Published 11 Jul 2025

Article by

4 min read

What is Petty Cash?

Petty cash is a set amount of money intended to pay for minor costs that impact daily business operations. It covers small expenses or a set of expenses deemed impractical to process through check payment, such as catered lunch and other reimbursables, such as parking fees, toll charges, and bus fares. Periodically replenished, the petty cash goes through regular accounting to ensure the integrity of its use. A petty cash log is a record custodians keep to accurately document expenditures and efficiently monitor the allocation of entrusted company funds.

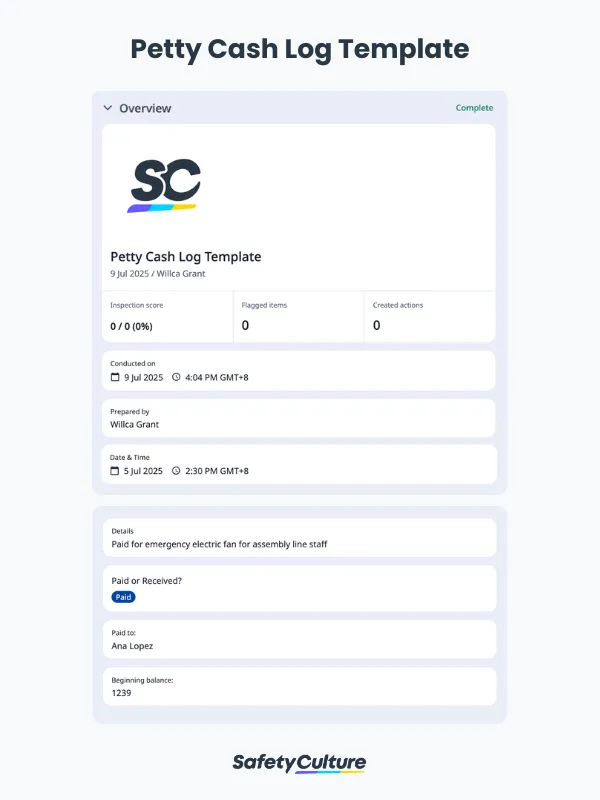

What is a Petty Cash Log Template?

A petty cash log template is a tool used by a petty cash custodian or cashier to maintain an accurate record of all petty cash fund and expenses. It can also act as a ledger that records all bookkeeping entries of financial transaction using petty cash. Failure to account for cash transactions or deposited related finances by maintaining the accuracy of a petty cash log and reconciling expenditures can lead to delays in the expected replenishment of petty cash.

Why Use a Template for Petty Cash Logs

The use of a petty cash log is crucial to ensuring that petty cash is sufficient and spent appropriately. Templates—especially digital ones—help standardize the process, ensuring consistency and accountability across departments.

Convenience

Though paper-based petty cash logs may suffice for certain operations, companies with several departments should digitize their logs for added security; minimizing the risk of loss, damage, and unauthorized expenditure of petty cash logs.

Efficiency

In terms of efficiency, digital petty cash logs have a lot of advantages over their paper-based counterparts. Paper logs need to be manually secured by the petty cash cashier. Petty cash expenditures are manually entered and calculated then reentered on a computer, should there be a need for electronic data transfer or storage of expenses.

Digital petty cash log templates are more convenient for cashiers who typically already use electronic devices such as laptops and smartphones on the job. Data entry can be automated, requiring less manual monitoring. Should expenditure r ecords need to be managed, corrected, or updated, the log template can be accessed from the app, eliminating the need to reprint and document the corrected logs.

Accuracy

Petty cash log templates help reduce human errors. Standardized fields ensure that every transaction is recorded with the same required details (e.g., date, amount, purpose, department), improving the reliability of the data. This not only supports better internal tracking but also simplifies audits and reporting, ensuring financial accuracy across the organization.

What to Include in a Petty Cash Log Template

A petty cash log template should have the following basic fields in order to help the petty cash cashier maintain a manageable record of all expenditures:

Date and details – The date and details of the expenditure should be identified on the log to differentiate each item.

Authorized person – The person who approved the expenditure should be included on the log in case there is a need for clarification during the review of expenditures.

Cash in/out – This section states the amount of money spent and/or received using the petty cash allocation.

Balance – Upon replenishment, petty cash is recorded as beginning balance. By the end of the allotted date range, it is updated to the ending balance.

How to Maintain a Petty Cash Log

Since there’s a separate accounting system needed for petty cash transactions, there are a few things to consider when maintaining a petty cash log template:

Determine the right and total mount of petty cash – The business needs to determine the optimal petty cash allocation across departments to be spent within an expected date range. The petty cash allotment should sufficiently cover all minor necessary expenses only since over-allocation may result in overspending.

Designate the petty cash cashier who will maintain the log – The designated person will be responsible for keeping track of the petty cash expenses and the recordkeeping for reference come auditing.

Design the log to fit your business needs – The logs are used across departments within an organization, and each log may be customized to fit the business need. It should be easy to use and maintain.

Utilize ready-to-use templates – To make the process even more efficient, take advantage of predesigned petty cash logs, that are also customizable. Having a go-to template already jumpstarts daily documentations, where you can avoid starting from scratch every time.

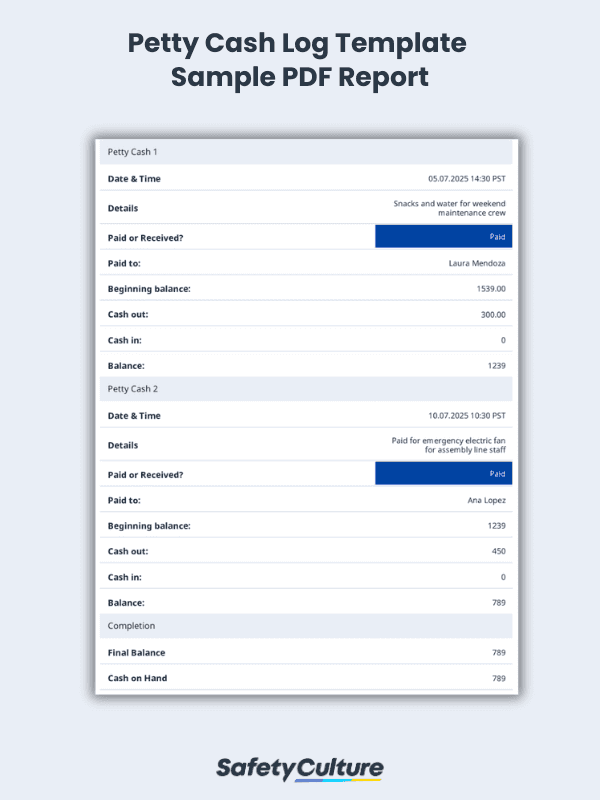

Petty Cash Log PDF Report

Here’s an example of a completed PDF cash log in PDF format:

Still looking for a checklist?

Search, filter, and customize 60,000+ templates across industries and use cases.