Building a Risk Appetite Framework for Your Organization

Discover the risk appetite framework, its benefits, and how to align risk tolerance with business objectives to make more informed decisions.

Published 12 Feb 2025

Article by

7 min read

What is a Risk Appetite Framework?

A risk appetite framework is a structured approach that defines the amount and types of risk an organization is willing to accept to achieve its strategic objectives. This framework provides a clear understanding of risk tolerance by establishing boundaries for decision-making and setting thresholds for acceptable risk levels.

By integrating the risk appetite framework into business processes, organizations can ensure that risk-taking aligns with their goals, resources, and stakeholder expectations. It includes key components such as risk appetite statements, quantitative metrics, and governance mechanisms, enabling leaders to make informed decisions while maintaining control over risk exposure.

Benefits

Implementing a risk appetite framework is critical for organizations seeking to balance opportunity and risk effectively. This framework serves as a guiding tool for strategic risk management, ensuring that all business activities are consistent with the organization’s risk capacity and objectives. Below are the key benefits:

Enhanced risk-based decision-making – A well-defined risk appetite framework provides clear guidelines on the level of risk the organization is willing to accept. This enables decision-makers to evaluate opportunities and threats more effectively, ensuring actions align with business objectives and risk tolerance. By reducing ambiguity, the framework helps leaders make consistent and informed decisions, even in uncertain conditions.

Improved risk culture and awareness – Implementing a risk appetite framework fosters a proactive risk culture throughout the organization. Employees and stakeholders better understand acceptable risk levels and their role in managing them. This alignment encourages accountability and collaboration, reducing the likelihood of reckless behavior or unmitigated risk exposure .

Alignment with strategic goals – The framework ensures that risk-taking activities closely align with the organization’s strategic objectives. Setting boundaries and thresholds helps prioritize resources toward opportunities that fit the company’s risk profile. This minimizes distractions from non-essential risks and enhances the achievement of long-term goals.

Regulatory compliance and stakeholder confidence – A robust risk appetite framework demonstrates an organization’s commitment to sound risk management practices. It helps organizations meet regulatory requirements by providing evidence of structured and proactive risk oversight. Additionally, it builds trust with stakeholders , investors, and clients by showing that risks are identified, monitored, and controlled effectively.

Enhanced resilience and risk mitigation – The framework aids in identifying and addressing potential threats before they escalate. By continuously monitoring risk exposure against established thresholds, organizations can take timely action to mitigate risks. This proactive approach enhances resilience, reduces financial losses, and ensures business continuity in a rapidly changing environment.

6 Components of a Risk Appetite Framework

A risk appetite framework consists of several key components that work together to define, implement, and monitor an organization’s approach to risk-taking. These components provide clarity and structure for effective risk management:

1. Risk Appetite Statement

This outlines the organization’s overall approach to risk-taking, including the types and levels of risk it’s willing to accept. It serves as a guiding document for aligning business activities with strategic goals and sets the tone for the organization’s risk culture. A clear and concise risk appetite statement ensures consistency in decision-making across all levels.

For example, a retail chain might establish a risk appetite statement indicating its willingness to accept moderate financial risk to invest in digital transformation but minimal risk when it comes to customer data security. Using this risk appetite framework example, the company sets specific tolerance levels, such as a maximum 5% loss from online sales initiatives or zero tolerance for data breaches. These guidelines enable the organization to balance growth opportunities, like expanding e-commerce operations, with necessary safeguards, such as investing in robust cyber security systems.

2. Risk Tolerance Levels

Risk tolerance levels define the specific thresholds for acceptable risk exposure in various areas, such as financial performance, operational efficiency, or compliance. These measurable limits provide a detailed view of how much variation from expected outcomes is acceptable. Establishing risk tolerance levels ensures all risks are managed within predefined boundaries, reducing the likelihood of significant deviations.

3. Key Risk Indicators (KRIs)

These metrics monitor and measure risk exposure against the organization’s defined appetite and tolerance levels. They provide early warning signals of potential issues, enabling timely action to mitigate risks. By leveraging the KRIs, organizations can track performance and ensure risks remain within acceptable limits.

4. Governance Structure

A robust governance structure defines roles, responsibilities, and accountability for implementing and monitoring the risk appetite framework. It typically includes oversight by the board of directors, executive management, and risk committees. Clear governance ensures that risk decisions align with the organization’s appetite and fosters a culture of accountability.

5. Integration with Business Processes

For a risk appetite framework to be effective, it must be integrated into the organization’s strategic planning, decision-making, and operational processes. This alignment ensures that all business activities consider risk appetite and tolerance levels. Integration improves resource allocation and promotes consistent risk management practices across departments.

6. Monitoring and Reporting Mechanisms

These essentials track the organization’s adherence to its risk appetite framework. Reports provide insights into risk trends, deviations from tolerance levels, and areas requiring attention. This continuous evaluation helps maintain alignment with strategic objectives and supports data-driven decision-making.

