Leveraging AI in Risk Management for Effective Implementation

Understand how artificial intelligence elevates risk management strategies with benefits, top applications, and practical steps for implementation.

Published 17 Sept 2025

Article by

6 min read

What is AI in Risk Management?

AI in risk management refers to utilizing artificial intelligence technologies for effective risk identification, assessment, and mitigation. AI-powered tools such as machine learning, predictive analytics, and natural language processing can evaluate large volumes of data and spot potential issues, enhancing decision-making and facilitating risk management activities more effectively.

Importance and Benefits

According to recently published statistics, nearly a quarter of all businesses have adopted AI for core functions, such as customer service and human resources. Many expect to see an increase in their productivity with this investment. More and more companies, especially those in high-risk industries, are utilizing AI for risk management. Here’s what they can achieve:

360-degree visibility and faster data analysis – Organizations acquire data from various sources in less time with the help of continuous monitoring tools, enhancing risk detection. Advanced analytics help them process a bulk of information faster, facilitating better decision-making.

Enhanced prevention and prompt mitigation – Predictive evaluations and historical data analysis nip potential issues in the bud. If a problem isn’t avoided, companies can immediately respond to and recover from it.

Improved regulatory compliance – By proactively identifying potential risks before they escalate, companies can implement timely interventions that ensure adherence to industry standards and government regulations. AI also automates administrative tasks, such as compliance reporting and submission.

Take Control of Your Risk Landscape

Seamlessly identify and proactively mitigate risks to enhance organizational resilience and decision-making.

How is AI Used in Risk Management?

World-renowned enterprises now leverage AI in operational risk management, from proactively identifying risks, prioritizing responses, and streamlining compliance management. Here are some AI-driven applications that are breaking new ground:

Fraud Detection

Machine learning algorithms can analyze transactional data, identify unusual patterns, and flag fraudulent activities. The application is especially useful in finance and retail, where billions of transactions happen daily.

According to research done by PricewaterhouseCoopers International Limited,AI-based fraud detection can reduce losses by a large margin. Reputable financial institutions like Paypal and Visa benefited from next-gen tech, promptly uncovering scams from sign-up and log-in to payments.

Risk Scoring and Prioritization

AI models analyze data across multiple risk factors and assign scores, helping companies prioritize risks based on their impact and effectively allocate resources. Financial institutions heavily rely on this application to assess client risk and assist them in developing mitigation strategies.

Insurance giant AXA can rapidly review multi-page documents with AI, helping clients identify potential issues and act expeditiously.

Predictive Maintenance

Companies with complex equipment utilize AI to collect data from machinery to predict failures based on usage patterns and sensors. Crucial in industries such as manufacturing and energy, AI-based predictive maintenance reduces operational downtime and safety risks.

General Electric (GE)’s investment in this AI application resulted in better return on investment (ROI) metrics: increased availability, reduced reactive maintenance, and lower inventory costs.

Cyber Security Threat Detection

Analyzing network traffic and detecting anomalies that may indicate cyber threats is possibly the most popular AI application in risk management today. Aside from financial services and retail, companies across industries utilize cyber security threat detection because of the sensitive customer, stakeholder, and project data they keep.

Healthcare organizations, for instance, have patient names, dates of birth, addresses, social security numbers, and banking details. AI solutions prevent ransomware, phishing, and hacking, safeguarding all the aforementioned data.

Compliance Monitoring

Another prevalent use of AI in risk management is analyzing communications, transactions, and operational activities to ensure adherence to regulations. Digital monitoring tools detect non-compliance faster than manual review.

While financial institutions were early pioneers in AI-powered compliance monitoring, other industries are now adopting this in various ways:

Driver hours of service (HOS) tracking in transportation and logistics

Behavioral safety monitoring in manufacturing and construction

Emissions monitoring and carbon footprint verification in energy

Implications of Using AI to Manage Risk

Integrating artificial intelligence into the company’s operations is a formidable undertaking. Understanding the probable challenges is crucial to prevent issues that may undermine the benefits of using AI in risk management. Here are some of them:

Low data quality (inconsistent, inaccurate, outdated, and incomplete) decreases the reliability of predictions, leading to flawed risk assessments .

Algorithmic bias due to skewed or limited data results in discriminatory practices, negatively impacting certain stakeholders.

Inherent cyber security risks don’t just compromise data privacy and regulatory compliance. These also lead to incorrect predictions that expose the company to more vulnerabilities.

The complexity of integrations , especially with legacy systems, can limit the effectiveness of AI business solutions and potentially increase operational risks.

