Strategic Risk Management: A Comprehensive Guide for Long-Term Success

Explore the essential tools and techniques for identifying, assessing, and mitigating risks and effectively integrate this system into the organization’s strategic framework for business endurance and resilience.

Published 12 Feb 2025

Article by

5 min read

What is Strategic Risk Management?

Strategic Risk Management (SRM) is the process of identifying, assessing, and managing risks that could potentially affect the organization’s broad strategic direction and overarching goals. Unlike standard risk management, which focuses on day-to-day threats to people and processes, SRM deals with long-term risks that arise from internal decisions and external environments. By implementing this, organizations become more resilient in the face of threats and ensure business sustainability.

Importance and Benefits

With the globalization of markets, rapid technological advancements, and increased regulatory burdens, organizations find it more difficult to anticipate and manage risks. Strategic risk management provides a systematic framework for addressing these complex challenges. Here are the benefits of integrating SRM into the company’s processes:

Enhanced resilience – Thanks to advanced risk management tools and techniques , strategic risk assessment is easier. When companies are empowered to address risks proactively, they reduce their vulnerability to disruptions.

Improved decision-making – Better communication and collaboration facilitate strategic risk planning , helping everyone understand the consequences of different actions and make thoughtful decisions.

Greater stakeholder confidence – Well-developed and implemented SRM initiatives enable companies to handle situations proactively, which investors and customers admire and support. It also allows them to capitalize on opportunities from changing circumstances , boosting their competitive edge in the market.

Types of Strategic Risks

Strategic risks are high-level threats that can significantly impact the organization’s ability to achieve long-term goals and objectives. Vigilance is vital because these can overlap or interact depending on the industry and market conditions, aggravating the company’s circumstances and prospects. Here are the most common strategic risk examples:

Change Risk

These are uncertainties associated with different types of transformations in the organization, such as the following:

Mergers and acquisitions

Introduction of new technology

Change in business models

Cultural shifts within the organization

Failure to manage these effectively can lead to resistance, operational disruptions, or loss of competitive advantage.

Competitive Risk

This refers to new products, services, and innovations that rivals introduced, possibly undermining the company’s market position or profitability. Failing to monitor competitive landscapes or respond to shifts in customer preferences results in the loss of market share. Constant innovation, market research, and benchmarking are key to mitigating this risk.

Regulatory Risk

Changes in laws, regulations, and industry standards could affect the company’s operations or profitability. This includes the following:

Compliance costs due to new legislation

Legal penalties for non-compliance

Reputational damage from negligence or outright violations

Keeping up with regulatory changes and advocating for industry standards helps reduce this risk.

Governance and Management Risk

Bad organizational structures and oversight mechanisms can lead to unethical practices, lack of accountability, or strategic misalignment. Strong governance frameworks are vital in promoting sustainable growth.

Economic or Financial Risk

Fluctuations in the broader economy can affect the company’s ability to meet its financial goals. Specific risks include the following:

Recession or economic downturns

Changes in interest rates, inflation, or currency exchange rates

Access to capital and credit

Financial stability is crucial for maintaining operations and pursuing future initiatives. Effectively managing this type of risk can protect companies from economic shocks.

Political Risk

This risk occurs when changes in government policies, instability, or geopolitical tensions affect the company’s operations or investments. It’s especially significant for companies operating in multiple countries or regions.

Continuously monitoring geopolitical development is crucial to the business’s future. It’s equally important to have contingency plans in place to prevent widespread disruptions.

Environmental Risk

This refers to the negative impact of environmental factors on the long-term strategy and overall performance of the company. Here are some examples of strategic risk:

Climate change

Resource scarcity

Environmental and sustainability requirements

Conducting environmental risk assessments can better understand and address their impact on the world. Companies that ignore or downplay this risk may be unable to comply with regulations, face operational disruptions, or suffer reputational damage.

