Retail Risk Management: Identifying and Mitigating Business Threats

Discover key risks in the retail industry and learn effective strategies for mitigating operational, financial, compliance, and cybersecurity threats to protect your business.

Published 25 Sept 2025

Article by

7 min read

What is Retail Risk Management?

Retail risk management involves identifying, assessing, and mitigating risks that could negatively impact business operations, finances, and reputation. Effectively handling potential threats before they cause serious disruptions is vital in protecting assets, ensuring business continuity, and improving resilience in the competitive retail landscape.

Importance and Benefits

Retail risks pose substantial setbacks to businesses, causing severe financial and reputational damage. Employing robust risk management strategies that cover financial issues, operational problems, and cybersecurity threats is crucial in today’s constantly evolving landscape. Here are its specific benefits:

Ensured financial stability – Anticipating financial risks by monitoring triggers (e.g., equipment failures, customer complaints, regulatory changes ) that may cause disruptions helps avoid costly losses and maintain profitability.

Increased operational efficiency – Developing and implementing a retail risk management plan aids in identifying and addressing bottlenecks and inefficiencies, allowing for a more fluid supply chain.

Enhanced overall security – In 2023, US retailers absorbed over a hundred billion dollars from inventory shrinkage due to inaccuracies, damage, and theft. Having robust physical and cybersecurity measures safeguards valuable assets and customer data.

Improved regulatory compliance – Changes in consumer law, data protection and privacy, employment rights, product safety codes, and supply chain regulations significantly impact the retail sector. Keeping updated ensures compliance and prevents costly fines and legal problems.

Boosted customer trust and reputation – One bad customer experience can rapidly spread in the age of social media, damaging the company’s reputation . Risk management in retail business prioritizes consumer safety, helping build trust and loyalty.

Efficiently Manage Retail Risks

Identify, evaluate, and mitigate risks to create a safe and secure environment for your employees and customers.

Most Common Retail Risks to Watch Out for

There are numerous risks that retail businesses should be prepared for to avoid financial and reputational problems. These are the five most common and grave ones:

Theft and Fraud

Shoplifting, employee theft, return fraud, and transactional rackets (e.g., credit card scams, counterfeit money, chargebacks) lead to significant financial losses. Large retailers, like Walmart, Home Depot, and Target suffer from employee theft and, very recently, a surge in organized retail crime.

Supply Chain Disruptions

Delays, raw material shortages, and transportation breakdowns affect imports. When suppliers, manufacturers, and logistics providers can’t provide the stocks retailers need, their operations suffer. The recent international health emergency practically halted the global supply chain, resulting in massive shortages and lost revenue.

Cybersecurity Threats

Data breaches, ransomware, phishing scams, and other e-commerce fraud result in financial loss and irreparable reputational damage. When hackers stole the credit card details of over 40 million Target customers in 2013, the company had to pay $18.5 million in settlement and more to set their stature straight.

Compliance and Legal Risks

Several regulations impact the retail sector, including data protection, tax statutes, and sustainability policies, to name a few. This becomes more complicated when companies operate in different regions. H&M was fined millions of euros for violating GDPR rules by illegally surveilling their employees.

Reputational Damage

Negative publicity due to customer complaints, poor reviews, or controversial practices can severely impact the retailer’s reputation. After a racial bias incident in 2018, Starbucks faced a global backlash that led to protests and boycotts. They also had to close down thousands of stores for racial sensitivity training.

Retail Risk Management Process

Utilizing a structured approach for risk management in retail business is the only way to go. It encompasses proactive identification and assessment of potential threats to reduce and mitigate uncertainties in the market. Here’s a concise rundown:

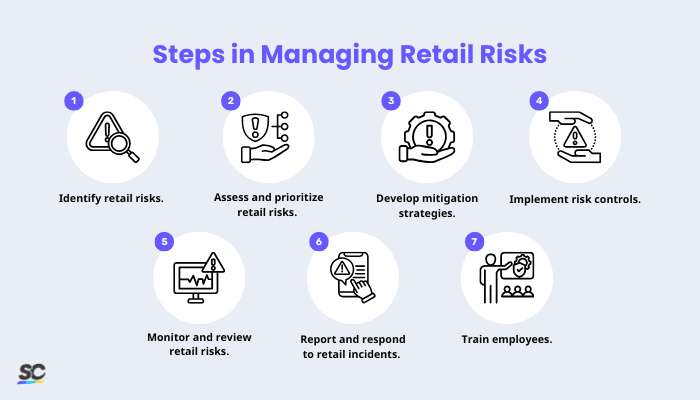

Steps in Managing Retail Risks

Step 1: Identify retail risks.

The first step toward prevention involves recognizing potential threats that could disrupt operations and cause subsequent dangers. Companies can’t be proactive without this foundational activity, leaving them vulnerable to threats. Here are a few specific must-dos:

Conduct store audits to detect physical security vulnerabilities, since theft is one of the most serious problems in the sector.

