Published 26 Sept 2025

Article by

3 min read

What is a Legal Due Diligence Checklist?

A legal due diligence checklist is a document that can be used to perform a careful assessment of a company before buying and selling businesses amongst themselves. It details the key legal factors to look out for such as contracts, intellectual property, and compliance.

What is the Purpose of Legal Due Diligence?

Due diligence refers to the act of collecting and analyzing information before making a final decision. In the world of business, the main purpose of legal due diligence is to ensure both buyer and seller are aware of any legal technicalities or issues before proceeding with their transaction. Performing a legal due diligence inspection helps identify potential issues that can come up later once a sale has been made, how to factor them into the final decision-making process, and if any changes need to be made before then.

However, performing this due diligence inspection is a long process that will require many people to be involved, hence the need for a legal due diligence checklist. With a dedicated checklist for managing due diligence activities, you can ensure that no important step is missed and that all standards are complied with before you and all other parties make a decision to buy or sell.

What to Include in a Legal Due Diligence Checklist

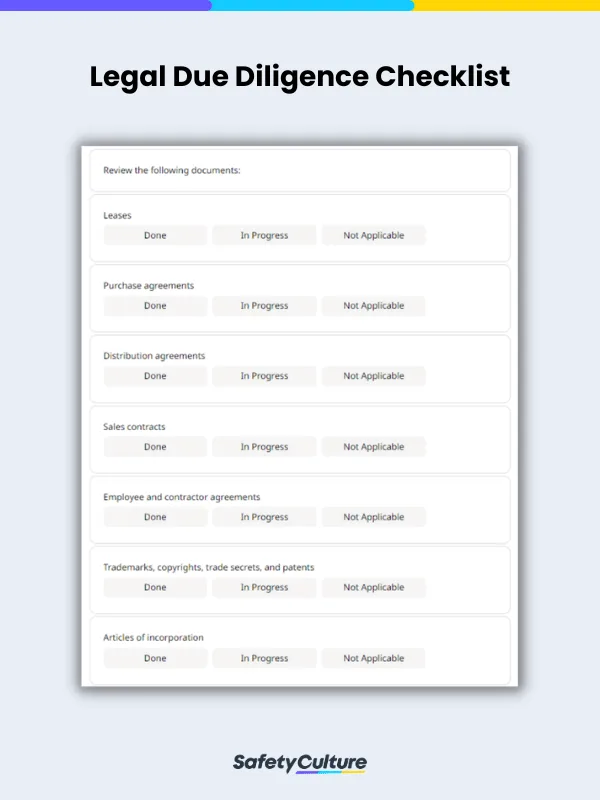

Different businesses in different industries will have different ways of creating and using a legal due diligence checklist. A typical legal due diligence checklist should ideally cover the following:

Leases and related history – Copies of all current and past property leases, rental agreements, and records of rent payments or disputes.

Purchase agreements – Contracts for the acquisition of assets, businesses, or significant goods, including terms and conditions of the purchase.

Distribution agreements – Legal agreements outlining the terms under which products or services are distributed, including exclusivity and territorial rights.

Sales contracts and past sales – Records of significant sales contracts, including terms, conditions, and any history of disputes or breaches.

Employee agreements and contractor agreements, if applicable – Employment contracts, independent contractor agreements, and any related confidentiality or non-compete clauses.

Trademarks, copyrights, and patents – Documentation of intellectual property ownership, registrations, applications, and any pending or past disputes.

Articles of incorporation – Founding documents outlining the company’s structure, shareholder information, and governance rules.

Business registration documents – Official filings, licenses, permits, and regulatory compliance documents necessary for legal operation.

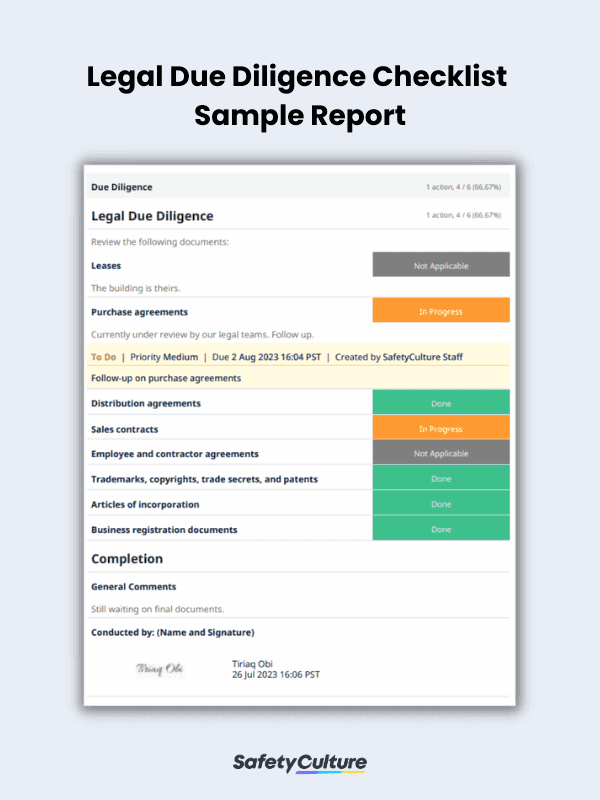

After these sections are covered, the user may add general comments and sign-off for record keeping. Here’s a sample digital legal due diligence checklist template in use:

Legal Due Diligence Checklist Sample Report | SafetyCulture

Going digital would also be the best way to create and manage a legal due diligence checklist. Not only does going digital reduce paper waste and the need for additional physical storage space, but it also makes performing any due diligence easier. A study shows that following the COVID-19 global pandemic and the rise in technological advancements, 64% of lawyers in the European region, Middle East, and Africa believe digitizing different processes can reduce the time it takes to perform legal due diligence to one month by 2025.

In addition, using a digital legal due diligence checklist that can be accessed anytime and anywhere can make your inspection process more efficient, as it allows you and other staff to work together no matter when and where. The right digital solution will also provide an extra layer of security to your checklists and reports, ensuring that only authorized personnel can access your files.