Why Perform a Focus Group Discussion?

Unlike surveys and polls, focus groups discussions tend to capture deep and more personal responses from consumers rather than purely quantifiable data. Focus group discussions are facilitated by researchers and marketers and are ideally conducted in small groups consisting of 4 to 8 participants. The researcher or interviewer poses questions to expose respondents to a more open discussion about their insights, motivations, reasons and preferences. This strategy can be used by market research teams and is best applied when conducting food taste surveys, product analysis, and service evaluation and reviews.

Understanding why consumers choose certain products or brands can be a challenge. However, focus groups are a handy tool to help companies explore this and similar questions. This article will explain how businesses can benefit from focus groups, provide tips on conducting effective discussions, help you know the right questions to ask, and recommend tools to capture significant research data.

Survey vs. Focus Group Discussion (FGD)?

If SURVEYS tell us that 78% of the middle aged women prefer drinking X milk, FOCUS GROUPS help us understand why 78% of the middle aged women prefer X milk above other milk brands.

Surveys capture quantitative data while focus groups explore qualitative and other influencing factors. Focus groups can be used to uncover the reasons driving people to make a certain decision. As in the example above, middle aged women may be attracted to drink milk X due to factors such as price and quality, or other factors like celebrity endorsement.

How to Conduct an Effective Focus Group Discussion?

Preparations should be made to perform an effective focus group discussion. Below we’ve listed focus group requirements and steps in conducting one:

Plan before you proceed.

- Establish a specific goal – e.g. What is driving 78% of middle aged women to purchase milk X above other brands?

- Conduct research beforehand – e.g. Evaluate milk X product, pricing, promotions, packaging, and competitive landscape.

Find the right audience.

- Who is our target audience? e.g. Middle aged women between 45 – 65 years of age in country Y who have previously purchased milk X.

- How can we get a small focus group of 4 to 8 target participants? e.g. Online newsletters, telephone outreach, or ask participants outside a grocery store.

Ask the essential questions.

Carefully choose questions which can prompt more meaningful conversations. Choose engaging and open-ended questions over simple “yes” or “no” close-ended questions.

For example:

- Open ended-questions – e.g. Why do you choose milk X over other brands?

- Probing questions – eg. When you think about the milk X product, what was the first thing that comes into your mind?

- Prompts and follow up questions – e.g. You mentioned that you like the packaging of milk X. What do you associate with the appearance of the packaging?

Create Your Own Focus Group Template

Eliminate manual tasks and streamline your operations.

Get started for FREEListen and document it well.

- Pay attention to highlights of the discussion – e.g. Listen out for motivations, biases, previous experiences, tone and also observe nonverbal cues.

- Document it well – e.g. Use a mobile data-gathering tool like SafetyCulture (formerly iAuditor) to record the focus group discussion.

Focus Group Example

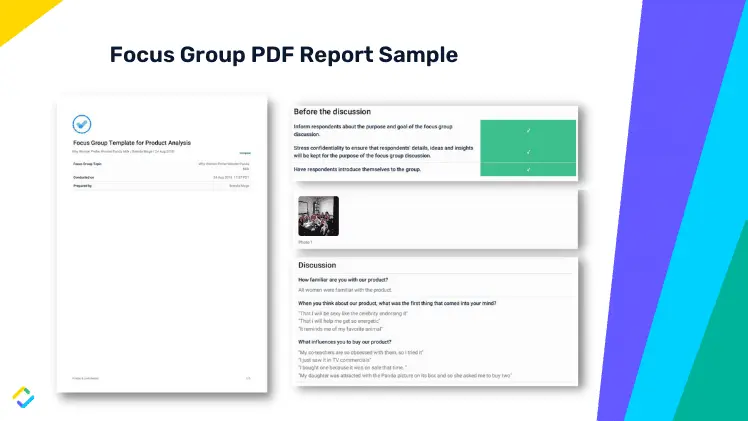

To give you a better picture and to serve as a guide, we’ve created a sample report using SafetyCulture’s Focus Group Template:

| Scenario: A focus group is organized for product analysis. They are trying to determine “Why Women Prefer Wonder Panda Milk”. The participants in the focus group will be women aging from 45 to 65. |

This focus group pdf report sample consists of 4 sections:

- Respondent Information – This section provides a brief summary of the respondents participating in the focus group. Their names, gender, age, educational background and marital status are recorded.

- Before the discussion – This serves as the moderator’s checklist.It’s to ensure that the moderator gives respondents a proper introduction before delving into the topic.

- Discussion – This is where the moderator begins to ask the group questions, and he/she records their feedback per question.

- Completion – For accountability purposes, have the moderator sign their name and signature as a verification that the focus group discussion has been completed.

Conclusion

Conducting focus groups can help uncover underlying motivating factors of consumer behavior. This arms businesses with qualitative data to improve and adapt their product and service offering during development and moving forward. Browse these free digital focus group templates you can use to conduct your next focus group discussions.

FAQs About Focus Groups

The different types of focus groups are listed as follows:

- Single focus group

- Two-way focus group

- Mini focus group

- Dual moderator focus group

- Dueling-moderator focus group

- Respondent-moderator focus group

- Online or remote focus group

An ideal focus group involves four to ten respondents in a session. Having a small group count provides participants enough time and comfort to answer questions, enabling a more open and in-depth discussion of the product, service, program, or topic. It also allows moderators to have better control over the flow of conversation compared to large group settings.

Focus group discussions typically last from 60 to 90 minutes and should not exceed two hours. This duration provides sufficient time to have meaningful conversations about all necessary questions for the product, service, or program discussed.