Key Steps in Strategic Risk Management

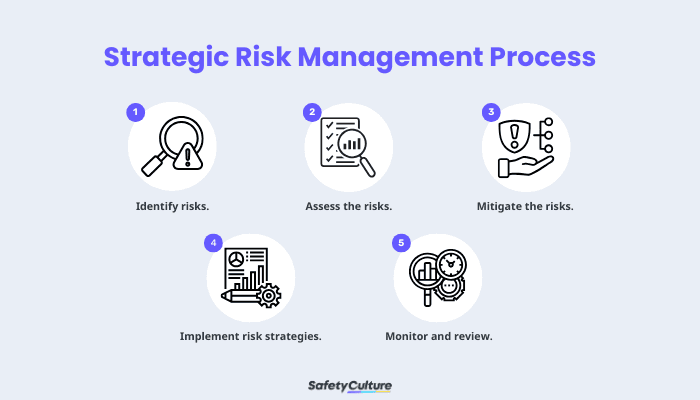

Step-by-Step Strategic Risk Management Process

Managing strategic risks involves a structured process aimed at proactively managing internal and external threats and making analyzed decisions that prevent any disruption to the company’s growth trajectory. Here’s a simple guide to follow:

Step 1: Identify risks.

Risk identification is the process of recognizing and categorizing potential risks that could impact the organization’s overarching strategy. Unidentified risks can manifest unexpectedly, leading to costly consequences. Determining risks at the outset enables companies to effectively and promptly respond to threats and vulnerabilities.

Step 2: Assess the risks.

Comprehensive risk assessment (i.e., evaluating the likelihood of occurrence and the severity of the impact) helps prioritize risks for better resource allocation. Strategic risk analysis can be accomplished with the following:

Scenario analysis

Step 3: Mitigate the risks.

Developing a strategic risk mitigation plan can reduce the likelihood of risks or minimize impact. It can enhance organizations’ capacity to respond effectively if the risk materializes.

Create your own Risk Mitigation Plan checklist

Build from scratch or choose from our collection of free, ready-to-download, and customizable templates.

Step 4: Implement appropriate risk strategies.

Steps taken to mitigate the risks should be integrated into the organization’s risk appetite framework and day-to-day operations. These are must-do tasks to effectively implement these risk mitigation strategies:

Assigning roles and responsibilities

Securing resources

A clear guide for execution

Reviewing alignment with business objectives

Step 5: Continuously monitor and review implemented strategies.

Risks evolve and new threats may emerge. Hence, continuous monitoring and periodic reviews of risks and mitigation strategies ensure that the organization remains agile and adaptive.

Regular risk audits, performance tracking of mitigation strategies, and Key Risk Indicators (KRIs) for monitoring changes build a risk-aware culture, ensuring employees at all levels are aware and equipped for prompt response.

Efficiently Manage Strategic Risks with SafetyCulture

Why Use SafetyCulture?

SafetyCulture is a mobile-first operations platform adopted across industries such as manufacturing, mining, construction, retail, and hospitality. It’s designed to equip leaders and working teams with the knowledge and tools to do their best work—to the safest and highest standard.

Streamline your strategic risk management process using tools for risk identification, analysis, monitoring, and reporting. These enable real-time tracking of risk factors, scenario planning, and data-driven decision-making, all in one unified platform.

✓ Save time and reduce costs ✓ Stay on top of risks and incidents ✓ Boost productivity and efficiency ✓ Enhance communication and collaboration ✓ Discover improvement opportunities ✓ Make data-driven business decisions

FAQs About Strategic Risk Management

Related articles

Food Safety

Safety

A Comprehensive Guide to Natasha’s Law Training

Learn about the process of Natasha’s Law training and how it helps food businesses efficiently meet allergen labeling requirements.

Construction Safety

Safety

A Complete Guide to Scaffolding Safety Training

Learn everything about scaffolding safety training, from topics to best practices, to uphold construction and maintenance safety.

Construction Safety

Safety

A Simple Guide to Oil and Gas Production

Learn about the oil and gas production process and the equipment and modern technologies used to improve field productivity.