risks and protect their operations. Here’s the complete guide on how to perform vendor risk assessment:

Vendor Risk Assessment Process

1. Identify vendors and categorize risks.

Start by creating an inventory of all vendors, then classify them based on the level of risk they pose. Factors like data access, regulatory requirements, and the criticality of their services should guide the categorization.

Best Practices:

Follow a risk-based decision-making framework to categorize vendors into high, medium, and low-risk tiers.

Maintain a dynamic vendor inventory that updates as new vendors are onboarded or relationships change.

Prioritize vendors handling sensitive data or critical business processes for immediate assessment.

2. Define risk assessment criteria.

In connection with the previous step, establish clear criteria to evaluate vendors based on factors like financial stability,cyber security measures,operational performance, and regulatory compliance. Tailor these criteria to align with your organization’s industry and risk appetite.

The first two steps involve standardizing the vendor risk assessment process as the lack of it becomes among the common challenges faced by organizations.

Best Practices:

Align assessment criteria with recognized standards like the International Organization for Standardization (ISO) or the National Institute of Standards and Technology (NIST) frameworks.

Customize the criteria to address industry-specific risks, such as the Health Insurance Portability & Accountability Act (HIPAA) or the Payment Card Industry (PCI) regulations.

Incorporate input from cross-functional teams, including IT, legal, and procurement, to ensure comprehensive coverage.

3. Conduct vendor due diligence.

Gather and analyze relevant data about each vendor, such as their security policies, financial health, certifications, and previous risk incidents. Use questionnaires,audits, and third-party risk management software for efficiency.

However, gaining comprehensive insights into a vendor’s internal operations, security measures, and compliance status can admittedly be difficult, especially with remote or international vendors.

Best Practices:

Request evidence of compliance certifications.

Leverage automated tools to streamline the collection and scoring of vendor data.

Conduct on-site audits for high-risk vendors to validate their practices.

4. Score and prioritize risks.

Analyze the data collected to assign risk scores to vendors, highlighting areas requiring immediate attention. Use these scores to prioritize risk mitigation plans based on potential impact.

Best Practices:

Employ a scoring model that integrates qualitative and quantitative risk factors.

Focus mitigation efforts on high-priority risks that pose the greatest threat to your organization.

Regularly review and adjust scores as vendors’ risk profiles change over time.

5. Develop and implement risk mitigation strategies.

Create tailored strategies to address identified risks, such as updating contracts, requiring additional security measures, or limiting vendors’ access to sensitive data.

Best Practices:

Include clear risk mitigation requirements in vendor contracts, such as Service Level Agreements (SLA) and incident response obligations.

Establish contingency plans to minimize disruption in case of vendor failures.

Collaborate with vendors to address risks rather than adopting a punitive approach.

6. Monitor and reassess vendors regularly.

Vendor risk is dynamic, so continuous control monitoring is essential. Periodically reassess vendors and track their compliance and performance to adapt to evolving threats. Keep up with constantly changing regulations, and ensure that vendors remain compliant no matter the jurisdiction.

Best Practices:

Set up automated monitoring tools for real-time updates on vendor risk changes.

Reassess vendors annually or after significant changes, such as mergers or new regulatory requirements .

Maintain open communication with vendors to stay informed about their practices and potential risks.

Common Challenges and Solutions

Implementing a vendor risk assessment is crucial for safeguarding your organization against third-party risks, but it comes with its own set of challenges. Understanding these obstacles and knowing how to address them can ensure a smooth and effective assessment process.

Here are the key challenges organizations may face in implementing a vendor risk assessment, along with the best solutions to handle each:

Resource Constraints

Conducting thorough vendor risk assessments can be time-consuming and resource-intensive, particularly for organizations with limited staff or expertise in risk management.

Solution:

Invest in automated vendor risk management tools that can help streamline the assessment process, reduce manual effort, and improve accuracy. Additionally, consider training existing staff or partnering with external experts to build the necessary expertise within your organization.

Resistance from Vendors

Vendors may be reluctant to share sensitive information or comply with rigorous assessment processes, hindering the effectiveness of the risk assessment.

Solution:

Foster strong communication and collaboration with your vendors by clearly explaining the importance of the risk assessment for mutual protection. Establish clear expectations and contractual obligations that require vendor participation in the risk assessment process, ensuring compliance and cooperation.

Data Privacy and Security Concerns

Handling sensitive vendor information during the risk assessment process raises concerns about data privacy and security, potentially exposing your organization to additional risks.

Solution:

Implement strict data protection policies and use secure platforms for storing and sharing vendor information. Ensure that all data handling practices comply with relevant data privacy laws, and train your team on best practices for maintaining data security throughout the vendor risk assessment process.

Efficiently Assess Vendor Risks with SafetyCulture

Why Use SafetyCulture?

SafetyCulture is a mobile-first operations platform adopted across industries such as manufacturing, mining, construction, retail, and hospitality. It’s designed to equip leaders and working teams with the knowledge and tools to do their best work—to the safest and highest standard.

Foster accountability and transparency in vendor risk assessment by ensuring team ownership, aligning governance practices, enhancing risk protocols, and meeting compliance requirements. Streamline and standardize workflows to improve efficiency, consistency, and decision-making while mitigating vendor risks effectively—all in a unified platform.

✓ Save time and reduce costs ✓ Stay on top of risks and incidents ✓ Boost productivity and efficiency ✓ Enhance communication and collaboration ✓ Discover improvement opportunities ✓ Make data-driven business decisions

Related articles

Food Safety

Safety

Cold Holding: The Ultimate Guide

Learn about cold holding methods for food safety and how it reduces contamination risks across operations.

Food Safety

Safety

A Comprehensive Guide to Natasha’s Law Training

Learn about the process of Natasha’s Law training and how it helps food businesses efficiently meet allergen labeling requirements.

Construction Safety

Safety

A Complete Guide to Scaffolding Safety Training

Learn everything about scaffolding safety training, from topics to best practices, to uphold construction and maintenance safety.