Use historical sales and loss data to identify fraud and theft patterns.

Monitor supply chain risks , including vendor reliability and potential delays.

Create your own Retail Audit checklist

Build from scratch or choose from our collection of free, ready-to-download, and customizable templates.

Step 2: Assess and prioritize retail risks.

Businesses should evaluate the potential impact and likelihood of the identified risks and focus the company’s resources on the most critical threats. These are some of the most useful tools in retail risk assessment:

The probability and impact matrix allows retailers to quickly identify and prioritize risks because it can be visualized in a grid format.

SWOT analysis provides a comprehensive overview of all factors (e.g., internal weaknesses and external threats) that affect the retailer’s performance.

The risk register systematically records and tracks identified risks, facilitating ongoing monitoring and management.

Step 3: Develop mitigation strategies to reduce exposure.

Addressing risks before they escalate is the most crucial phase in the process. Implementing preventative and corrective measures based on risk insights minimizes financial loss, protects assets, and maintains customer trust. Here are some helpful solutions:

Loss prevention technology, like Radio-Frequency Identification (RFID) tags , helps track inventory and prevent shrinkage.

Vendor risk management protocols minimize supply chain disruptions.

Multi-layered cybersecurity measures , such as encryption and Multi-Factor Authentication (MFA) protect customers.

Step 4: Implement risk controls to strengthen security and compliance efforts.

Risk controls enforce security measures, compliance protocols, and fraud prevention tactics. These should be consistently applied across locations and platforms using the following:

Artificial Intelligence (AI)-powered tools , like checkout monitoring systems, prevent theft.

Surveillance cameras and Electronic Article Surveillance (EAS) tags improve physical security.

POS system alerts flag suspicious transactions.

Strict access controls must be in place for employees handling sensitive customer data.

Inventory management and auditing reconcile discrepancies.

Step 5: Monitor and review retail risks to ensure ongoing protection.

New risks emerge constantly, from fraud tactics to consumer behavior shifts. Continuously assessing threats and vulnerabilities allows businesses to stay ahead of evolving threats. Consider these best practices:

Conduct monthly or quarterly retail risk audits across all store locations.

Utilize real-time analytics software to track unusual patterns in inventory and sales.

Review customer feedback for service-related risks (e.g., faulty products, odd charges, poor customer service).

Step 6: Report and respond to retail incidents.

Problems like theft, cyberattacks, and product recalls should be addressed efficiently. Businesses must have clear incident response procedures to minimize damage and ensure compliance with related regulations. A few actions to take include the following:

Develop a crisis management plan for different types of retail incidents .

Establish communication protocols for notifying law enforcement and disseminating information to the general public.

Utilize incident reporting software to document and review cases for future improvements.

Step 7: Train employees to increase retail risk awareness.

Inexperienced employees may overlook threats, mismanage incidents, and fail to comply with regulations. Ongoing training ensures that retail staff are well-equipped to prevent and respond to emerging risks. These are topics to include in the program:

Loss prevention and security (e.g., employee theft prevention, organized retail crime, workplace violence prevention)

Safety and hazard management (e.g., ergonomics, emergency procedures, etc.)

Financial risk management (e.g., inventory control, proper cash handling, fraud prevention)

Cybersecurity and data protection (e.g., data privacy and compliance, cybersecurity awareness)

Customer service and conflict resolution

Drive Effective Retail Risk Management with SafetyCulture

Why Use SafetyCulture?

SafetyCulture is a mobile-first operations platform adopted across industries, such as manufacturing, mining, construction, retail, and hospitality. It’s designed to equip leaders and working teams with the knowledge and tools to do their best work—to the safest and highest standard.

Empower workers to make data-driven decisions, strengthen risk controls, and proactively address risks before they escalate through a centralized information hub. Drive resilience, maintain customer trust, and safeguard the company’s reputation through real-time risk monitoring and automated compliance tasks. Revolutionize risk management through a unified platform.

✓ Save time and reduce costs ✓ Stay on top of risks and incidents ✓ Boost productivity and efficiency ✓ Enhance communication and collaboration ✓ Discover improvement opportunities ✓ Make data-driven business decisions

Related articles

Environmental Safety

Safety

A Comprehensive Guide to Stormwater Pollution Prevention Best Management Practices (SWPPP BMP)

Learn about the types of best management practices for SWPP and the steps to effectively implement them in prevention plans.

Risk Assessment

Safety

The Ultimate Guide to Emergency Preparedness and Response

Learn how you can develop an effective emergency plan and stay one step ahead of natural disasters or other catastrophes.

Safety

Safety Management

Disaster Preparedness Plan

Learn more about the disaster preparedness plan, its importance, features, and example. Find out how a digital tool can help prepare against disasters.