Risk Insights: Transforming Data into Actionable Intelligence

Learn how to leverage risk insights to make data-driven decisions, mitigate risks, and strengthen governance frameworks.

Published 25 Sept 2025

Article by

5 min read

What are Risk Insights?

Risk insights are valuable information and understanding gained from analyzing identified threats and their possible impact on the organization. It involves advanced tools and methodologies beyond traditional risk assessments to interpret trends and patterns, make informed decisions, and proactively address vulnerabilities and uncertainties across operational, strategic, and compliance domains.

Importance and Benefits

When risk management emerged as a discipline in the 20th century, organizations began embedding the framework into their operations, helping them achieve their goals. One of the most crucial elements in the system is the analysis, from which insights are derived. Risk management insights provide the following:

Proactive risk mitigation – Risk insights help organizations systematically analyze risks , from understanding their risk appetite and tolerance levels to prioritizing resources required for efficient and successful management.

Better strategic alignment – Integrating operational risk insights into the company’s processes ensures that strategies conform to the realities of their environment. This helps them navigate uncertainties while meeting their objectives.

Enhanced operational resilience – As organizations implement better risk management strategies, they gather data that inform their future operational practices. This creates a feedback loop for continuous improvements , enhancing their adaptability and business resilience.

Increased regulatory confidence – Understanding the risks that may emerge also helps organizations prepare for them, avoiding penalties and legal issues that may come with them.

Improved stakeholder trust – Demonstrating robust risk management practices builds trust among stakeholders, especially investors and customers, leading to better relationships and opportunities for growth.

Real-Life Applications Across Industries

Risk insights have transformed organizations across different sectors, enabling them to anticipate and mitigate risks to sustain success and resilience. Here are specific examples:

Financial services – Banks, insurance companies, and similar institutions reduce losses by understanding transaction patterns that may indicate fraudulent activity.

Vendor management in supply chains – Continuity is ascertained by analyzing vendor performance , compliance with contracts and standards, and early reporting of risks.

Construction – Project outcomes are improved by predicting potential delays, cost overruns, and safety hazards during construction.

Healthcare – Minimizing medical errors and other adverse events enhances patient outcomes and improves the overall care quality in the facility.

Cybersecurity and data protection – Costly data breaches can be proactively identified with Machine Learning (ML) and other advanced tech that detect anomalies in network traffic.

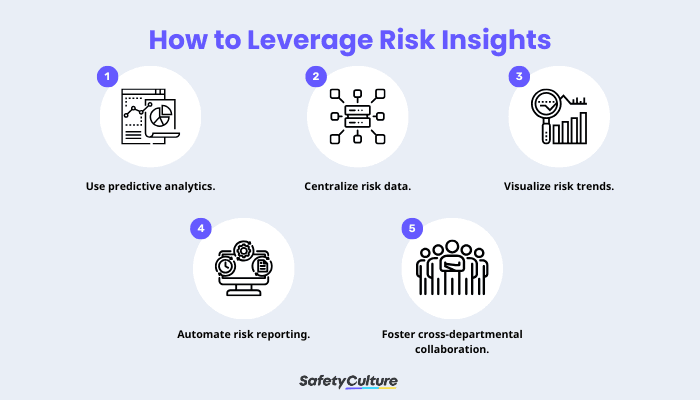

How to Leverage Risk Insights for Effective Risk Management

Leveraging risk insights ensures businesses remain proactive rather than reactive. The structured approach detailed below is an effective roadmap to understanding the full potential of insights for better decision-making.

How to Leverage Risk Insights

1. Use predictive analytics.

Organizations should anticipate potential threats to prioritize responses and allocate resources effectively. Predictive analytics requires the following:

Historical data from internal systems and external sources

ML algorithms for better trend and pattern identification

Predictive models to simulate risk scenarios and estimate outcomes

2. Centralize risk data.

All risk-related information should be consolidated into a single platform for easier access, analysis, and management. Managing data in centralized repositories eliminates silos, helping decision-makers get a holistic view of risks across the organization.

3. Visualize risk trends.

Complex risk data becomes more comprehensible with visualization. Charts, graphs, and dashboards present the information clearly, speeding up the process of determining trends and anomalies while ensuring accuracy. These are some tools that can help:

Augmented analytics

Natural Language Processing (NLP)

Artificial Intelligence (AI) and extended reality

4. Automate risk reporting.

Stakeholders should be informed about the company’s risk exposure and management efforts, helping them decide their next steps. Risk reports can be generated on a scheduled or real-time basis with the help of technology. Automating this task saves time, ensures consistency, and provides timely insights for faster responses.

5. Foster cross-departmental collaboration.

Create a culture of shared responsibility for risk management by involving stakeholders at all organizational levels. Diverse perspectives help organizations develop more comprehensive and long-lasting strategies.

Common Pitfalls and How to Avoid Them

Erroneous risk insights lead to poor decision-making and increase the organization’s vulnerability to potential threats. These are the most common issues risk analysts may encounter and the best way to get around or deal with them.

Insufficient data quality – Incomplete, outdated, or inaccurate information leads to flawed insights and unreliable predictions. Implementing strict data governance policies ensures data accuracy and consistency.

Overcomplication of risk models – Models with too many variables are hard to understand and use. Focus on simplicity and clarity to increase practical application.

Ignoring the human factor – Focusing entirely on technology without human expertise also provides inaccurate results. Combine data-driven insights with inputs from experienced personnel.

Lack of real-time reporting – Depending on just historical data generates incomplete, erroneous, and outdated risk profiles. Acquiring the most recent updates clarifies decision-making.

Lack of proper system integration – Data silos hinder a comprehensive view of risks. Adopt the right tools to support data sharing and interdepartmental communication.

Substantially Utilize Risk Insights with SafetyCulture

Why Use SafetyCulture?

SafetyCulture is a mobile-first operations platform adopted across industries, such as manufacturing, mining, construction, retail, and hospitality. It’s designed to equip leaders and working teams with the knowledge and tools to do their best work—to the safest and highest standard.

Collect and aggregate data from multiple sources with the help of advanced tools, such as AI and ML, for visualization, real-time analytics, and predictive modeling. Facilitate team collaboration to ensure strategic alignment by automating risk-related tasks, like routine assessments and reporting. Foster a culture of transparency where all stakeholders understand risks and how they are managed through a unified platform.

✓ Save time and reduce costs ✓ Stay on top of risks and incidents ✓ Boost productivity and efficiency ✓ Enhance communication and collaboration ✓ Discover improvement opportunities ✓ Make data-driven business decisions

Related articles

Environmental Safety

Safety

A Comprehensive Guide to Stormwater Pollution Prevention Best Management Practices (SWPPP BMP)

Learn about the types of best management practices for SWPP and the steps to effectively implement them in prevention plans.

Risk Assessment

Safety

The Ultimate Guide to Emergency Preparedness and Response

Learn how you can develop an effective emergency plan and stay one step ahead of natural disasters or other catastrophes.

Safety

Safety Management

Disaster Preparedness Plan

Learn more about the disaster preparedness plan, its importance, features, and example. Find out how a digital tool can help prepare against disasters.