High implementation and maintenance costs can strain budgets. Smaller companies may struggle to justify their investment in infrastructure, skilled personnel, and ongoing support without clear and measurable returns.

Process of Utilizing AI in Risk Management

A structured approach is essential for successful AI integration and utilization. Following these steps helps organizations mitigate potential challenges and ensures the system is accurate, reliable, and aligned with their overarching business goals.

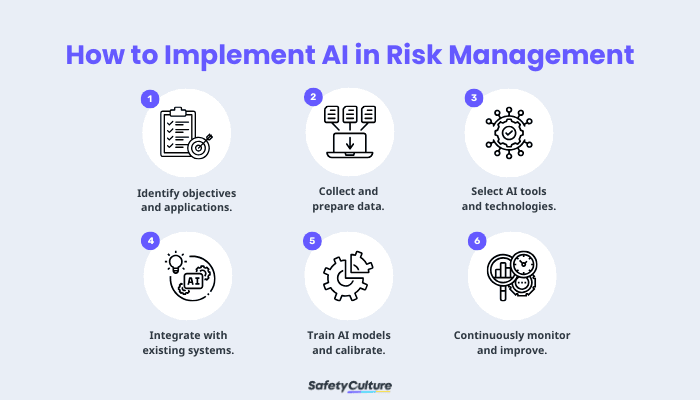

How to Implement AI in Risk Management

1. Identify objectives and key applications.

Define clear objectives and determine how AI solutions can support them. Identifying these priorities helps relevant teams focus resources effectively to address the more relevant risks.

2. Collect and prepare data.

Gather, clean, and organize data from various sources, ensuring accuracy, completeness, and relevance. Preparing information is vital before AI analysis and prediction to reduce algorithmic bias.

3. Select AI tools and technologies.

AI risk management platforms and algorithms should align with the organization’s risk management goals, operational requirements, and budget. Choosing the right tools enhances accuracy, reduces maintenance costs, and maintains adaptability with the company’s evolving needs.

4. Integrate with existing systems.

Smooth integration ensures a seamless flow of information and enhances risk management strategies. This is a complex task especially for those still utilizing legacy systems. However, this is possible through the following:

API-based integration exposes relevant functionalities in legacy systems and implements real-time data exchange.

Middleware solutions connect disparate systems and transform data into suitable AI formats.

Cloud-based AI solutions allow the migration of legacy systems to the cloud, improving accessibility and scalability.

A phased approach means starting with small-scale projects to test the AI solution and scaling it as the organization’s needs grow. This is recommended for companies without funds for major overhauls in their systems.

5. Train AI models and calibrate.

This step involves feeding the AI model with vast amounts of cleaned data. It should also include factors influencing risk, such as economic indicators, market trends, and past incidents, enabling it to make accurate predictions about potential threats.

Calibration means adjusting the model’s output to match real-world outcomes, ensuring that predictions are accurate and reliable. Backtesting, statistical visualization, and human judgment should be utilized during this phase.

6. Continuously monitor to drive improvements.

Assess the AI model’s performance. Make adjustments and update it with new data to maintain relevance. Regular monitoring delivers consistent value in risk management, upholds adaptability with emerging risks, and drives continuous improvements.

Effectively Utilize AI in Risk Management with SafetyCulture

Why Use SafetyCulture?

SafetyCulture is a mobile-first operations platform adopted across industries such as manufacturing, mining, construction, retail, and hospitality. It’s designed to equip leaders and working teams with the knowledge and tools to do their best work—to the safest and highest standard.

Harness the power of AI in risk management and transform how your organization approaches risk. Conduct comprehensive risk assessments, identify potential hazards, and implement proactive measures as part of your integrated risk management strategy. Streamline workflows, enhance decision-making, and foster a culture of accountability across your teams. Stay ahead of risks while maintaining compliance with regulatory standards using one unified platform.

✓ Save time and reduce costs ✓ Stay on top of risks and incidents ✓ Boost productivity and efficiency ✓ Enhance communication and collaboration ✓ Discover improvement opportunities ✓ Make data-driven business decisions

Related articles

Environmental Safety

Safety

Stormwater Pollution Prevention Best Management Practices

Learn about the types of best management practices for SWPP and the steps to effectively implement them in prevention plans.

Construction Safety

Safety

Understanding Mechanical Excavation in Modern Construction

Learn about mechanical excavation and how to maintain safety across excavation projects with this guide.

Risk Assessment

Safety

Disaster Recovery Policy: The Ultimate Guide

Discover how a disaster recovery policy bolsters operational resilience and safety through clear procedures and continuous improvement.