Conducting a GRC Audit to Verify Your Organization’s Framework Efficiency

Learn the benefits, importance, and components of a GRC audit and implement the best practices to demonstrate adherence to GRC standards.

Published 5 May 2025

Article by

6 min read

What is a GRC Audit?

A GRC audit is a structured evaluation process for assessing an organization’s adherence to Governance, Risk, and Compliance (GRC) standards, guidelines, and policies. It focuses on ensuring that an organization meets legal, regulatory, and internal policies while effectively managing risks and maintaining corporate governance.

By performing internal GRC audits, companies can identify gaps in their risk management strategies, assess the effectiveness of compliance measures, and ensure that governance frameworks are functioning effectively.

Key Components of GRC

To understand and strengthen their GRC strategy better, organizations need to differentiate its components comprised of the following equally important elements:

Governance (G) – It focuses on leadership, accountability, and ethical management . Strong corporate governance ensures that a company adheres to best practices and ethical standards while aligning operations with strategic objectives.

Risk (R) – It tackles managing risks that can stem from various sources, including financial uncertainties, legal liabilities, strategic management errors, and accidents. Effective risk management ensures that potential threats are minimized or mitigated.

Compliance (C) – It involves ensuring that the company meets all regulatory requirements to avoid legal issues, penalties, or reputational damage. Regular compliance audits help maintain alignment with industry standards and legal obligations.

Importance and Benefits of a GRC Audit

GRC audits benefit organizations looking to maintain operational integrity, minimize risks, and ensure regulatory adherence. Below are the key advantages of conducting regular internal audits according to the components of GRC:

Ensures regulatory compliance

By evaluating current processes, an audit identifies areas of non-compliance and offers recommendations for improvement, helping to avoid costly fines, penalties, and legal consequences. Regular audits also ensure the company is prepared for any external GRC audits or regulatory assessments.

Recent evaluations by US federal agencies underscore the importance of robust GRC auditing practices. For instance, the US Office of Personnel Management (OPM) reported in its 2024 Agency Financial Report that it successfully closed 73 cybersecurity-related audit recommendations, reflecting a 60% reduction in open FISMA (Federal Information Security Modernization Act) recommendations compared to FY 2022. This progress indicates the effectiveness of consistent auditing in enhancing compliance and reducing vulnerabilities.

Strengthens risk management

One of the core benefits of a GRC audit is enhancing an organization’s ability to identify,assess, and mitigate risks. The audit reviews risk management frameworks and strategies, ensuring that all potential threats are properly managed. This proactive approach minimizes the likelihood of disruptions that could impact business continuity.

Improves operational efficiency

A GRC audit can uncover inefficiencies and recommend streamlined workflows. This not only reduces operational costs but also ensures optimized resource management. Implementing recommendations from an audit can lead to improved decision-making and smoother operations across the organization.

Enhances corporate governance

GRC audits reinforce strong corporate governance by ensuring leadership and management adhere to ethical standards and best practices. This leads to greater accountability, transparency, and strategic organizational alignment. Strengthened governance fosters trust with all key parties involved, which enhances the company’s reputation and contributes to its long-term success.

Supports strategic decision-making

With a clearer understanding of GRC landscapes, a GRC audit provides valuable insights into areas that require attention, helping leadership prioritize actions and allocate resources more effectively. This strategic alignment with business goals ensures sustained growth and resilience in a competitive market.

Ensure Accountability with Smarter Audits

Automate, track, and manage audits seamlessly to strengthen compliance and governance. Leverage efficient audit tools to enhance oversight, gain valuable insights, and mitigate risks.

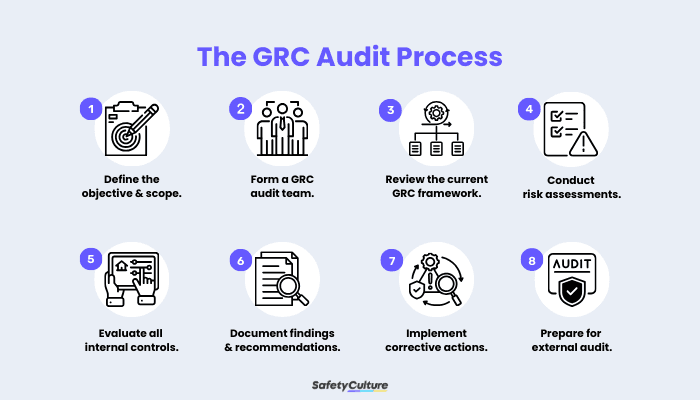

How to Perform a GRC Internal Audit

Following a structured approach ensures that your organization is well-prepared and compliant with all GRC standards. Below is a step-by-step procedure on how to perform an internal audit for GRC:

GRC Audit Process

1. Define the audit objectives and scope.

Begin by identifying the goals of the internal GRC audit, such as assessing compliance with specific regulations, risk management practices, or governance policies. Determine the audit’s scope, including the departments and processes systems that need to be reviewed.