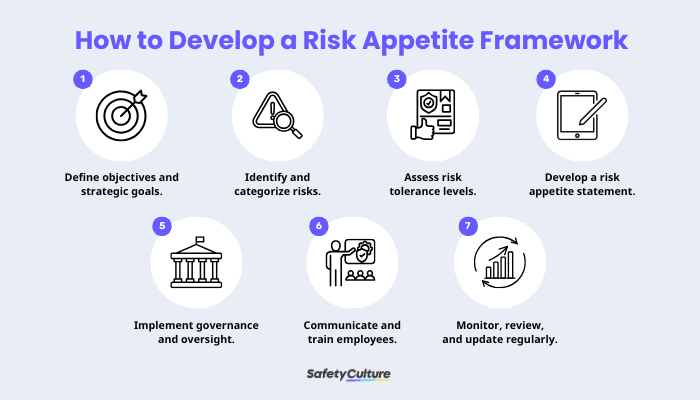

How to Develop a Risk Appetite Framework

Implementing a risk appetite framework is critical for organizations seeking to balance opportunity and risk effectively. This framework serves as a guiding tool for risk management, ensuring that all business activities are consistent with the organization’s risk capacity and objectives.

How to Develop a Risk Appetite Framework

1. Define objectives and strategic goals.

A risk appetite framework must align with the organization’s overarching goals and strategies. Begin by identifying your core objectives, priorities, and long-term vision.

Best Practices:

Engage key stakeholders: Include leadership, risk managers, and department heads to ensure alignment across all levels.

Integrate with strategy: Ensure risk tolerance levels are directly tied to specific business goals, such as market expansion or operational efficiency .

2. Identify and categorize risks.

Identify the potential risks that could impact your organization, categorizing them into operational, financial, compliance, strategic, and reputational risks.

Best Practices:

Use a risk taxonomy :Establish a clear and consistent classification of risks to ensure comprehensive coverage.

Conduct a vendor risk assessment :For organizations heavily reliant on third-party vendors, evaluate risks associated with each vendor.

3. Assess risk tolerance levels.

Identify and define the levels and types of risks your organization is prepared to accept. This step requires quantifying risk in measurable terms, such as financial loss, time delays, or reputational damage.

Best Practices:

Set quantifiable metrics: Define risk limits using measurable indicators like percentages, monetary values, or incident thresholds.

Leverage historical data: Analyze past performance and risk incidents to establish realistic tolerance levels.

4. Develop a risk appetite statement.

Develop a formal statement that summarizes the organization’s risk appetite. This statement should outline acceptable and unacceptable risks, including boundaries for key risk categories.

Best Practices:

Ensure clarity: Use concise language that’s understandable to all stakeholders.

Create tiered levels: Define specific appetite levels for high, medium, and low-risk areas to provide more nuanced guidance.

5. Implement governance and oversight.

Establish governance structures to monitor and enforce adherence to the risk appetite framework. Assign responsibilities for risk management and decision-making.

Best Practices:

Define roles and responsibilities: Clearly outline who’s responsible for risk assessment, monitoring, and reporting.

Integrate technology tools: Use software solutions to automate risk monitoring and reporting for real-time insights.

6. Communicate and train employees.

Educate employees and key stakeholders on the risk appetite framework to ensure alignment across the organization. Clear communication fosters understanding and compliance.

Best Practices:

Tailor communication: Customize messaging for different roles to ensure relevance and engagement.

Offer practical training: Provide real-world scenarios and case studies to illustrate how the framework applies to daily operations.

7. Monitor, review, and update regularly.

Risk appetite isn’t static. Continuously monitor and review the risk appetite framework to ensure it remains aligned with changing business conditions, regulations, and risk landscapes.

Best Practices:

Schedule periodic reviews: Conduct quarterly or annual reviews to evaluate the framework’s effectiveness.

Use feedback loops: Incorporate stakeholder feedback to make necessary adjustments and improvements.

Create an Effective Framework with SafetyCulture

Why Use SafetyCulture?

SafetyCulture is a mobile-first operations platform adopted across industries such as manufacturing, mining, construction, retail, and hospitality. It’s designed to equip leaders and working teams with the knowledge and tools to do their best work—to the safest and highest standard.

Foster a unified risk-aware culture by setting a feasible framework for managing risk appetite, streamlining incident reporting, and automating workflows. Leverage real-time monitoring and simple analytics to identify and address potential operational risks proactively through a unified platform.

✓ Save time and reduce costs ✓ Stay on top of risks and incidents ✓ Boost productivity and efficiency ✓ Enhance communication and collaboration ✓ Discover improvement opportunities ✓ Make data-driven business decisions

Related articles

Food Safety

Safety

Cold Holding: The Ultimate Guide

Learn about cold holding methods for food safety and how it reduces contamination risks across operations.

Food Safety

Safety

A Comprehensive Guide to Natasha’s Law Training

Learn about the process of Natasha’s Law training and how it helps food businesses efficiently meet allergen labeling requirements.

Construction Safety

Safety

A Complete Guide to Scaffolding Safety Training

Learn everything about scaffolding safety training, from topics to best practices, to uphold construction and maintenance safety.