Best Practices:

Align the objectives with the external audit requirements and prioritize high-risk areas to ensure all critical components are covered.

Involve key stakeholders to gather insights on the most crucial aspects of GRC.

Document your objectives and communicate them to the GRC internal audit team.

2. Form a GRC audit team.

Ensure that the team consists of experienced professionals from risk management, compliance, and internal control departments. The team should possess deep knowledge of the organization’s operations and relevant regulations.

Best Practices:

Include employees with different perspectives to ensure a holistic review.

If needed, provide supplementary training on GRC frameworks and tools to ensure everyone is aligned.

Clearly define roles and responsibilities for each GRC internal audit team member to avoid confusion.

Consider including external advisors to gain an objective perspective before the start of the internal audit process.

3. Review the current GRC framework.

Evaluate the existing GRC framework, covering governance structures, risk management processes, and compliance controls. Identify whether the organization’s policies align with current regulations and industry standards.

Best Practices:

Use a checklist or audit tool to systematically assess each area and ensure thorough documentation for future reference.

Maintain a centralized repository for all GRC documents for easy access.

4. Conduct risk assessments.

Perform a comprehensive risk assessment to identify potential vulnerabilities in all aspects of the GRC system or framework. This includes reviewing internal controls,business continuity plans, and incident response strategies.

Best Practice:

Prioritize assessment of risks based on their likelihood and impact, and document mitigation strategies for the most critical risks.

5. Evaluate internal controls and compliance mechanisms.

Assess the effectiveness of internal controls in managing risks and ensuring compliance with regulatory requirements. This includes reviewing access controls, monitoring systems, and policy enforcement mechanisms.

Best Practice:

Test controls by sampling processes or activities, and ensure the results are well-documented for audit trails .

6. Document findings and recommend improvements.

After completing the audit, document all findings, including areas of non-compliance, risks, and governance gaps. Provide actionable recommendations for improvement, such as updating policies or strengthening internal controls.

Best Practices:

Categorize findings by urgency and use the 5×5 risk matrix to prioritize action plans effectively.

Ensure that action plans are realistic and achievable within the set timeframe.

7. Implement corrective actions.

Collaborate with relevant departments to implement the audit’s recommendations to ensure each team is actively engaged in the corrective action process and takes ownership of their respective responsibilities.

Best Practice:

Set deadlines, track progress through regular follow-ups, and establish a monitoring system to ensure corrective actions are effectively implemented.

8. Review and prepare for external audit.

Gather all audit findings, risk assessments, and action plans into a comprehensive report. Then, conduct a final review to ensure accuracy and that all corrective actions have been fully implemented. Make a final round of adjustments based on the internal audit findings.

Best Practices:

Create an executive summary that highlights key findings and action plans.

Simulate an external audit by performing a mock audit to identify any last-minute gaps or areas needing improvement before the actual external audit.

Perform an Effective GRC Audit with SafetyCulture

Why Use SafetyCulture?

SafetyCulture is a mobile-first operations platform adopted across industries such as manufacturing, mining, construction, retail, and hospitality. It’s designed to equip leaders and working teams with the knowledge and tools to do their best work—to the safest and highest standard.

Promote a culture of accountability and transparency within your organization where every member takes ownership of their roles in GRC. Strengthen GRC audit readiness by aligning governance practices, enhancing risk management protocols, and enforcing compliance with legal, regulatory, and internal policy requirements. Simplify and standardize audit workflows through a unified platform.

✓ Save time and reduce costs ✓ Stay on top of risks and incidents ✓ Boost productivity and efficiency ✓ Enhance communication and collaboration ✓ Discover improvement opportunities ✓ Make data-driven business decisions

Related articles

Safety

Safety Management

Transforming Workplaces with AI Safety Inspection

Learn about AI safety inspection and its role in smarter audits, automated insights, and proactive risk management.

Food Safety

Safety

Cold Holding: The Ultimate Guide

Learn about cold holding methods for food safety and how it reduces contamination risks across operations.

Food Safety

Safety

A Comprehensive Guide to Natasha’s Law Training

Learn about the process of Natasha’s Law training and how it helps food businesses efficiently meet allergen labeling requirements.